This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Hermès Surpasses LVMH: What It Means for Luxury Investors

Nikkan Navidi•28.4.2025

In April 2025, Hermès overtook LVMH to become the most valuable luxury company in the world, reaching a market capitalisation of more than €247 billion. This development followed LVMH’s weaker-than-expected Q1 results, which triggered an 8% drop in its share price and raised broader concerns about softening demand in the global luxury sector.

This change in leadership reflects more than a short-term market reaction. It comes against the backdrop of macroeconomic headwinds, including newly imposed tariffs on European goods, ongoing inflationary pressure, and a slowdown in discretionary spending in key regions such as China and the United States. Together, these factors have introduced a more cautious outlook across the luxury industry and financial markets in general.

While many brands are feeling the effects of this environment, Hermès has remained comparatively resilient, supported by a strategy built on limited production, pricing control, and long-term brand equity. Unlike more diversified conglomerates, its tightly focused model appears well suited to navigate current market dynamics.

For investors, particularly those exploring alternative assets, the Hermès-LVMH shift highlights an important point: in uncertain conditions, scarcity and quality-driven demand may outperform scale. This trend has significant implications for how luxury assets are perceived, not only as symbols of prestige but as potential components of a diversified investment strategy.

Understanding the Market Shift

LVMH, home to powerhouse brands like Louis Vuitton, Dior, and Moët Hennessy, reported weaker-than-expected Q1 results, particularly in Asia and the U.S.—two historically strong markets for luxury goods. Revenue in its fashion and leather division, usually a key growth engine, underperformed forecasts amid caution around discretionary spending and macro uncertainty.

Adding pressure, the U.S. introduced new tariffs on select European goods in early 2025, compounding challenges for high-end exporters like LVMH. Analysts from Bernstein now expect a 2% contraction in the luxury sector this year—its worst performance in more than two decades.

In contrast, Hermès continues to outperform. The brand’s tightly controlled production, low exposure to trend-driven product cycles, and refusal to discount have made it especially attractive to investors during a period when consumer selectivity is rising.

Macroeconomic Pressures Reshape the Luxury Landscape

Slowing Demand in Key Markets

Over the past several quarters, demand for luxury goods has shown signs of weakening in major growth regions. In China, where luxury consumption had been a major driver of post-pandemic recovery, recent consumer data indicates a more cautious spending environment, driven by slower economic growth and renewed focus on domestic savings. Similarly, in the United States, inflation-adjusted discretionary spending has declined across several upper-middle-income segments, affecting categories such as fashion accessories, cosmetics, and entry-level luxury.

Tariff Effects on European Exports

In early 2025, the U.S. implemented a new wave of tariffs on European luxury exports, targeting goods such as leather bags, wine, and perfumes. While LVMH and similar brands generate a significant portion of their revenue from these categories, Hermès has a more limited exposure to volume-sensitive export markets. Its strategy of low-volume, high-margin sales through directly controlled channels has helped insulate it from short-term trade disruptions.

Monetary Policy and Interest Rate Sensitivity

With central banks in the U.S. and Europe holding interest rates higher for longer, the cost of capital remains elevated. This has increased pressure on publicly traded companies with high operating leverage and extensive global retail infrastructure. For investors, it reinforces the case for luxury businesses with stable cash flows, high operating margins, and limited debt exposure — characteristics that Hermès continues to exhibit.

Divergence Within the Sector

The divergence in performance between Hermès and other luxury giants reflects an emerging trend: not all luxury businesses are equally positioned to navigate the current economic cycle. Companies with broad brand portfolios, exposure to lower-margin categories, and heavier reliance on tourist-driven sales have faced greater earnings volatility. In contrast, ultra-luxury brands that emphasise supply control, pricing discipline, and timeless positioning have weathered recent headwinds more effectively.

What the Hermès Shift Could Reveal About Luxury Investment Strategy

Segmenting the Luxury Market: High-End vs. Scalable

Hermès' recent outperformance reinforces a key principle: the luxury sector is not homogenous. While certain segments — particularly beauty, fashion diffusion lines, and accessible luxury — have faced pressure due to slowing discretionary demand, ultra-high-end categories have remained more resilient. Investors are beginning to differentiate between brands that depend on volume growth and those built on pricing power and scarcity.

