This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Gemstone Investments: A Small Asset with Large Potential

Nikkan Navidi•11.7.2024

Gemstones capture the imagination not only with their beauty and rarity but also through their potential as a viable investment. Valuable due to their scarcity, inherent beauty, and the desire they evoke, gemstones stand out as both luxury items and as alternative investment assets. Understanding the intricacies of gemstone valuation can significantly enhance an investor's approach to incorporating these precious stones into a diversified portfolio.

Are the Rarest Gemstones Always the Most Valuable?

It's a common misconception that rarity is the sole determinant of a gemstone's value. While rarity contributes significantly, it isn't the only factor. For instance, diamonds, widely regarded due to extensive marketing, are not the rarest gemstones but are among the most valued. This perception is shaped by their perceived beauty and the demand driven by their status as symbols of wealth and commitment.

In contrast, certain minerals such as roselite, mansfieldite, and fingerite, though extremely rare, do not attract the same level of commercial demand as more familiar stones. They are typically sought after by niche collectors and scientific communities rather than the general jewellery-buying public. This illustrates that a gemstone's market value is not merely a function of its rarity but also its desirability and usability, particularly in jewellery making.

The most sought-after gemstones for jewellery and investment are not just rare but also possess qualities that make them exceptionally desirable:

- Grandidierite

- Painite

- Benitoite

- Red beryl

- Taaffeite

- Poudretteite

- Jeremejevite

- Musgravite

- Serendibite

- Hibonite

While these stones are extremely rare, and would theoretically offer significant investment potential, they lack popularity in the mass market which is why investors should be cautious, as their extreme rarity can sometimes limit liquidity. Finding buyers at the time of resale can prove especially challenging without sufficient industry knowledge and the right network.

If you are looking to invest in gemstones without any direct professional guidance, experts recommend investing in established coloured gemstones, especially rubies, sapphires and emeralds. However, in order for these stones to be considered investment grade various factors next to rarity such as market trends and demand dynamics, geological origin, certified colour grade, clarity grade, shape and cutting precision as well as carat weight.

