This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

What should I invest in? - Your Portfolio Diversification Guide

Nikkan Navidi•24.3.2022

Diversification is a fundamental concept in investment management aimed at reducing risk by allocating investments among various financial vehicles, industries, and other categories. It involves creating a mix of different asset types and investment vehicles within a portfolio to minimize exposure to any single asset risk. The essence of diversification lies in the saying, "Don't put all your eggs in one basket". This approach ensures that even if some investments perform poorly, others may succeed, balancing the overall portfolio performance.

Why Diversify?

Diversification is crucial for managing investment risk. It helps to ensure that the impact of poor performance in one area can be mitigated by stronger performance in another. Essentially, diversification can lead to more consistent and safer returns over time by reducing the risk exposure an individual investment would carry. A well-diversified portfolio is particularly valuable during times of market uncertainty and volatility, as it can protect the portfolio against significant losses and essentially act as a hedge.

What Asset Classes can I use?

Investment professionals and individual investors frequently allocate their investments across various asset classes, each offering unique risks and opportunities. The portfolio's allocation percentages are carefully chosen based on these factors. Common asset classes include:

- Stocks: Ownership shares in publicly traded companies.

- Bonds: Debt securities issued by governments and corporations.

- Real Estate: Investments in property, including land, buildings, and natural resources.

- Exchange-Traded Funds (ETFs): Diverse portfolios of stocks, bonds, or commodities that track an underlying index.

- Commodities: Essential goods used in commerce that are interchangeable with other goods of the same type.

- Cash and Cash Equivalents: Highly liquid investments like Treasury bills, certificates of deposit, and money market funds.

- Alternative assets: Everything that does not fall into the category of conventional investments. They can include private equity or venture capital, hedge funds, managed futures, Real estate, art and antiques, commodities, and derivatives contracts.

Selecting the right asset classes to achieve a well-diversified portfolio can be an intricate process as the interaction between different asset classes can be complex. For instance, rising interest rates may depress bond values due to higher yields becoming necessary, whereas they could increase returns from real estate investments and commodity prices. This leads us to learn how correlation interplays in the decision-making process when making well-founded portfolio decisions.

Understanding Correlation in Diversification

At the core of effective diversification is the principle of correlation, which measures how different investments move in relation to one another. The correlation coefficient is measured and denoted as a value ranging from -1 to +1, indicating a perfect negative or positive relationship and 0 zero indicating no relationship between two variables respectively. Investments that are less correlated or negatively correlated to each other can help balance the portfolio's performance and risk exposure.

On the other hand, it is also important to look at the correlation the investment has to the market, which can also help you significantly reduce your risk exposure during times of economic downturns. For instance, since alternative assets show a low correlation to the overall market, they are considered a great hedge against inflation or stock market declines. Conversely, only investing in ETFs such as the S&P500 that show nearly perfect correlation to the market can become very unfavourable during market downturns.

