This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Why Now is the Perfect Time to Invest in Alternative Assets

Nikkan Navidi•7.11.2024

In today’s complex economic environment, characterized by elevated inflation and frequent market fluctuations, alternative assets have become increasingly attractive to investors seeking stability and growth outside of traditional markets. Assets such as fine art, rare fossils, and fine wine offer unique advantages, including low correlation to traditional markets and a track record of appreciation during uncertain economic times. These qualities make them invaluable for those looking to diversify their portfolios with assets that are resilient to stock market swings and less sensitive to inflation.

Alternative assets have long been favored by ultra-high-net-worth individuals for their rarity and appreciation potential. However, recent innovations in fractional ownership and curated investment platforms now make it easier for a wider range of investors to access these exclusive markets. With inflation rates staying above average, political changes on the horizon, and economic uncertainty affecting traditional asset classes, now is an ideal time to explore the benefits of alternative assets for portfolio diversification.

Economic Volatility and the Growing Appeal of Alternative Assets

The economic landscape has seen significant upheavals over the past few years, marked by persistently high inflation, rising interest rates, and ongoing market volatility. Inflation rates remain higher than historical norms, with the U.S. at approximately 3.2% and the Eurozone at 4.3% as of late 2023. Central banks have responded with interest rate hikes, aiming to slow inflation, but this strategy has introduced its own challenges, leading to increased instability in the stock and bond markets.

As a result, many investors are turning to alternative assets that are better insulated from these macroeconomic shifts. Tangible, culturally significant assets such as fine wine, art, and fossils are less vulnerable to economic policies and interest rate changes. They also tend to hold their value or even appreciate during times of market turbulence, providing investors with a more stable portfolio option.

Inflation-Resilient Investments with Low Market Correlation

One of the defining characteristics of alternative assets is their low correlation with traditional markets. Unlike stocks or bonds, whose values fluctuate with economic trends, alternative assets are largely driven by demand, scarcity, and cultural value. This makes them a powerful hedge against inflation and a stabilizing force in a diversified portfolio.

For example, collectables like rare fossils and vintage wines often appreciate over time, providing a store of value that isn’t affected by stock market volatility. Fine wine, with its unique production cycles and limited supply, has historically retained value even during economic downturns. By diversifying with alternative assets, investors can create a financial buffer, reducing their exposure to the unpredictable swings of traditional markets.

The Influence of Political Events on the Economy and Investments

Political events can have a significant impact on economic stability, market confidence, and investor behaviour. Recently, the U.S. elections underscored the potential for shifts in policy, tax structures, and regulatory changes that can affect traditional investments. Regardless of election outcomes, political cycles often bring new economic policies that can either bolster or unsettle markets, creating an environment of uncertainty for investors in traditional assets.

In contrast, alternative assets like art, fine wine, and fossils are less sensitive to these political and regulatory shifts. Their value is primarily driven by intrinsic factors—such as rarity, cultural significance, and demand within collector markets—rather than by government policies or interest rates. This insulation from political influences makes alternative assets particularly appealing to those seeking a stable store of value amidst potential policy changes.

Diversifying Against Political Risks with Alternative Assets

Alternative assets can serve as a defense against political risk by offering a form of investment that remains largely unaffected by political changes. For instance, regulatory adjustments to trade agreements or tax policies may impact stocks, but they have minimal effect on the art and collectables market. High-quality fossils, for example, derive their value from their scientific and historical rarity rather than their reaction to global trade policy.

By including alternative assets in a portfolio, investors can reduce exposure to politically induced market shifts. This not only helps maintain portfolio stability but also allows investors to focus on assets that offer long-term value appreciation without the volatility linked to political cycles.

Scarcity as a Key Driver of Appreciation in Alternative Assets

Scarcity is one of the most powerful factors influencing the value of alternative assets. Unlike traditional assets, which are largely driven by market dynamics and supply and demand, many alternative assets owe their value to inherent limitations in supply. Fine wine, fossils, and high-value art are prime examples of how scarcity drives appreciation, making these assets highly attractive for investors looking to balance their portfolios with tangible, appreciating assets.