Scarcity as a Strategic Asset

One of Hermès’ defining characteristics is its deliberate undersupply. Rather than expanding to meet demand, the brand intentionally limits production, particularly for flagship products like the Birkin and Kelly bags. This maintains exclusivity and enhances pricing integrity and secondary market performance. For investors, this is increasingly seen as a defensible moat in an otherwise cyclical sector.

From Product to Portfolio Component

Products like the Birkin are no longer viewed purely as luxury goods — they are being analysed as physical assets with real appreciation potential. With proven historical returns and growing secondary market liquidity, these items are being reframed as investable assets rather than discretionary purchases. As a result, ultra-luxury collectables are entering the portfolios of high—net—worth individuals and retail investors via fractionalisation.

Long-Term Value in Cultural Capital

Beyond economics, Hermès's success reflects the relevance of cultural capital to investment. The brand’s ability to consistently maintain desirability over decades, without dependence on trends or celebrity endorsement cycles, contributes to its financial resilience. For investors evaluating collectables or brand-linked assets, brand equity, scarcity, and multi-generational appeal are becoming key value drivers.

The Implications for Alternative Investors

For investors already looking beyond traditional equities and bonds, the Hermès-LVMH story reinforces the potential of high-end physical assets as part of a well-diversified portfolio.

In recent years, luxury collectables—from handbags to timepieces, fine art to wine—have proven themselves to be tangible stores of value with relatively low correlation to the broader market. This was particularly evident during the COVID-era volatility and is once again becoming relevant as traditional markets wobble in the face of inflation, tariffs, and earnings pressure.

As volatility continues to weigh on global markets, institutional investors are actively rethinking traditional asset allocation strategies. The once-standard 60/40 portfolio split between equities and bonds is increasingly seen as inadequate in environments where both asset classes face simultaneous drawdowns — a scenario witnessed in 2022 and again in early 2025. In response, alternative assets are gaining prominence, not only among high-net-worth individuals but also within the strategic frameworks of major asset managers. A notable example is KKR, which has allocated 30% of its wealth portfolio to alternatives, including infrastructure, private equity, and tangible assets such as collectables.

This allocation strategy reflects a growing belief that exposure to real-world, low-correlation assets can offer better downside protection in periods of economic instability. BlackRock CEO Larry Fink echoed this sentiment in his 2025 annual letter, noting that the traditional 60/40 model “may no longer fully represent true diversification.” Meanwhile, Goldman Sachs’ Head of Asset Allocation Research, Christian Mueller-Glissmann, has called for “more diversification across assets,” warning against overreliance on public equities. Together, these perspectives point to a broader shift in capital markets: investors are increasingly recognising that physical, culturally resilient assets — including high-end luxury collectables — can play a meaningful role in long-term wealth preservation strategies.

Why Collectables Like the Birkin Are Gaining Portfolio Relevance

Tangible Assets in a Shifting Market

In a climate marked by interest rate uncertainty, shifting consumption patterns, and concerns over asset class correlation, investors are increasingly turning to physical assets that offer low volatility and intrinsic scarcity. Luxury collectables — particularly those with strong resale histories and cultural significance — have emerged as a growing segment within the broader universe of alternative investments.

