This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Investing in 19th and 20th-century Art Pieces: Strategies and Insights

Nikkan Navidi•31.5.2024

Art investment offers a unique opportunity to preserve cultural heritage while also seeking financial gains. Traditional art pieces from the 19th and 20th centuries hold particular appeal due to their historical significance and potential value appreciation. There are several avenues through which collectors and investors can acquire these artworks, each with its own set of benefits and considerations. Additionally, the decision to invest in emerging artists versus established blue-chip art involves a complex balance of risk and reward.

Investment potential of 19th & 20th Century Art

Historical Significance and Collector Appeal

The 19th century was a time of great innovation in art, with movements ranging from Realism and Romanticism to the nascent stages of Impressionism and Modernism. Artists of this era, such as Delacroix, Courbet, and Corot, pushed the boundaries of artistic expression, paving the way for the modern movements that would follow. Their works capture a transformative period in history, marked by revolutions, the rise of industrialism, and significant cultural shifts. This rich historical context not only enhances the cultural value of 19th-century artworks but also deepens their appeal to collectors who are drawn to art with a strong narrative quality.

Investment Potential of 19th-Century Art

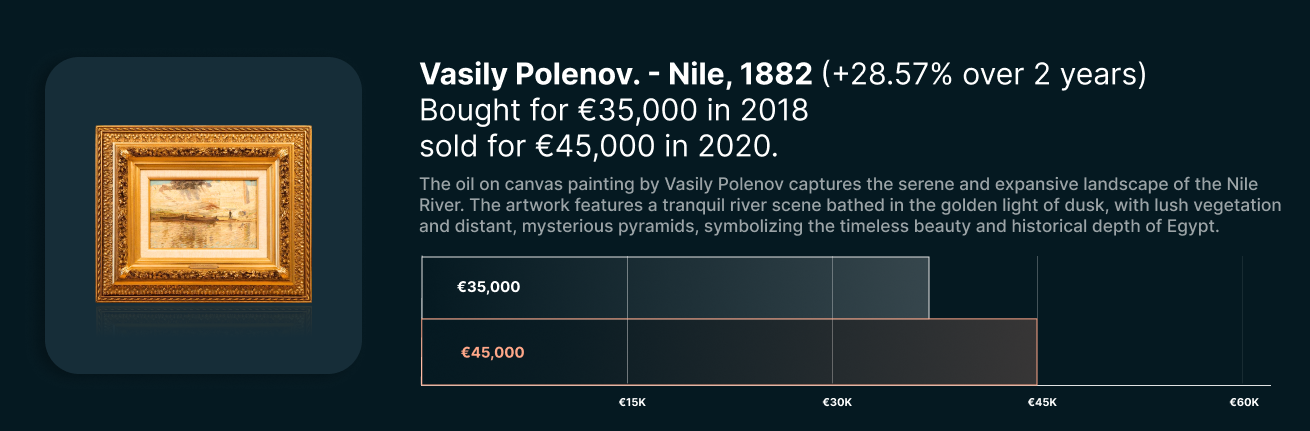

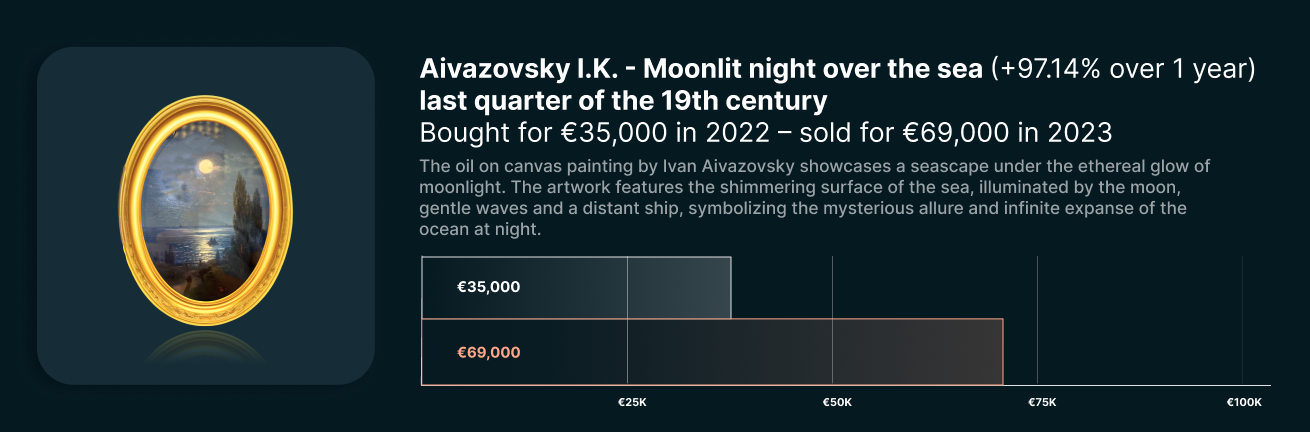

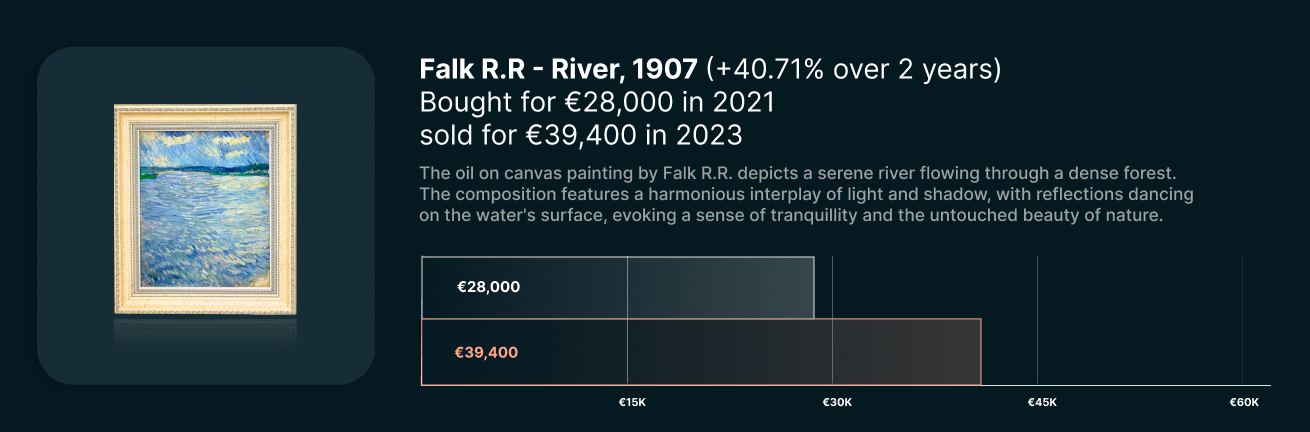