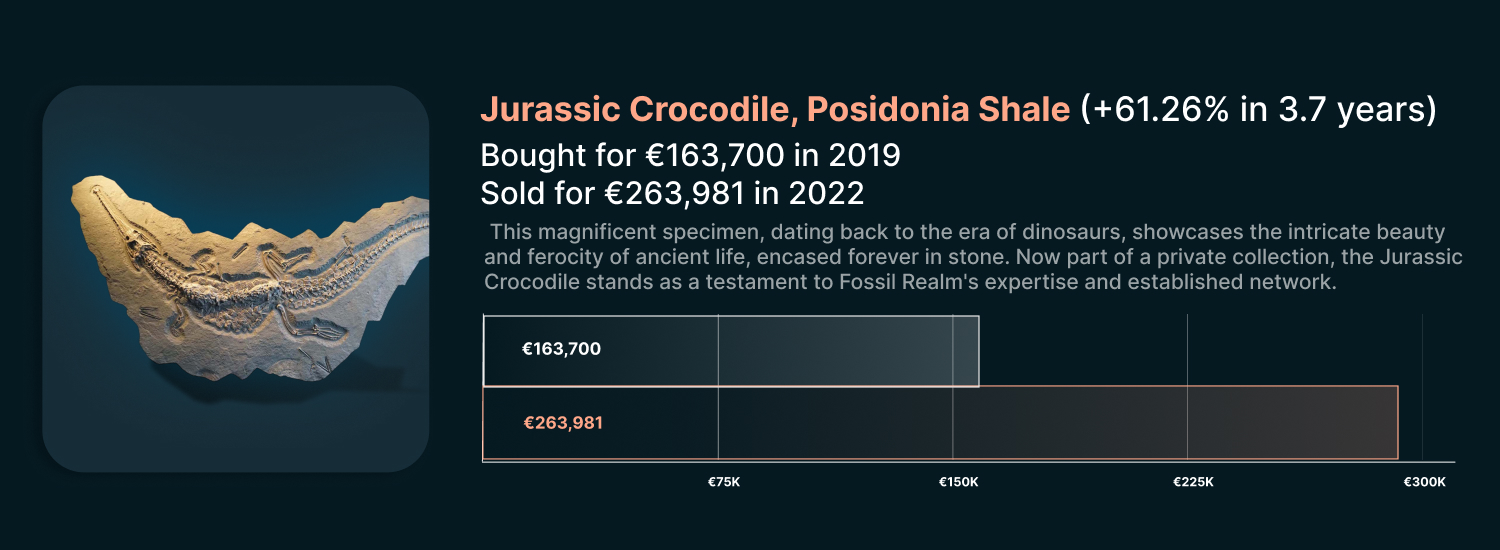

Fossils – Inherent Scarcity and Investment Potential

Fossils, by nature, are exceptionally rare. Each fossil is a product of millions of years of geological processes, and only a small fraction of fossilized remains are ever discovered and preserved in a condition suitable for collection. Excavating, preserving, and authenticating fossils requires expertise and resources, further limiting their availability. This natural scarcity has made high-quality fossil specimens highly collectable, with demand coming from both private collectors and institutions.

For investors, fossils represent a unique opportunity to own a piece of natural history that has proven to retain and even grow in value. The interest in fossils spans both scientific and cultural fields, which drives steady demand independent of traditional market cycles. Fossils offer a distinct combination of rarity, appreciation potential, and a level of market stability, making them a valuable addition to a diversified investment portfolio.

Fine Wine – Climate Challenges and Limited Production Leading to Value Appreciation

Fine wine offers another compelling example of scarcity-driven appreciation. Each bottle is not only a product of the vineyard but also a reflection of the specific conditions of the growing season. Climate change and environmental factors play a significant role in shaping the yield and quality of each vintage, making some years more limited and valuable than others. As global warming continues to impact grape harvests, the scarcity of high-quality vintages is expected to increase, driving up their value.

