This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

How Gen Z, Millennials, Gen X and Boomers Are Rethinking Wealth in 2025

Nikkan Navidi•22.5.2025

In 2025, investing has evolved into more than just a vehicle for building wealth. It has become a form of self-expression — a reflection of personal values, generational experience, and economic outlook. How we invest often says as much about our priorities and worldview as it does about our risk appetite.

Generational differences play a crucial role in shaping these behaviours. Baby Boomers, who accumulated wealth during decades of relative stability, typically favour capital preservation through blue-chip stocks, bonds, and real estate. Gen X, entering their peak earning years, leans toward pragmatism, diversifying steadily with an eye on long-term security. Millennials, deeply shaped by the 2008 financial crisis, combine cautious strategies with a willingness to explore digital tools and cultural assets. Gen Z, digital-native and globally connected, approaches investing with an emphasis on access, values, and thematic relevance.

These generational dynamics are unfolding at a pivotal time. Inflation uncertainty, wealth transfer forecasts, and the rise of alternative asset classes are prompting investors to question the legacy models of wealth accumulation. At the same time, technology has lowered the barriers to entry, enabling new strategies, platforms, and communities to emerge.

This article explores how different generations are investing in 2025, what’s driving their decisions, and what these shifts mean for the future of wealth.

Gen Z (Born 1997–2012): The Digital-First, Values-Led Investor

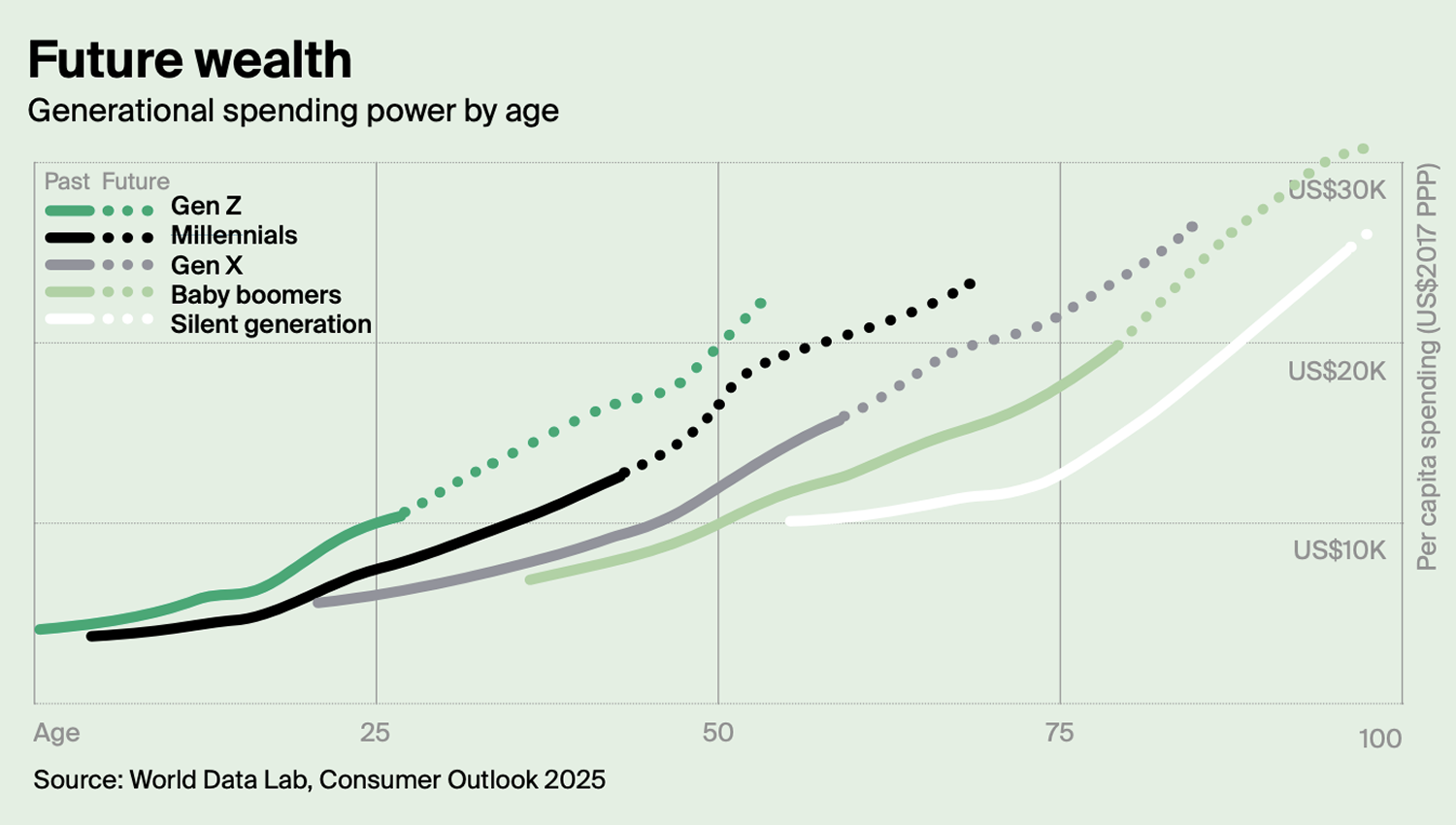

Gen Z is rapidly shaping the future of investing. On average, they start investing at just age 19, significantly earlier than Millennials (25), Gen X (32), and Boomers (35), as stated in a 2024 Charles Schwab survey published by Visual Capitalist.

According to research from Entrepreneur, Gen Z investors prefer tools like robo-advisors, micro-investing apps, and social trading platforms, often relying on peer recommendations from TikTok, Reddit, or YouTube. A majority favour impact investing, backing causes like clean energy, sustainability, and diversity. Thematic ETFs — for sectors like green tech or cybersecurity — are more appealing than legacy index funds.

