This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Investing in Rare Books: How Collectible Literature gains value

Nikkan Navidi•20.6.2025

In the evolving world of alternative investments, rare books are turning a new page. Once considered the domain of literary collectors and antiquarians, first editions, signed manuscripts, and historically significant volumes are now being viewed through a different lens, as cultural assets with tangible financial upside.

This shift isn’t just anecdotal. Sales at major auction houses like Christie’s and Sotheby’s have hit record highs, with modern classics joining the ranks of centuries-old religious texts and scientific treatises. From a first edition of Mary Shelley’s Frankenstein to a signed copy of Harry Potter and the Philosopher’s Stone, rare books are drawing a new kind of attention: that of emotionally engaged, financially motivated investors.

As Konvi prepares to offer its first rare book investment, this article explores the dual value of collectible literature, the market’s evolution, and what new investors should know before turning the page on this unique category.

Emotional vs. Financial Value in Book Collecting

Rare books sit at a unique intersection of passion and profit. To own a first edition is for many more than to just hold a printed object, it’s a mixture of nostalgia and in some cases also owning a fragment of cultural history. Whether it’s a Gutenberg Bible or a Beat Generation manifesto, books tell stories beyond their pages, they embody a moment in time, an idea, a legacy.

This emotional resonance is part of what makes rare books so appealing to investors. According to market research and auction results, top-performing books have appreciated in value at rates comparable to fine art or vintage watches.

Key Drivers of Value:

- Scarcity: Most rare books exist in limited quantities, often with fewer than 1,000 surviving copies.

- Condition: A pristine dust jacket or original binding can significantly influence price.

- Cultural relevance: Books tied to literary milestones or historical figures often command premiums.

Rare books are deeply personal, yet they offer liquidity and investment potential that rivals many other cultural assets. For some, it's about preserving literary heritage. For others, it's about building a portfolio with stories that resonate both intellectually and economically.

The Evolution of Book Collecting Through the Centuries

Rare book collecting is one of the oldest forms of cultural collecting, with a lineage that predates modern financial markets. Early collections were typically assembled by royalty, religious institutions, and scholars, driven by the pursuit of knowledge and preservation. These collections were often curated for their theological or philosophical significance, such as illuminated manuscripts or classical works in Greek and Latin.

By the Renaissance, book collecting became more secular and refined, as the printing press made books more accessible and sparked a growing bibliophilic culture. The invention of moveable type by Johannes Gutenberg in the 15th century laid the foundation for what many consider the beginning of the rare book market. Today, surviving Gutenberg Bibles are among the most valuable printed works in existence, with copies fetching tens of millions of dollars.

In the 19th and early 20th centuries, book collecting matured as a field. Collectors like J.P. Morgan and Henry Huntington amassed vast libraries, many of which are now public institutions. The market also began to formalize, with the emergence of antiquarian booksellers, professional appraisers, and scholarly catalogues.

Fast-forward to the 21st century, and the demographic of rare book collectors is shifting. No longer the exclusive realm of bibliophiles or academia, rare books are attracting entrepreneurs, investors, and technology professionals looking to combine cultural capital with investment-grade assets.

The digitisation of catalogues and growth of online marketplaces have also expanded access and transparency, making it easier to research provenance, verify authenticity, and participate in global auctions from anywhere.

Famous Sales and Record-Breaking Auctions

Over the past few decades, rare books have quietly entered the realm of high-value collectibles, with several titles achieving multimillion-euro prices at auction. These sales demonstrate not only the emotional and historical importance of rare books, but also their appeal as long-term stores of value.

One of the most notable transactions in the field was the 2021 sale of an original copy of the U.S. Constitution, which fetched over $43 million at Sotheby’s. Purchased by hedge fund billionaire Ken Griffin, the sale broke all previous records for a historical document and underlined the cultural weight such items can carry.