The fine wine market has shown resilience over the years, maintaining its value during times when traditional markets have struggled. This is particularly evident in premier regions like Bordeaux, Burgundy, and Champagne, where specific vintages can become collector items due to their limited availability and outstanding quality. Fine wine, as an asset class, benefits from a reliable demand from collectors and investors alike, making it a well-suited alternative asset for those seeking long-term appreciation in a portfolio.

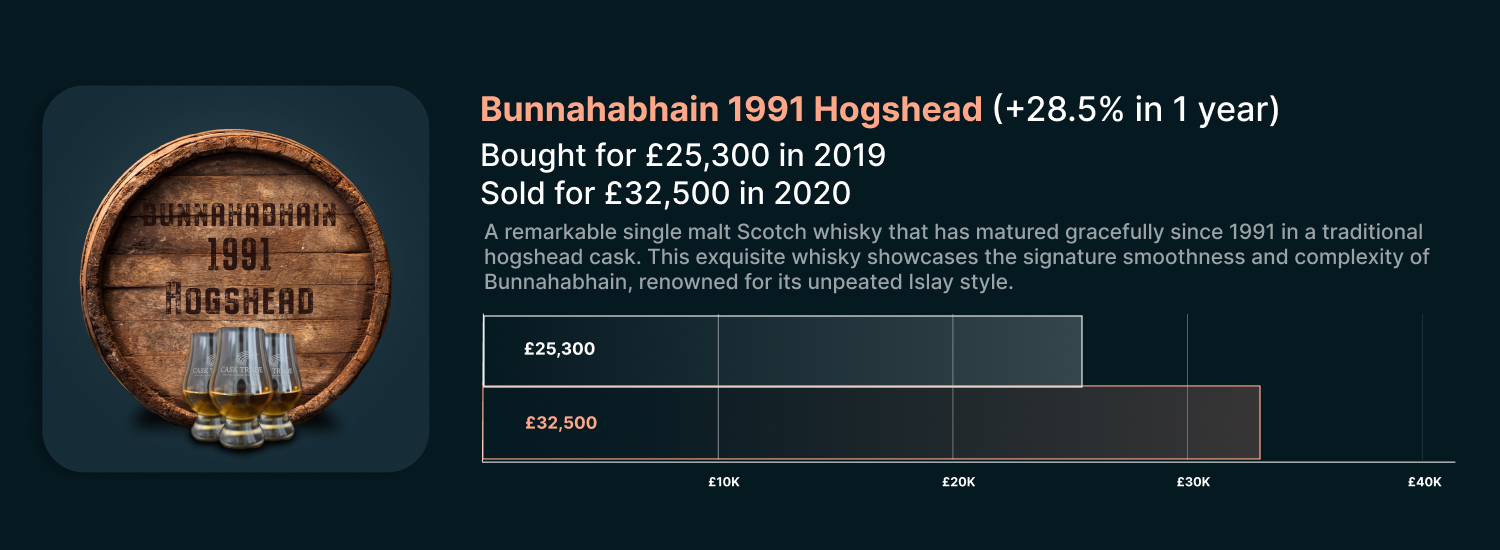

Whisky – Aged Rarity and Global Demand Driving Investment Returns

Whisky investment stands out due to the unique interplay of ageing and limited releases. Each whisky barrel ages differently, and the longer it matures, the richer the flavours, creating a distinct profile that cannot be replicated. This ageing process not only enhances the whisky's quality but also its rarity and value over time. As barrels age, some of the whisky is lost to evaporation, often referred to as the "angel's share," which reduces the volume available for bottling and inherently increases its scarcity.