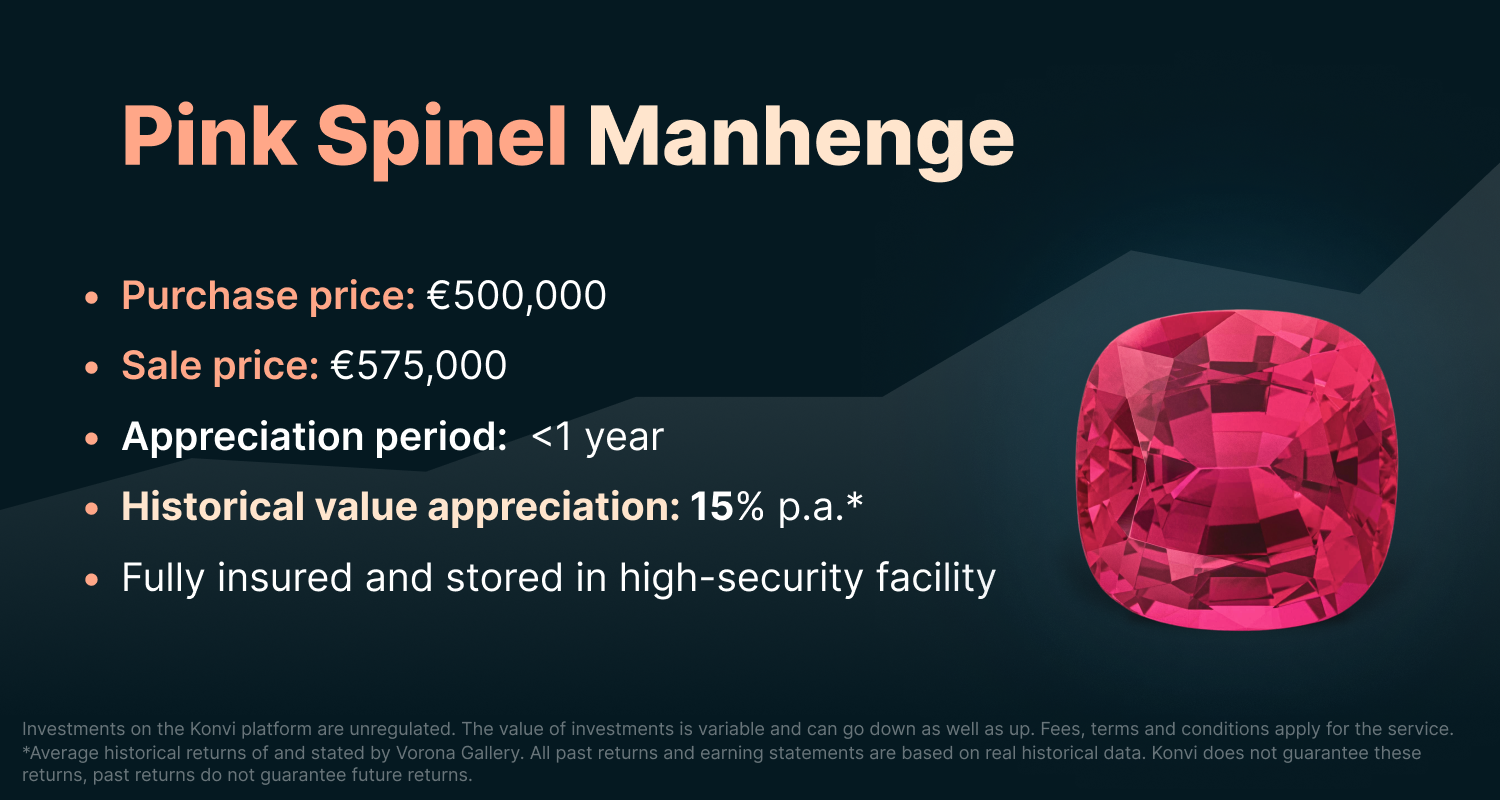

Should you wish to venture outside the “big 3” of coloured gemstones and invest in more exotic and upcoming gemstones, high-quality tanzanites, tourmalines, tsavorites, alexandrites as well as spinels can offer significant investment potential and have fetched high prices at auction in the past. For example: an investment-grade 24+ Carat Mahenge Spinel was sold for €575,000 by Ruby International.

How Are Gemstone Prices Determined?

As mentioned before the price of gemstones is dependent on various factors and their valuation is significantly more complex than that of precious metals, which typically have a market-standard price per unit. Gemstones are evaluated individually based on several qualitative attributes known as the 4 Cs:

- Carat (Weight): Larger gemstones generally have a higher value due to their rarity and the visual impact they offer.

- Colour: The colour of a gemstone plays a critical role in its valuation. The ideal colours vary by type; for example, rubies are most valuable in a deep "pigeon blood" red, while the best sapphires feature a vibrant "cornflower blue" hue. The richness, saturation, and consistency of the color are major factors in assessing a gemstone's quality and price.

- Clarity: The clarity of a gemstone refers to its purity and the absence of inclusions (mineral crystals or cavities filled with fluid and/or gas that occur in a host gemstone). While some inclusions can enhance a stone's uniqueness (such as the star effect in star sapphires), generally, a clearer stone will be more valuable.

- Cut: A gemstone's cut is crucial for its aesthetic appeal and ability to reflect light and exhibit the stone's best colours and brilliance. A well-executed cut can significantly increase a gemstone's market value.

What Impact Does the Source of Gemstones Have on Their Value?

The provenance of a gemstone significantly influences its market value. Traditionally, gemstones sourced from renowned locations like the Mogok Valley in Burma, known for its exquisite rubies, or the Kashmir region, celebrated for its incomparable sapphires, command premium prices. These regions are esteemed not only for the superior quality of their gemstones but also for the unique characteristics that make stones from these areas highly desirable among collectors and investors.

In recent years, emerging regions in South America and particularly Africa have also begun to gain recognition in the gemstone market. These areas are rich in diverse mineral resources and have started producing gemstones that are quickly becoming favourites due to their quality and unique attributes. For instance, new deposits in countries like Madagascar, Zambia, and especially Tanzania are yielding gemstones that rival traditional sources. For example, the Spinel, famous for its presence in the Imperial State Crown, had been primarily sourced from regions such as Sri Lanka, Afghanistan, and Myanmar before. However, since 2007 a major discovery has led Tanzania to become a leading source of pink, red, and cobalt coloured Spinels.