Following the report on U.S. investment trends by YouGov, many in this generation also hold crypto assets and NFTs, with 42% of Gen Z investors owning cryptocurrency, compared to just 8% of Boomers. Their comfort with tokenisation and blockchain means they are more likely to explore tokenised real assets, gamified investing experiences, and emerging markets in cultural capital, such as sneakers, cards, or artist collaborations

Despite limited capital, Gen Z maximises engagement through fractional investing and automated tools. For them, investing isn’t a purely financial act — it's a form of participation, identity, and self-determination.

Data from the Knight Frank Wealth Report 2025 also supports this trend: while Gen Z is still largely in secondary decision-making roles, their influence is growing fast. Many are being trained to take over wealth responsibilities within family offices, and already hold strong views on sustainability, technology, and transparency. Platforms that meet these needs — blending cultural insight with tech accessibility — are positioned to grow with this generation.

Source: Knight Frank Research, 2025

Millennials (Born 1981–1996): The Experience-Driven Diversifiers

Millennials have had a uniquely formative relationship with financial markets. Many entered adulthood during the 2008 financial crisis, navigated record student debt, and came of age alongside the rise of digital financial tools. As a result, their approach to investing blends caution with adaptability; they are open to innovation but grounded by a desire for transparency, diversification, and meaning.

As reported by Boldin’s 2025 generational trends, Millennials are the most diversified generation in terms of strategy. They hold a mix of traditional investments like index funds and property, but are also strong adopters of digital-first platforms, alternative assets, and environmental, social, and governance (ESG) criteria. Roughly 63% of Millennials report having already invested in sustainable or ethical vehicles, nearly double the rate of Baby Boomers.

This generation has also embraced fractional ownership, using platforms like Konvi to invest in tangible assets, from whisky and fine art to handbags and comics. Their investment choices often intersect with culture and identity, driven not only by financial return but also by narrative and long-term relevance.