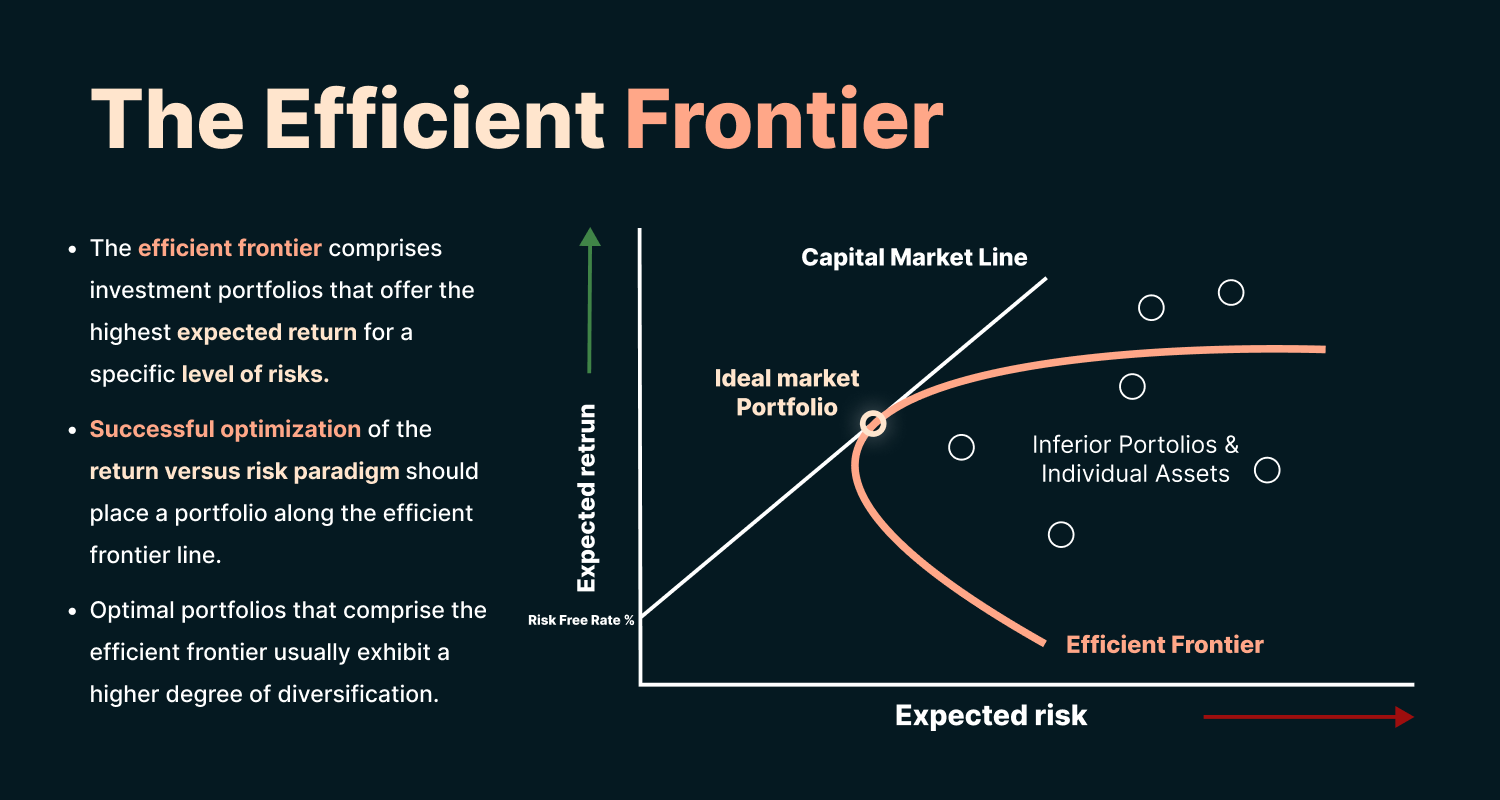

Can you have the perfect portfolio?

Now you might ask: is there a portfolio that gives me the highest expected return for the level of risk I want to take? The Modern Portfolio Theory (MPT) employs correlation metrics among portfolio assets to identify the optimal balance of risk and return, known as the efficient frontier. By incorporating assets that are minimally correlated with each other, MPT aims to minimize the overall risk within a portfolio while maximizing expected returns. This strategy helps investors achieve a more stable performance across varying market conditions.

Strategic Diversification Approaches

Investors can diversify their portfolios through various strategies, considering not only different asset classes but also sectors, geographical locations, and investment styles:

- Asset Classes: Diversification across asset classes such as stocks, bonds, real estate, and commodities can help protect against sector-specific risks and market fluctuations. Each class responds differently to market conditions, providing a natural hedge against volatility.

- Geographical Diversification: Investing in markets across different countries or regions can safeguard against country-specific economic downturns and political risks. Global diversification can tap into growth opportunities in emerging markets while balancing exposure to mature economies.

- Sector and Industry Diversification: Different industries react differently to economic cycles. By investing across various sectors, such as technology, healthcare, and energy, investors can reduce the risk that an industry-specific downturn will adversely affect their entire portfolio.

- Diversification by Company Size (Market Capitalization): Including a mix of large-cap, mid-cap, and small-cap stocks can diversify the risk characteristics of the equity portion of a portfolio. Smaller companies often offer higher growth potential, albeit with higher volatility, while larger companies tend to be more stable and established and hence be less volatile but also potentially yield fewer returns in the same time period.

- Investment Style Diversification: Combining growth and value investment styles can also be an effective diversification strategy. Growth stocks offer the potential for substantial capital appreciation, whereas value stocks are generally priced below what they are worth and tend to be more stable with less price volatility.

However, while the majority of retail investors have been bound to invest in traditional investment vehicles such as stocks, bonds, or ETFs and would be hence limited to only a certain degree of diversification and hence risk exposure, ultra-high-net-worth individuals (UHNWI) have been leveraging their wealth to gain access to other opportunities.

The Opportunity of Alternative Investments

For centuries, high-net-worth individuals have leveraged alternative investments as a sophisticated strategy to diversify their portfolios and hedge against inflation. These assets, which include fine wine, whiskey, luxury watches, and art, are characterized by their low correlation to traditional market investments, providing a buffer against market volatility.

Alternative investments often operate independently of the fluctuations seen in stock and bond markets, making them an appealing option for portfolio diversification. For instance, during economic downturns, while traditional investments may see a decline, alternative assets like blue-chip art or vintage watches often retain value or even appreciate.