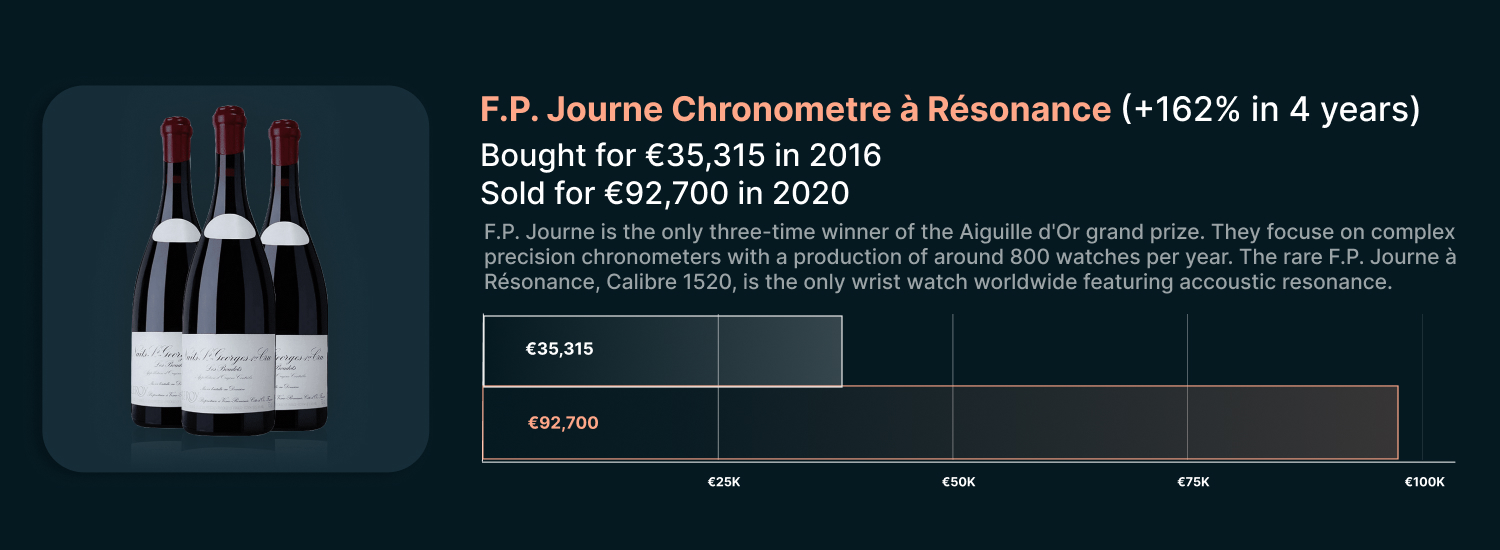

Moreover, distilleries often release limited editions or single-cask editions, which are highly sought after by collectors and connoisseurs. For instance, whiskies from closed distilleries, also known as "ghost whiskies," can become extremely rare and desirable, sometimes fetching astronomical prices at auctions. The limited availability, coupled with robust global demand, ensures that whisky appreciates in value, providing excellent investment returns. The international appeal of Scotch, Japanese, and American whiskies adds to this dynamic, as emerging markets continue to develop a taste for these premium spirits.

Whisky's investment appeal is further bolstered by its performance during economic downturns, often outperforming traditional investments like stocks and bonds. The tangible nature of whisky, combined with its enjoyment factor, offers a dual appeal: a potential for significant appreciation and the pleasure of ownership. As a result, whisky continues to attract new investors looking for alternative assets that offer not just financial returns but also a deep sense of satisfaction and pride in their holdings.