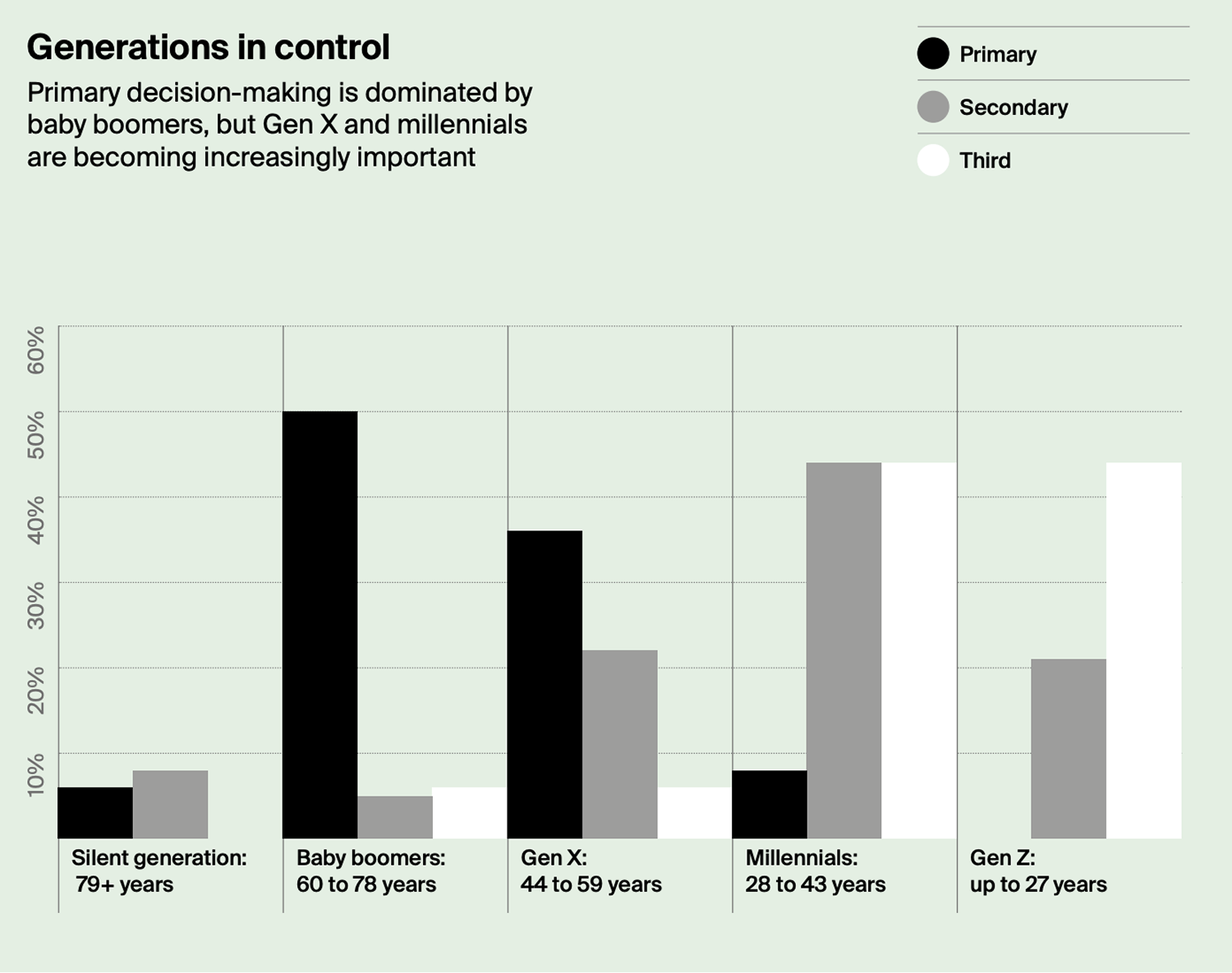

Millennials are becoming increasingly important in wealth transfer conversations. As the 2025 Knight Frank Wealth Report notes, decision-making responsibilities are gradually moving to this generation, with 44% already playing a secondary role in family offices and private wealth structures. Many are in the process of taking the helm, shaping strategies around transparency, ethical alignment, and digital efficiency.

They represent the first generation to treat cultural collectables as legitimate portfolio additions, and they’re proving that wealth-building doesn’t need to follow legacy playbooks to be effective. One of the most recent collectable surges is centred around Pokémon trading cards. These cards have gained significant momentum due to their cultural resonance among millennials but also their inherent appreciation characteristics like rarity, condition relevance, and provenance.

Gen X (Born 1965–1980): The Peak-Earning Pragmatists

Often described as the “sandwich generation,” Gen X is currently balancing peak earning years with complex financial responsibilities, including mortgage debt, college expenses, and retirement planning. Their investment approach tends to reflect this position: disciplined, risk-aware, and increasingly open to diversification.

According to the 2025 Knight Frank Wealth Report, 36% of Gen X investors hold primary decision-making power within family offices, positioning them as a core financial cohort across private wealth structures. While their strategies have historically leaned traditional, this generation is steadily integrating alternative assets and digital tools into their portfolios, particularly where they offer long-term value and tangible security.

Boldin reports that Gen X investors are more conservative than Millennials or Gen Z but still more likely than Boomers to experiment with robo-advisors, ESG-focused ETFs, and real asset exposure such as real estate investment trusts (REITs), fine wine, and collectables. Many are also motivated by a desire for passive income and capital preservation, using dividend stocks and rental property as foundational vehicles.