Verified Performance: Birkin vs. Traditional Assets

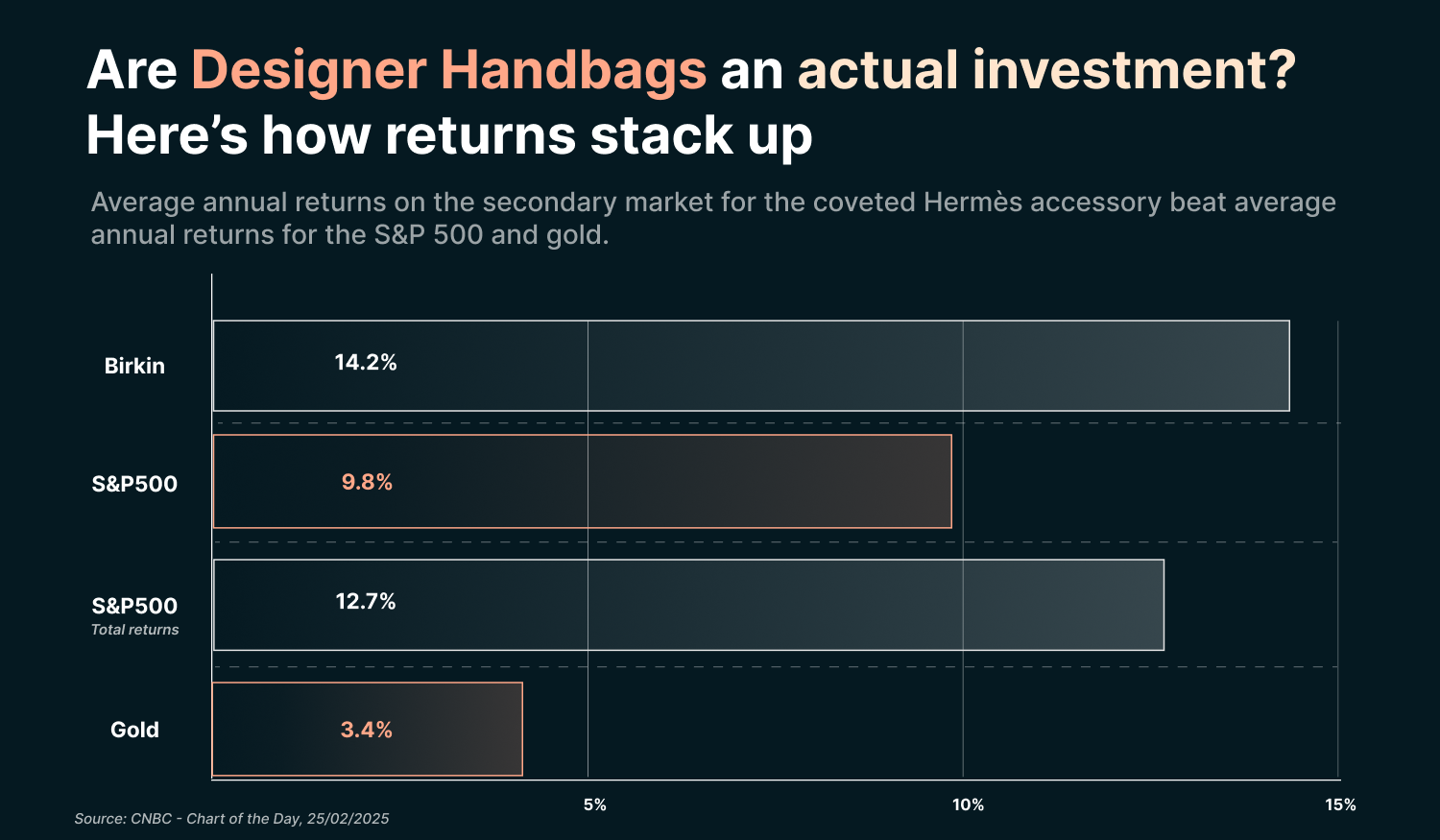

Recent data from a March 2025 CNBC report, citing research from Baghunter, NYU Stern, and FactSet, highlighted the performance of Hermès Birkin bags compared to other major asset classes. According to the analysis, Birkins have delivered an average 14.2% annual return on the secondary market, outperforming both the S&P 500 (12.7%) and gold (3.4%) over the same time period.

This performance suggests that certain collectables, when selected based on supply constraints, condition, and brand prestige, can not only preserve capital but also generate competitive long-term returns.