These newer sources are creating exciting opportunities for investors, as gemstones from these regions offer a blend of exceptional quality and potential for appreciation in value due to their growing popularity and market demand.

Why Is Certification Important in Gemstone Investments?

Certification from a reputable gemological institute is essential when investing in gemstones. Certificates from esteemed institutions such as SSEF, GUBELIN, GRS, GIA, AGL, and LOTUS authenticate a gemstone's natural origin and provide a comprehensive analysis of its attributes, including colour, clarity, cut, and carat weight, as well as any treatments it may have undergone. These certifications bolster investor confidence by verifying the quality and provenance of the gemstones, facilitating the assessment of their market value and ensuring transparency in all transactions.

How have Gemstone Prices developed in the past?

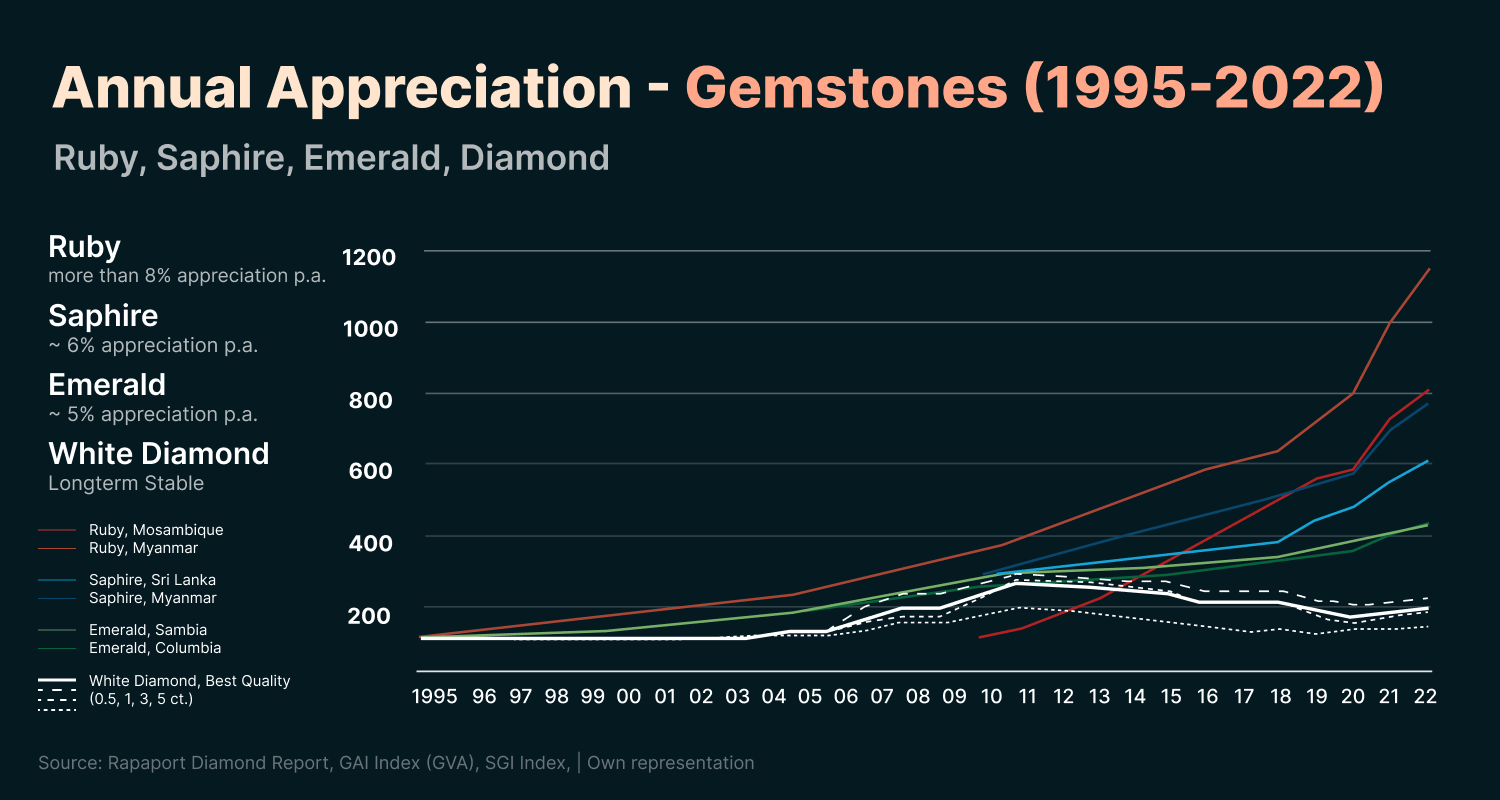

Since 1995, the market prices for naturally coloured, untreated gemstones have more than tripled, reflecting significant growth in their investment value. This upward trajectory is influenced not only by the traditional demand for gemstones but also by the emergence of new gemstone sources.

Newly emerging gemstone-producing regions are reshaping the global market dynamics. As mentioned before regions such as East Africa, specifically Tanzania and Mozambique, have become prominent for their deposits of rubies, sapphires, and other coloured gemstones. Contributing to the diversification of the gemstone supply, they have further introduced rare qualities and colours into the market that were previously unavailable. The introduction of gems from these new sources can sometimes lead to fluctuations in market prices as they add to the overall supply, yet their unique characteristics often fetch higher prices and attract more collectors and investors.

For instance, the discovery of the Montepuez ruby mine in Mozambique. Uncovered in 2009, Montepuez is now one of the most important ruby deposits in the world. These rubies have revitalized the global market due to their high quality and volume of production, which rivalled traditional sources like Myanmar. Montepuez rubies are particularly noted for their vibrant red colours and good clarity, which make them highly sought after in the gemstone market.

Illustrating the appreciation rates of various gemstones and white diamonds from 1995 to 2022, one can see a general upward trajectory, particularly for rubies and sapphires. Rubies from Burma, shown with a steep red line, and sapphires from the same region, depicted by a dark blue line, exhibit the highest growth, exceeding 6% annually. Colombian emeralds and Zambian counterparts also show appreciable growth but at a slightly lesser rate, around 5% per year. White diamonds, represented by dashed black lines, demonstrate long-term value stability rather than rapid growth. Notably, the graph highlights a sharp increase in gemstone values starting around 2010, suggesting a surge in investor interest and market value for these precious stones during the last decade. This trend underscores the dynamic nature of the gemstone market, where provenance significantly influences investment returns.