Art Investments: From Exclusive to Accessible

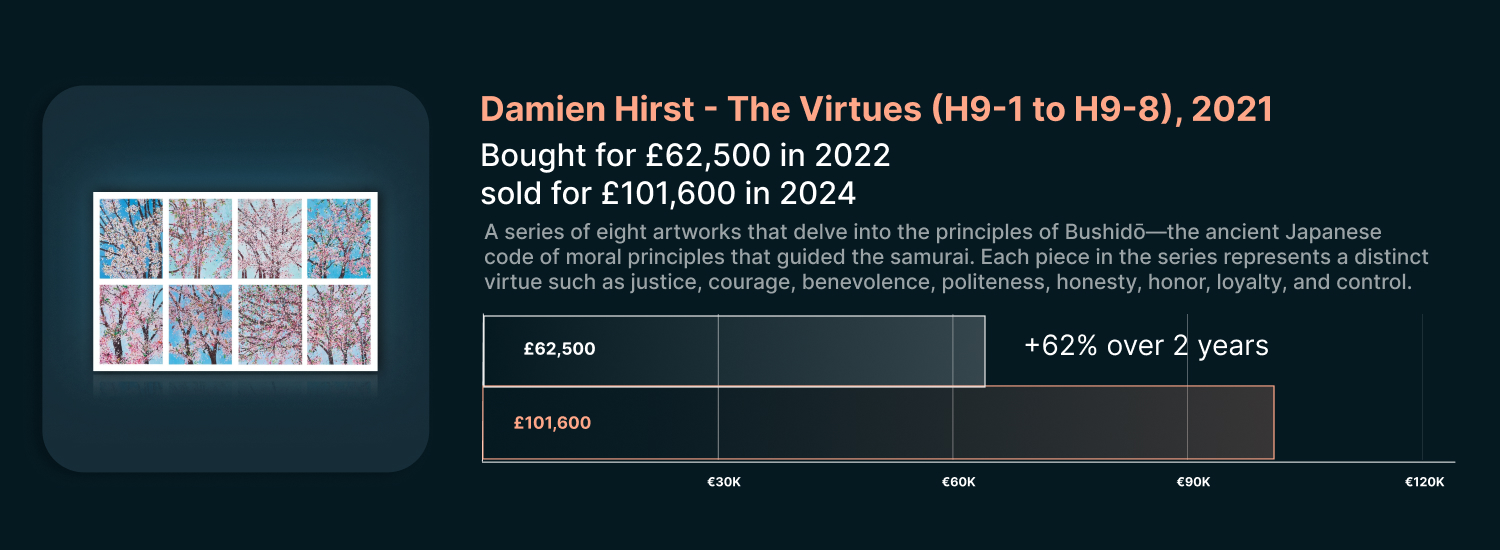

Fine art has long been regarded as a premier asset class, traditionally reserved for ultra-high-net-worth individuals (UHNWIs) and major institutions. Blue-chip artworks, created by renowned artists, have consistently appreciated in value over decades, making art a favoured asset for those with substantial capital to invest. However, with the advent of fractional ownership and curated investment platforms, access to the fine art market has broadened, allowing a more diverse range of investors to benefit from the appreciation potential of high-value art.

Investing in Blue-Chip Art

Blue-chip art refers to pieces created by established, widely recognized artists whose works have shown consistent appreciation over time. Art by these creators is often seen as a “safe” investment in the art world due to its historical resilience and long-term growth. Blue-chip pieces are valuable not only for their cultural and aesthetic significance but also for their tendency to retain or increase in value even during economic downturns.

Traditionally, such pieces have been available only to the wealthiest investors, as high purchase prices create a barrier to entry. However, the ability to invest fractionally in blue-chip art has transformed this market. By owning a share of artwork by master artists, investors can access the security and growth potential of blue-chip art without requiring millions in capital. This model brings a historically exclusive asset class within reach, giving retail investors a new opportunity to diversify and grow their portfolios.

Supporting Emerging Artists and Participating in Growth Potential

While blue-chip art offers stability, emerging art represents the potential for significant appreciation. Investing in works by up-and-coming artists provides the chance to participate in early-stage investments that can see substantial gains as these artists’ careers grow. As more galleries and collectors turn to emerging artists for fresh and innovative works, the demand in this segment has grown, creating a promising market for investors willing to explore new talent.

Early investments in promising artists allow investors to benefit from long-term value appreciation, while also supporting new voices in the art world. This dual benefit of financial potential and cultural contribution makes emerging art an attractive alternative asset for those looking to diversify portfolios while participating in the broader evolution of the art market.

Why Alternative Assets Outperform in Economic Uncertainty

During periods of economic instability, alternative assets have shown their strength by maintaining or even increasing in value when traditional markets face challenges. One of the primary reasons for this resilience is that alternative assets—such as fine art, fine wine, and fossils—are less impacted by factors that typically influence traditional asset classes, like interest rate changes or economic policy shifts. Instead, their value is largely driven by rarity, cultural significance, and intrinsic appeal, which often remain strong regardless of economic conditions.