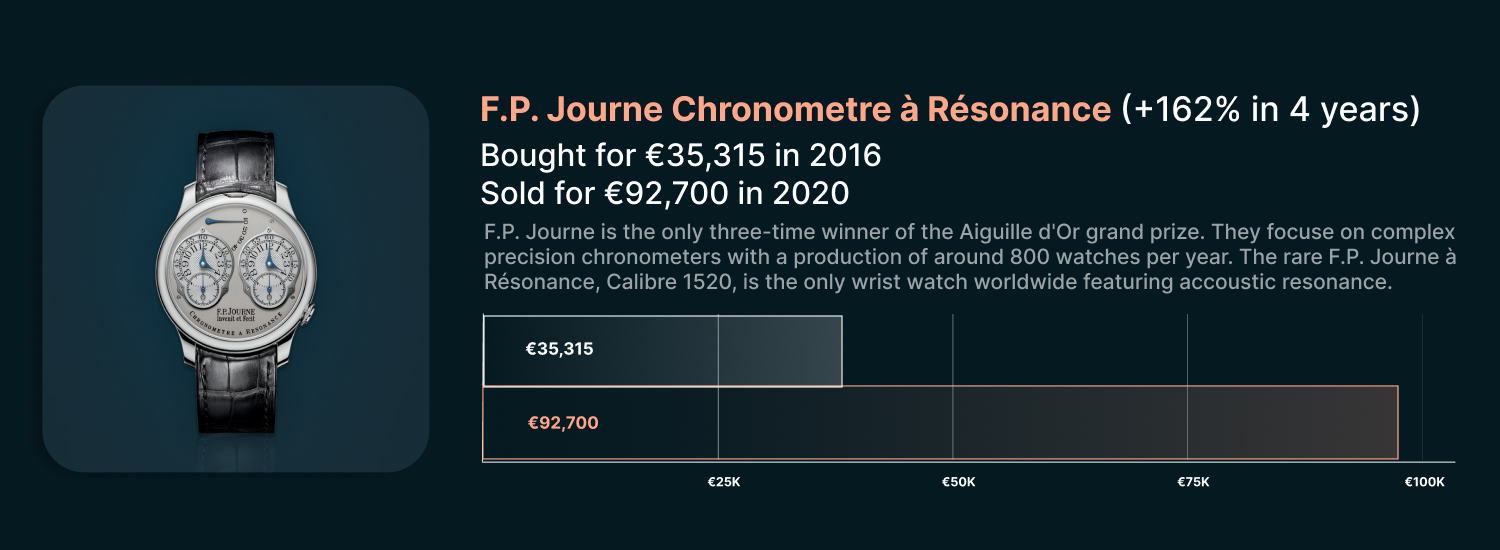

Case studies across various sectors illustrate the potential for substantial returns. For example, certain blue-chip art pieces have been known to appreciate considerably in price. A notable piece, "Precision Bombing" by Banksy was acquired for €261,500, and saw a return of 47% over less than a year due to its increased demand among collectors. Similarly, luxury watches such as the "F.P Journe Chronometre à Résonance" have shown significant appreciation; a model purchased in 2020 for €35,315 could fetch over €97,700 today, highlighting a 162% increase in value.

Prestigious wines offer another compelling case. Bottles of the "Domaine Leroy Nuits Saint Georges 1er Cru Aux Boudots 2011 750ml," initially valued at €896, commanded prices upward of €896 during the sale, delivering more than 516% returns to the investors. Such investments not only serve as robust hedging tools against inflation but also enhance the growth potential of investment portfolios.

Therefore Konvi has set its mission to democratize access to such asset types and enable investors to participate in such opportunities starting from €250. Konvi works with connects you with industry-leading experts that curate investment opportunities with the highest appreciation potential given the most current market conditions. One of these experts is TGB Contemporary, a leading curator for Banksy and other contemporary blue-chip artists such as Damien Hirst.

Implementing Diversification

To implement diversification effectively:

- Assess Current Investments: Review and understand your current portfolio composition by identifying any concentration risks or imbalances.

- Set Clear Investment Goals: Define what you aim to achieve through your investments, considering your risk tolerance and time horizon.

- Continuous Monitoring and Rebalancing: Regularly review and adjust your portfolio to maintain your desired level of diversification. This helps to realign your portfolio with your investment goals as market conditions change and as investments deviate from their target allocations.

Challenges and Considerations

While diversification is aimed at reducing risk, it's not without its challenges:

- Over-Diversification: Excessive diversification can dilute potential returns and complicate portfolio management.

- Costs: Buying and maintaining a diversified portfolio can incur higher transaction fees and management costs.

- Complexity: Managing a diversified portfolio requires ongoing analysis and adjustment to respond to market changes and opportunities.

Conclusion

Diversification is a powerful investment principle that serves as a defensive mechanism against volatility and market downturns, while potentially smoothing out returns over time. By spreading investments across various asset classes, sectors, and geographical areas, investors can significantly reduce risk and create more resilient portfolios. As with any investment strategy, it requires careful planning, consistent monitoring, and a clear understanding of one's financial goals and risk tolerance.

Note: this article only engages the opinion of its author and does not constitute financial advice.