Unlike younger generations, Gen X investors tend to rely on a combination of digital platforms and financial advisors, seeking both accessibility and expertise. Their openness to innovation is pragmatic — if a tool adds measurable value, they’ll use it. That mindset is increasingly leading them toward platforms that offer secure access to high-quality, curated alternatives.

This generation is well-positioned to benefit from the generational wealth transfer now underway. Many will inherit and manage substantial capital in the coming decade, and their preference for structured yet flexible investing makes them a key driver of growth in private market platforms like Konvi.

Boomers (Born 1946–1964): The Capital Preservation Generation

Baby Boomers hold the majority of the world’s private wealth, and their investment style reflects a focus on security, stability, and legacy planning. This generation grew up during a period of strong post-war economic expansion and has largely benefited from real estate appreciation, long-term stock market growth, and defined-benefit pension schemes.

Boomers typically prefer investments that offer predictable returns and low risk, such as blue-chip equities, dividend-paying stocks, government bonds, and income-generating property. As stated in the data from Entrepreneur and Boldin, they are the least likely generation to invest in high-volatility assets like crypto or NFTs, and they remain more loyal to traditional banks and financial advisors than digital-first platforms.

That said, change is happening. The Knight Frank Wealth Report 2025 notes that Boomers are showing increased interest in tangible luxury assets, especially those perceived as hedges against inflation or economic uncertainty. This includes fine art, rare whisky, classic cars, and investment-grade jewellery — all of which are attractive for their cultural significance and capital preservation characteristics.

Boomers are also beginning to engage with alternative investment platforms — particularly those that offer expert-led curation, secure storage, and clearly defined exit strategies. While they may not be driving the digital collectables market, they are becoming participants in the tangible alternative space, often in collaboration with younger family members or advisors.

As this generation plans for intergenerational wealth transfer, they are prioritising assets that retain value, tell a story, and offer structure. Platforms that provide these features, without overwhelming complexity, will continue to find favour among this cohort.

According to the 2025 Knight Frank Wealth Report, primary investment decision-making remains concentrated among Baby Boomers (60–78 years), who hold 50% of the control within family offices and wealth structures. However, the baton is clearly being passed.

The chart below illustrates how Gen X (44–59) and Millennials (28–43) are steadily increasing their influence, with 36% of Gen X already in primary roles and Millennials dominating secondary and tertiary decision-making. Gen Z, though still early in their wealth journey, is rising fast, particularly in third-line involvement, and is being actively prepared to assume greater control in the coming decade.

This shift underscores a broader trend: the next generation is not only inheriting wealth but increasingly shaping how it's allocated, managed, and aligned with values like sustainability, digital access, and cultural relevance.

Source: Knight Frank Research, 2025

Shared Trends Across Generations

While each generation brings distinct investment behaviours shaped by their life stage and historical context, several key trends are bridging the generational divide in 2025.