Another icon in the rare book world is the Codex Leicester , a 72-page manuscript of scientific writings by Leonardo da Vinci. Acquired by Bill Gates in 1994 for $30.8 million, it remains one of the most expensive books ever sold, and is now periodically exhibited for public viewing.

In the literary realm, first editions of J.K. Rowling’s "Harry Potter and the Philosopher’s Stone" have become modern collectibles. In 2021, one copy sold at Heritage Auctions for over $470,000, marking the highest price ever paid for a 20th-century work of fiction. The combination of limited print run, cultural significance, and global fanbase turned a once-contemporary children's book into an alternative asset.

Other highlights include:

- A first edition of Darwin’s “On the Origin of Species”, sold for over £500,000.

- Shakespeare’s First Folio (1623), which can reach $10 million depending on condition and provenance.

- A signed copy of “The Great Gatsby” with an inscription to the critic who panned it, sold for $377,000.

These sales reflect a broader trend: books with historical, cultural, or narrative gravity , especially those in excellent condition with verified provenance , are commanding prices usually reserved for fine art and classic cars.

What Makes a Book Valuable?

Not every old book is a rare book, and not every rare book is inherently valuable. The investment potential of a collectible book depends on a combination of physical, historical, and cultural factors that intersect to create true scarcity and lasting desirability.

First Editions and Limited Print Runs

One of the most significant indicators of value is whether the book is a first edition, particularly from a limited print run. First appearances of iconic works , such as Frankenstein (1818), Ulysses (1922), or Catcher in the Rye (1951) , are highly sought-after, especially if they were issued in small quantities or before the author gained fame.

Books that were originally printed in modest numbers but gained cultural prominence over time are especially attractive to collectors and investors. For example, the original 1997 Bloomsbury edition of Harry Potter and the Philosopher’s Stone had only 500 copies in hardback , most of which were sent to libraries, making surviving copies incredibly scarce.

Author Signatures and Annotations

Books signed by the author, or better yet, personally inscribed, can command a significant premium. The presence of marginal notes, sketches, or dedications (especially to notable individuals) elevates a book’s uniqueness and often ties it directly to the author’s creative process or social circle.

For instance, a signed copy of The Great Gatsby inscribed to a key critic or influencer of the era holds more historical resonance than a standard signed copy.

Condition and Provenance

Like other tangible assets, the physical condition of a book significantly affects its market value. Grading includes assessment of the dust jacket, binding integrity, paper quality, and presence of any repairs or annotations. Books in fine or near-fine condition are exponentially more valuable than those in average shape.

Provenance also plays a vital role. A clear and verifiable chain of ownership, particularly if it includes notable collectors or institutions, boosts both credibility and desirability. Auction houses and major dealers often highlight provenance as a key value driver.

Cultural and Historical Importance

Books that shaped public thought, marked turning points in history, or influenced entire generations tend to gain value as their cultural impact deepens. Religious texts, foundational scientific treatises, and pivotal literary works, such as the Gutenberg Bible, Darwin’s On the Origin of Species, or Newton’s Principia Mathematica, all exemplify how significance translates into sustained demand.

Modern examples, such as books tied to political events, social revolutions, or groundbreaking pop culture, are also gaining momentum. Think of first printings of The Communist Manifesto, or inscribed copies of books by Martin Luther King Jr. or James Baldwin.

Market Trends Over the Past 10–20 Years

The market for rare and collectible books has undergone a quiet but powerful transformation over the last two decades. Once considered the domain of antiquarian specialists and academic collectors, rare books are increasingly recognised as alternative investments with real financial upside, especially when combined with cultural relevance and historical weight.