From an investment perspective, 19th-century art is particularly compelling due to its relative undervaluation in the market. Despite the critical roles these artists played in shaping the direction of Western art, their works are often available at prices that are more accessible than those of their more famous successors like the Impressionists. For example, while a painting by Monet can sell for millions, influential precursors like Jongkind, who directly influenced Monet, can be acquired for much more reasonable sums. This pricing discrepancy highlights a significant opportunity for growth, as the market gradually corrects these imbalances in recognition and value. Art Most, an industry expert when it comes to investing in appreciating art pieces, has successfully exited numerous 19th and 20th-century works:

What Draws Collectors to 19th-Century Art

Collectors are increasingly drawn to 19th-century art due to its pioneering spirit and the opportunity it presents to acquire significant works at lower entry points. The period's artists were instrumental in developing key concepts and techniques that would define future artistic movements. Their experimentation with light, colour, and subject matter represented a departure from the more rigid practices of earlier periods, making their works not only historically important but also visually and thematically engaging. Additionally, the growing recognition of these artists in recent exhibitions and art historical discourse is likely to enhance the value of their works, making them attractive prospects for both new and seasoned collectors.

Methods of Acquiring Traditional Art

Galleries and Auctions for Art Investments

Art galleries and auctions represent the most established venues for acquiring 19th and 20th-century art. Galleries often represent a mix of historical and contemporary artists, offering collectors a vetted selection of works. Auction houses like Sotheby’s and Christie’s also provide a platform for purchasing rare and sought-after works, often setting the trends in art valuation.