How can I Invest in Gemstones?

Investing in gemstones can be done as easily as going to your trusted jeweller and either purchasing gemstones directly from them or buying jewellery that integrates a gemstone. However, when deciding on the latter option will in most cases see less appreciation as you will have to offset the premium paid for the craftsmanship that went into creating that jewellery. As mentioned before investing in investment-grade gemstones involves not only a thorough understanding of various factors of the stone itself but also the how demand from the mass market and supply from newly discovered regions. Furthermore, purchasing gemstones from retailers or other middle-men parties can decrease your overall return on investment and hence lead to longer holding periods before you can sell at a worthwhile profit.

In Konvis’ most recent partnership with Ruby International, we aim to mitigate these burdens for retail investors and allow everyone easy access to an asset class that has been previously reserved for an exclusive elite.

Ruby International, leveraging its own mining operations, provides direct access to rare Mahenge Spinel gemstones. This not only eliminates the need for intermediaries but also ensures a more transparent and cost-effective procurement process. By controlling the supply chain from the mine to the market, Ruby International maximizes the authenticity and value of the gemstones, offering a unique advantage for investors seeking to invest directly in high-quality, rare gemstones. With each gemstone being examined by SSEF, GUBELIN, GRS, GIA, AGL, as well as LOTUS, they ensure the absolute authenticity of the stone and also determine the stone's investment potential in the selling process.

Check our most recent investment project purchasing a rare Tanzanian Gemstone

Conclusion

Investing in gemstones offers a unique opportunity to hold a tangible asset that not only holds intrinsic beauty but also the potential for appreciation. The market for high-quality, untreated natural gemstones has seen significant price increases over the past decades, indicating a robust and growing demand. While market trends can vary, premium gemstones have historically retained or increased their value, making them a worthwhile consideration for those looking to diversify their investment portfolios beyond traditional stocks and bonds. With the right knowledge and advice, investing in gemstones can be both a profitable and enriching experience.

Note: this article only engages the opinion of its author and does not constitute financial advice.