Source: CNBC - Chart of the Day, 25/02/2025

Demand Drivers: Rarity, Utility, and Cultural Status

What makes the Birkin particularly attractive from an investment standpoint is its combination of:

- Proven secondary market liquidity

- Production scarcity enforced by Hermès

- Multi-market demand across fashion, collectables, and ultra-luxury segments

- Transportability and insurability as a physical asset

Its continued auction performance and private resale premiums underscore not only desirability but market maturity, an important consideration for investors seeking alternative exposure without excessive complexity.

From Market Shake-Up to Asset Strategy

Hermès' rise isn't just a reshuffling of brand rankings—it's a signal to investors about what holds value in today’s economic environment. As luxury brands are increasingly split between mass aspirational consumption and true exclusivity, the investing world is taking note.

Unlike equities or ETFs that can be bought and sold in seconds, luxury assets like Birkin bags, piece unique watches from H. Moser & Cie., or first-edition artworks trade in markets defined by limited supply, provenance, and narrative. These are not volume assets; they are story-driven stores of wealth, often changing hands through private sales or specialist auctions.

In this context, ultra-luxury items function less like consumer goods and more like cultural capital. Their value lies not only in materials or brand, but in symbolism, legacy, and scarcity. For investors looking for low-correlation assets that are resilient to macroeconomic shifts, these collectables offer a compelling strategic edge.

Konvi’s Alec Monopoly Birkin: A Cultural Asset Nearing Its Exit

In 2024, Konvi added a unique Hermès Birkin 30 bag to its portfolio of curated alternative assets. Acquired in September 2024, the asset was not just a standard Birkin — it was a one-of-a-kind collaboration with renowned street-pop artist Alec Monopoly, whose work bridges the worlds of contemporary art and luxury fashion. Known for his celebrity commissions and financial iconography, Alec Monopoly has previously customised Birkin bags for collectors, including Khloé Kardashian, blending visual storytelling with cultural prestige.

The investment embodies the characteristics that increasingly define value in today’s alternative asset landscape: scarcity, provenance, cultural cachet, and crossover appeal. As a custom-painted, artist-enhanced Birkin 30, the bag is both a collectable and a statement, highly desirable across art, fashion, and high-net-worth collector circles.

Now, as the bag approaches the end of its appreciation period in mid-2025, Konvi investors will soon be invited to vote on a potential sale. This marks a key phase in Konvi’s model, where fractional co-owners can exercise governance and make data-informed decisions about timing an exit. With broader interest in alternative assets continuing to rise, this case illustrates how structured access to iconic cultural investments is reshaping the way individuals think about diversification and capital preservation.

Fractional Investing as a Gateway to Prestige

Traditionally, ownership of high-value assets like Hermès Birkins or fine art pieces has been reserved for ultra-high-net-worth individuals. These items carry not only steep acquisition costs but also complexities around storage, authentication, and resale.

Konvi’s fractional investment model changes that. By allowing investors to co-own curated luxury assets from as little as €250, Konvi makes it possible to access the same rarefied market that was once gated by wealth and exclusivity.

Each asset offered on the platform—whether it’s a vintage watch, rare whisky, or a customised Birkin bag—is:

- Independently authenticated and appraised

- Stored securely in professional facilities

- Curated based on scarcity, cultural value, and historical price resilience

Importantly, Konvi empowers investors through community-led decision-making. When an asset reaches the end of its appreciation period, investors vote on whether to initiate a sale, ensuring alignment with the asset’s real-time market potential.

This is more than access. It’s participation in the evolving narrative of cultural wealth.

Conclusion: Investing in Cultural Icons Amid Market Change

The fact that Hermès has overtaken LVMH as the world’s most valuable luxury brand isn’t just a corporate headline—it’s a signal. In a world grappling with shifting economic tides, trade friction, and fluctuating consumer demand, what’s holding value isn’t volume. It’s rarity, legacy, and prestige.

From the resilient secondary market of Birkin bags to the surge in demand for artist-customised collectables, the message is clear: investors are moving toward assets that tell stories, hold cultural significance, and exist outside traditional volatility cycles.

As we enter a new phase of luxury investing, platforms like Konvi are giving modern investors the tools to not only preserve wealth, but to own a piece of history.