Buying Art Through Private Dealers

Private dealers offer a more personalized approach to buying art, often specializing in a particular genre or period. These experts can provide bespoke advice and access to exclusive pieces that aren't available in public galleries or auctions. Working with a private dealer allows investors to build relationships that can lead to first dibs on highly coveted art as it becomes available.

Investing through Art Funds

Art funds offer a collective investment model for those interested in the art market. By pooling resources, investors can engage with the art world through a managed portfolio without owning specific artworks directly. These funds are handled by experienced professionals who apply strategic insights to purchase, manage, and eventually sell art pieces. This arrangement allows participants to gain exposure to the lucrative art market's potential returns while mitigating individual risks. However, while they offer diversified access to high-value artworks, balancing investment growth with expert risk management, the barrier to entry into those funds can be very significant and sometimes compared to that of hedge funds with minimum buy-ins reaching between €500,000-€1,000,000.

Investing in Art starting from €250

While art funds provide an effective gateway to the art market's opportunities, the high barrier to entry can limit access to only the most affluent investors. Konvi innovatively addresses this challenge by offering a more accessible entry point into the art investment world. By requiring a significantly lower initial investment of just €250, Konvi opens the door to a broader demographic of art enthusiasts and investors. Leveraging professional networks of buyers and sellers traditionally utilized by larger art funds, Konvi connects investors with established and experienced industry experts.

This approach ensures that even small-scale investors can benefit from expert curation and strategic market insights, traditionally reserved for high-net-worth individuals. Through Konvi, investors enjoy the advantages of collective buying power and professional management, making it easier and more affordable to diversify their portfolios with valuable art pieces. In our most recent collaboration with our renowned expert for 19th and 20th-century artworks, Art Most, we have launched “Imperial Art Piece”. After the funding period has ended Art Most will curate an art piece that offers the highest investment potential in the current market.

Investing in Emerging Artists vs. Established Blue-Chip Art

Emerging Artists

Investing in emerging artists carries a higher risk but potentially higher rewards. These artists, often at the beginning stages of their careers, may not yet have established a reputation in the art world. However, purchasing their work can be a strategic move for those looking to support new talent with the potential for significant appreciation in value. For instance, an early investment in artists like Jean-Michel Basquiat or Frida Kahlo before they achieved widespread fame could have yielded immense returns.

The primary challenge with investing in emerging artists lies in the difficulty of predicting success. Many emerging artists may never reach the status where their works significantly appreciate in value. Therefore, this investment route requires thorough research, keen insight, and sometimes, an element of luck.

Established Blue-Chip Art

Conversely, investing in established blue-chip artists is generally considered safer. These artists have a proven track record of demand and stable or increasing value over time. Works by artists such as Claude Monet or Vincent van Gogh, for instance, are likely to be more resilient to market fluctuations due to their historical significance and enduring demand.

The drawback to blue-chip investments is their high entry price. Acquiring pieces from renowned artists requires a significant upfront investment, which might not be accessible to all collectors. Additionally, while the risk of depreciation is lower, the growth in value might not be as rapid or as high as it could be with a successful emerging artist.

Balancing Risk and Reward

The key to successful art investment lies in diversification and a balanced portfolio. Just as with financial investments, combining high-risk and low-risk art assets can mitigate potential losses while maximizing potential gains. For those looking to explore the vibrant field of art investment, incorporating both emerging and established artists can offer a rewarding strategy that balances potential risks and rewards.

Conclusion

Investing in art from the 19th and 20th centuries, whether through galleries, auctions, private dealers, or directly from artists, presents various pathways to enrich one’s investment portfolio. Each method offers unique advantages and caters to different investment strategies and preferences. By carefully considering the risk associated with emerging artists versus the stability of blue-chip art, investors can make informed decisions that align with their financial goals and passion for art. As the market continues to evolve, staying informed and responsive to changes in art trends and market dynamics will be crucial for success.

Note: this article only engages the opinion of its author and does not constitute financial advice.