A Shift Toward Modern Collectibles

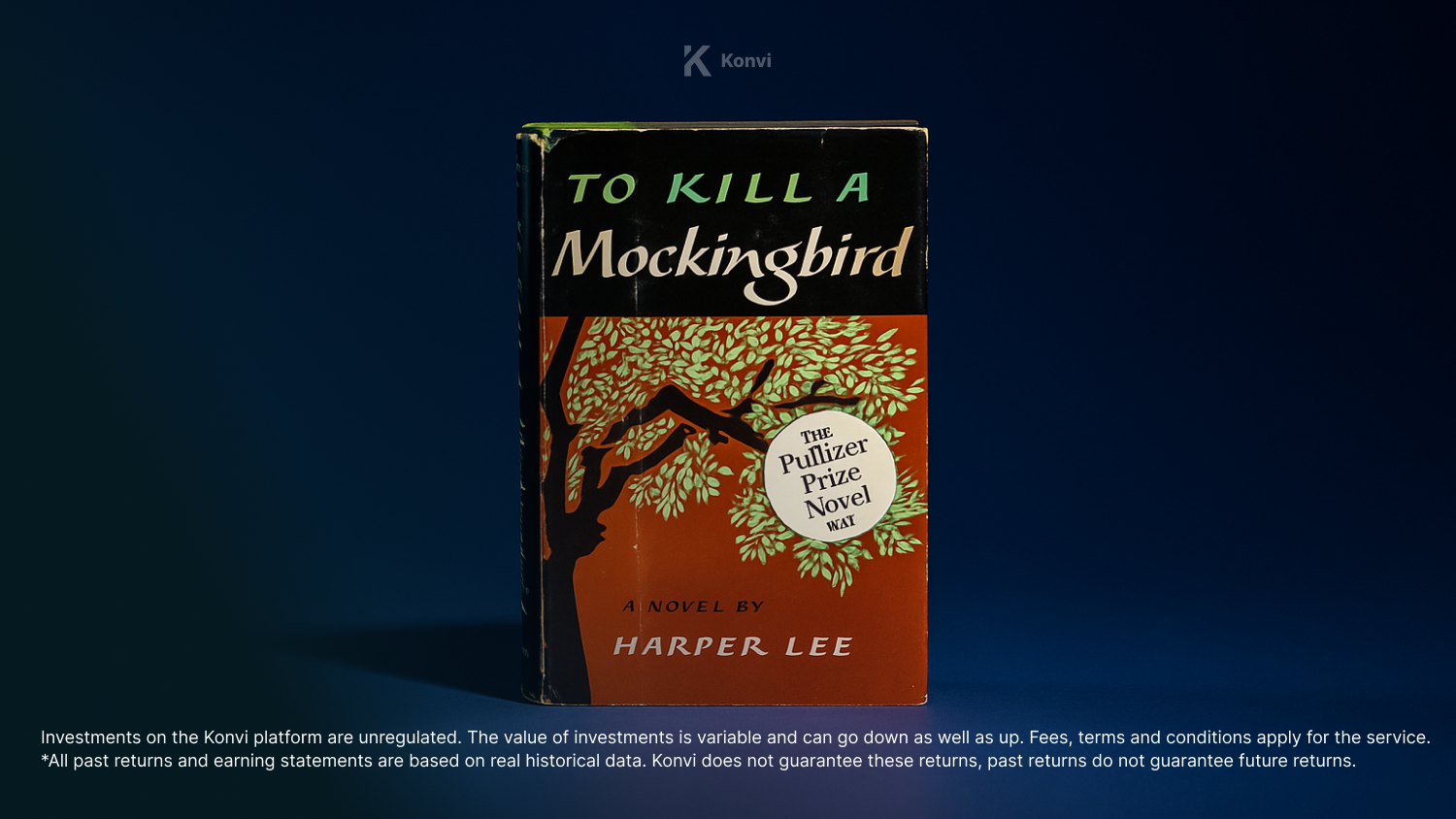

While 19th-century and early 20th-century literature remains important, there has been a marked uptick in interest for modern and contemporary books, particularly those with strong pop-cultural resonance. First editions of To Kill a Mockingbird, 1984, and The Lord of the Rings have seen steady appreciation, but so have modern classics like Harry Potter, The Handmaid’s Tale, and American Psycho.