1. Buy-and-hold remains the most popular approach

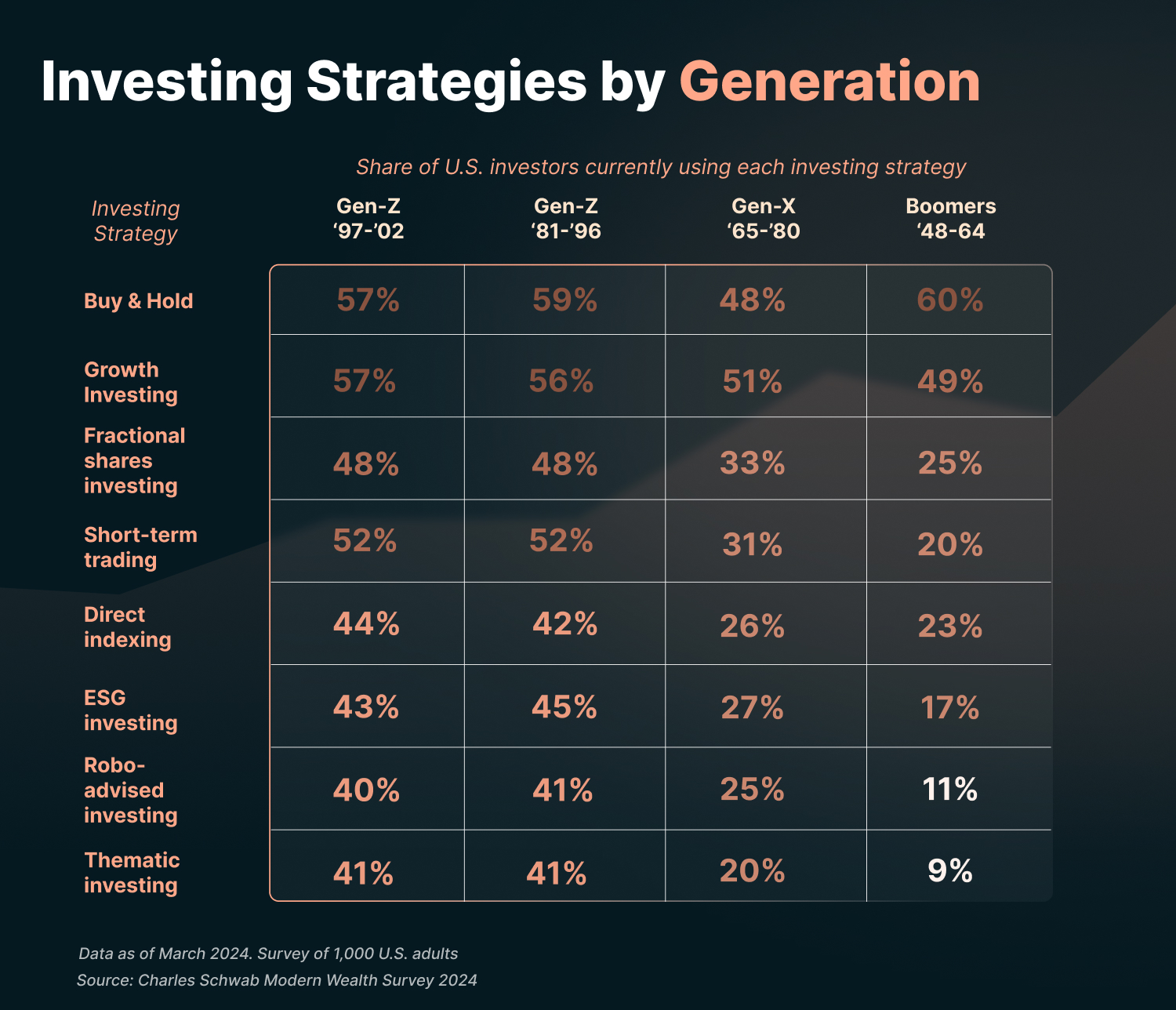

Among the most enduring investment strategies, buy-and-hold remains a cornerstone across all generations. As reported by Charles Schwab’s 2024 survey reported via Visual Capitalist, it is used by 60% of Baby Boomers, 59% of Millennials, and 57% of Gen Z, though Gen X is somewhat more cautious, with only 48% adhering to it.

This consistency highlights a shared recognition of the value of long-term wealth-building, especially in an era where high-frequency trading and algorithmic investing dominate media headlines. Buy-and-hold reflects a belief in the power of compounding, market cycles, and asset durability — principles that continue to be relevant regardless of age.

That so many younger investors continue to favour this strategy, despite their comfort with high-risk assets and short-term tools, suggests a surprising degree of financial maturity. It shows that financial literacy is evolving not just through institutions, but through community learning, digital education, and hands-on experience with diversified portfolios.

Buy-and-hold also serves as a counterbalance in increasingly fragmented investment behaviour. While younger generations embrace thematic ETFs, crypto, and alternative collectables, the anchoring of a core long-term portfolio indicates that strategic patience remains a trusted tool, not just for retirement planning, but for wealth creation that aligns with broader life goals.

2. Growing Demand for Tangible Assets

According to the Knight Frank Wealth Report 2025, tangible assets — including fine art, rare whisky, luxury watches, and classic cars are gaining appeal across all age groups. These items are viewed not just as passion investments but as culturally relevant stores of value that can hedge against inflation and economic uncertainty.

Younger investors are increasingly drawn to these assets for their emotional and symbolic value, while older generations see them as vehicles for capital preservation and legacy.

3. ESG and Impact-Driven Investing

Environmental, social, and governance (ESG) investing, once seen as a niche category, is now influencing portfolio decisions across the spectrum. Millennials and Gen Z lead adoption, but Gen X and even Boomers are showing increasing interest in aligning capital with personal values.

In the Entrepreneur and Boldin studies, Gen Z and Millennials consistently ranked clean energy, ethical consumption, and diversity as factors influencing their portfolio preferences that are now reshaping fund offerings across wealth management firms.