Case Studies of High-Performing Collectables and Alternative Assets

Historically, alternative assets have demonstrated impressive growth, even during economic downturns. Here are a few examples:

- Fossils: Rare, scientifically significant fossils have appreciated steadily, with many high-quality specimens commanding significant premiums due to their unique historical value and natural scarcity. Being able to curate these extraordinary pieces requires a strong and well-established network in the industry which our partner Fossil Realm has acquired through its long history in the scientific community. Through this network, Konvi investors were able to invest in a gigantic Green River palm frond worth over $120,000.

- Fine Wine: The fine wine market has shown consistent returns over time, with certain vintages from regions like Bordeaux and Burgundy appreciating significantly due to limited supply and high demand among collectors and connoisseurs.

- Art by Blue-Chip Artists: Artworks by master artists have long been resilient to market fluctuations, with pieces by names like Picasso or Monet not only retaining value but appreciating significantly over time. Even during recent economic downturns, high-quality blue-chip art has shown stability and appreciation, highlighting its role as a valuable store of wealth. Other more current blue-chip artists include Banksy, Jeff Koons, Keith Haring, Jean-Michel Basquiat, or Damien Hirst. Through our partnership with TGB Contemporary, Konvi investors are able to participate in the value appreciation of such artists.

Each of these examples underscores how alternative assets can add a layer of resilience and growth potential to a portfolio, particularly in times when stocks, bonds, and other traditional assets are underperforming. With historical performance data supporting their long-term appreciation, these assets provide investors with a unique means of preserving wealth through diverse market conditions.

How Konvi Makes Alternative Assets Accessible to Retail Investors

For many years, investing in alternative assets such as fine art, fine wine, and rare collectables was a privilege reserved for ultra-high-net-worth individuals. The high capital requirements and niche expertise needed to access these markets often created barriers for the average investor. Today, however, platforms like Konvi have made these markets accessible to a wider audience by leveraging fractional ownership, expert curation, and strategic partnerships.

Through fractional ownership, Konvi allows investors to buy shares in premium assets rather than purchasing entire pieces outright, lowering the entry barrier and opening up a world of unique investment opportunities. This model enables retail investors to diversify their portfolios by adding valuable assets that may have previously been out of reach.

Expert Curation and Transparency Through Partnerships

Konvi’s approach is rooted in partnerships with industry experts, ensuring that each asset offered is carefully vetted, authenticated, and chosen for its appreciation potential. Working with specialized partners like Fossil Realm for fossils, TGB Contemporary for blue-chip art, and Vorona Gallery for emerging artists, Konvi provides access to curated collections that meet high standards of rarity, quality, and investment potential. This network of expertise enables investors to enter these markets confidently, knowing that the assets have been selected with precision and professionalism.

An Investor-Centric Process with Low Entry Barriers

Konvi also prioritizes transparency and investor empowerment by offering a straightforward process from Initial Asset Offerings (IAOs) to collective ownership and eventual returns distribution. Investors have a say in key decisions—such as whether to hold or sell an asset when it reaches a potential appreciation threshold—allowing them to play an active role in their investments. With affordable minimum investment requirements, Konvi makes it simple to diversify with alternative assets and build a portfolio that’s resilient to economic shifts and political uncertainty.

Why Now is the Ideal Time to Invest in Alternative Assets

In today’s economic climate, with persistent inflation, political changes, and heightened market volatility, alternative assets present an exceptional opportunity for investors to strengthen and diversify their portfolios. Tangible assets like fine art, fine wine, and fossils are resilient to the economic fluctuations that affect traditional investments, offering a unique combination of stability, scarcity, and appreciation potential.

As the demand for alternative assets continues to grow, fueled by both economic factors and increased accessibility, now is an ideal time to consider adding these assets to a well-rounded portfolio. By investing in high-quality, curated alternative assets, investors can benefit from their long-term growth potential and enjoy a more balanced, diversified portfolio.

Whether you're looking for a hedge against inflation, a way to protect wealth from market swings, or an opportunity to invest in culturally significant and rare assets, alternative assets offer a unique path forward. The time has never been better to explore these options, and with platforms making them more accessible than ever, alternative assets are becoming an essential component of modern investment strategies.