This trend mirrors similar shifts in other collecting categories, such as comic books and trading cards, where 20th-century nostalgia has become a major value driver for Millennial and Gen Z buyers. These younger investors are not just buying books for prestige or academic interest; they are backing emotional assets with cultural cachet and future market relevance.

Record-Breaking Auctions and Institutional Buying

High-profile auctions have brought renewed visibility to the rare book market. In 2021, a copy of Shakespeare’s First Folio sold for nearly $10 million at Christie’s, while a first edition of Darwin’s On the Origin of Species crossed the $500,000 mark. These sales reflect not just rarity, but an expanding collector base that includes private investors, institutional buyers, and even hedge funds.

Increasingly, technology entrepreneurs and digitally native investors are entering the market, drawn by the combination of tangible scarcity and symbolic prestige. Many of these buyers are building diversified collections that include both traditional financial assets and cultural capital, from wine and watches to rare books and street art.

Resilience During Volatile Markets

One reason rare books are gaining traction as investment assets is their resilience during economic uncertainty. Like other real assets, books with high historical or cultural value tend to hold their worth even during downturns. This makes them appealing as long-term portfolio stabilisers, especially when acquired with strong provenance and authenticated condition.

Additionally, the rise of fractional ownership platforms and alternative asset funds is creating new access points for investors who don’t want to commit six or seven figures to a single copy. This fractional model allows for broader participation in a traditionally opaque and high-barrier market.

How to Invest in Rare Books

Entering the rare book market can seem daunting at first, especially for those unfamiliar with bibliographic nuances and valuation subtleties. But with the right approach and resources, rare books can become a compelling and rewarding part of an alternative asset portfolio.

Auction Houses and Dealers

Traditional auction houses like Sotheby’s, Christie’s, and Bonhams remain key gateways for acquiring high-value books. These venues offer trusted provenance, expert authentication, and global buyer visibility. They’re also where many of the market’s record-setting sales occur, making them an essential benchmark for book valuations.

In parallel, specialised rare book dealers continue to play a central role. Reputable dealers often operate through private sales or niche book fairs such as the New York Antiquarian Book Fair or London’s Firsts. These experts curate catalogues, provide condition assessments, and assist with sourcing specific titles, a vital service in a market where rarity and authenticity are paramount.

Online Marketplaces and Platforms

The digital shift has also transformed book collecting. Platforms like AbeBooks, Biblio, and Heritage Auctions make it possible to browse, compare, and bid on rare titles from anywhere in the world. While these marketplaces cater to a wider price spectrum, they are particularly useful for investors looking to track trends, explore catalogue histories, and verify relative pricing.

Some platforms, such as Raptis Rare Books or Bauman Rare Books, offer online purchasing directly from established dealers, often accompanied by condition reports and historical background.

The Role of Experts and Appraisers

In rare book investing, expert guidance is essential. Factors like binding condition, dust jacket presence, edition state, and even printer errors can dramatically impact value. A first edition in excellent condition may be worth 10x more than a slightly worn copy of the same book. Because of this, working with a qualified appraiser or rare book consultant is critical, especially when transacting in the higher-end of the market.

Independent appraisal is also important for insurance, resale, and tax reporting. In many cases, books are acquired as part of estate strategies or cultural portfolios, making professional documentation essential.

New Models: Fractional Ownership and Alternative Platforms

As with fine art, watches, and wine, rare books are entering the fractional investment ecosystem. Konvi is exploring this evolution through the launch of its first book-based concept, offering access to high-value titles in collaboration with rare book experts. By partnering with specialists and structuring ownership models around secure custody and liquidity planning, fractional platforms make it possible to own a share in iconic works that were previously out of reach.