4. Declining Trust in Traditional Institutions

Across generations, investors are demonstrating a growing scepticism toward legacy financial systems and institutions. Whether due to the 2008 financial crisis, ongoing inflation, or geopolitical instability, more people are seeking transparency, flexibility, and direct access to investment opportunities.

This is reflected in the rise of fintech, decentralised finance platforms, and co-investment models — particularly among younger demographics, but with notable spillover among Gen X and Boomers.

5. Convergence Through Digital Platforms

Though their adoption curves vary, all generations are now engaging with digital platforms. From mobile trading apps and robo-advisors to secure alternative asset platforms like Konvi, technology is becoming the universal medium for accessing both mainstream and niche investments.

Even Boomers, once hesitant, are increasingly using apps and dashboards, particularly when supported by advisory services or user-friendly interfaces. The democratisation of investing is no longer a trend, but a reality, uniting users across age groups.

Source: Charles Schwab Modern Wealth Survey 2024

What This Means for the Future of Wealth

In 2025, wealth is no longer defined solely by how much someone owns, but also by how aligned their investments are with their beliefs, lifestyle, and goals. The traditional model of wealth accumulation through equities, bonds, and property is being expanded, not abandoned. Investors are seeking flexibility, emotional resonance, and long-term cultural value — especially as markets become more volatile and information flows more freely.

One of the defining shifts is the increasing demand for access. Platforms that allow investors to participate in high-quality assets, without requiring institutional capital, are reshaping what financial inclusion looks like. Whether it’s through fractional ownership, thematic portfolios, or curated collectables, modern investors are no longer content with passive allocations. They want to understand, engage with, and often identify with their portfolios.

At the same time, the largest wealth transfer in history is already underway. Trillions in assets are expected to shift from Baby Boomers to Millennials and Gen Z over the next two decades. As this capital changes hands, the investment strategies around it will evolve. The new stewards of wealth are more tech-savvy, more culturally aware, and more impact-driven than any previous generation.

In response, wealth platforms will need to meet a higher bar. It’s not just about performance anymore — it’s about narrative, access, and values. The future belongs to investment ecosystems that can speak across generations, offering a blend of structure, authenticity, and innovation.

How Konvi Bridges Generational Investment Strategies

At Konvi, we’ve built our platform with a clear vision: to make premium alternative assets accessible to investors of all generations — whether they’re exploring collectables for the first time or seeking to diversify legacy portfolios with tangible cultural assets.

For Gen Z and Millennials

Younger investors want more than returns. They seek access, authenticity, and emotional alignment. Konvi offers entry into highly sought-after asset classes — such as vintage comics, limited-edition watches, rare whisky, and culturally iconic fashion items — with a starting investment as low as €250.

Fractional ownership allows this generation to participate in traditionally exclusive markets without the capital barriers, while curated storytelling around each asset ensures the experience remains personally meaningful and financially transparent.

For Gen X and Boomers

Konvi offers older investors a way to explore diversification within a structured, professionally managed environment. All assets listed on the platform are independently authenticated, securely stored, and vetted by industry experts. This level of diligence resonates with Gen X’s pragmatic mindset and Boomers’ desire for capital preservation with cultural value.

With clearly defined holding periods and investor voting rights for potential asset sales, Konvi ensures that users maintain visibility and control, whether they’re first-time co-owners or seasoned portfolio builders.

A Shared Platform for a Multi-Generational Investor Base

By combining technology, expert curation, and accessible investment structures, Konvi helps bridge the gap between generations. Whether driven by passion, strategy, or legacy, each investor can find assets that reflect their values and financial goals, without needing millions in capital or a private banker on call.

Conclusion: One Market, Many Mindsets

In today’s investment landscape, there is no single “correct” strategy, and that’s precisely the point. Each generation brings unique experiences, priorities, and preferences to the table. Gen Z invests early and digitally, seeking alignment with their values. Millennials embrace diversification and emotional resonance. Gen X balances growth with caution, and Boomers focus on security and legacy.

What’s changing is the infrastructure around these investors. Platforms like Konvi are creating space where these differences don’t clash; they converge. By offering secure, curated access to alternative assets that carry both cultural significance and financial potential, we’re helping bridge generations through a shared language of investing.

In 2025 and beyond, the future of wealth will be defined by flexibility, purpose, and inclusion. From Pokémon cards to rare whisky, what we choose to invest in increasingly reflects how we see the world and how we want to shape it.