This model also provides important safeguards: secure storage, authenticated provenance, and curated exits. For new investors, it offers a blend of transparency, flexibility, and educational access, all while participating in an asset class with centuries of prestige and cultural relevance.

Challenges and Risks of Rare Book Investing

While rare books can offer emotional satisfaction and long-term value appreciation, investors should be mindful of the complexities that come with collecting physical, historically significant assets. These challenges can be navigated effectively with research, expert guidance, and proper infrastructure, but they are essential to understand upfront.

Forgery and Authentication

One of the most pressing concerns in the rare book market is authenticity. Forgeries, facsimiles, and altered copies have long circulated, especially for popular or high-value titles. Sophisticated counterfeits can be difficult to detect without proper expertise, particularly when it comes to first editions or signed works.

Investors should only purchase from reputable dealers, auction houses, or platforms that provide full documentation and offer return guarantees. In higher-value purchases, third-party authentication or bibliographic analysis by a qualified expert is advisable.

Market Liquidity

Unlike stocks or bonds, rare books are not liquid assets. Even highly desirable titles can take months or years to resell, depending on demand, condition, and pricing strategy. The buyer pool is often niche, and the sale of a book frequently requires targeted outreach through auctions, fairs, or specialist networks.

This means rare books are better suited for long-term holds, rather than short-term speculation. Investors need to enter with patience and a willingness to weather slower transaction cycles, especially if targeting outsized returns.

Conservation and Storage

As physical objects, rare books require proper care to maintain their condition, and their value. Light exposure, humidity, temperature fluctuations, and mishandling can all degrade paper, bindings, and dust jackets. For this reason, institutional-quality storage with climate control and secure housing is recommended for high-value works.

Books must also be insured appropriately, especially when part of a growing portfolio. While conservation specialists can sometimes restore minor damage, most collectors and investors place a premium on original, undisturbed condition.

Price Volatility and Subjectivity

The rare book market can fluctuate based on factors that are both cultural and unpredictable. A resurgence in popularity of a particular author, new biographical discoveries, or a film adaptation can dramatically increase demand, while overexposure or changing tastes can just as easily cool interest.

Moreover, valuations are not always transparent or standardised. Unlike commodities or securities, book pricing often involves subjective factors, including aesthetic preferences, collecting trends, or institutional interest. Understanding these nuances is part of the art of rare book investing, but it also introduces an element of unpredictability that must be factored into any financial strategy.

How Konvi is Making Rare Books Investable

With its upcoming launch into rare book investment, Konvi is bringing one of the world’s most culturally resonant asset classes to a new generation of investors. By working with trusted collectors and bibliographic experts, Konvi ensures that every book offered on the platform is carefully vetted, securely stored, and accompanied by full provenance documentation.

Our model enables fractional access to historically significant books, including first editions, signed volumes, and culturally iconic works, with starting investments from just €250. This opens the door to ownership and appreciation of museum-grade books that would otherwise remain inaccessible to most private collectors.

Whether driven by literary passion or financial diversification, Konvi offers a platform where rarity, relevance, and return potential come together. As the market for alternative assets expands, rare books present not only a window into the past, but a stake in a culturally significant, historically proven store of value.

Conclusion

Rare books sit at the intersection of emotional legacy and financial opportunity. They are vessels of knowledge, artistic craftsmanship, and cultural memory, but also increasingly recognised as legitimate components of alternative investment portfolios.

From illuminated medieval manuscripts and Renaissance first editions to modern cult classics and pop-culture phenomena, rare books offer something few asset classes can: a tangible, intellectually rich experience paired with real market potential. Their scarcity, historical relevance, and cross-generational appeal position them uniquely in a world where tangible, story-driven assets are gaining traction.

Yet, success in rare book investing depends on more than taste. It requires attention to condition, provenance, and market dynamics, as well as access to networks and expert insight. That is why platforms that bridge passion and professional curation are becoming essential in opening this field to a wider audience of investors.