This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Time to retire for the 60/40 rule: modern allocation turns alternative

Nikkan Navidi•12.9.2022

The following is an adaptation and more elaborate version of the interview with Giulia Bacelle, Branded content editor & Project manager at WeWealth, the most important Fintech in the wealth management field in Italy

With a new world (and new finance) emerging from persistent inflation and a prevailing recession, some argue that the 60/40 portfolio rule, a simple investment strategy that allocates 60 per cent of your holdings to stocks and 40 per cent to bonds, has finally reached retirement age.

In its place, a new 'modern' portfolio finds its way, in which 30% is allocated to alternative investments. Among these are collectable goods, including watches, vintage cars, wines, and spirits, far more than mere "passions" when considered investment goods. We spoke with Ioana Surdu-Bob, co-founder of Konvi, the first pan-European crowd-investment platform that allows small investors to own fractions of alternative assets such as watches.

The market well acknowledges the concept of asset diversification. However, while it is nowadays pretty simple to acquire bonds or equity, how can one safely integrate alternative assets?

In the last few years, investors have been searching for methods to build different alternative asset allocations by themselves, moving forward from the traditional 60% equity and 40% bonds. In addition, investment guidelines are evolving with the markets within the context of high inflation, slow economic growth, geopolitical turmoils, and a less globalized world.

For instance, research by the New York-based private equity firm KKR has shown how a modern portfolio consisting of 40% equity, 30% bonds, and 30% alternative investments enhances returns and reduces volatility in contexts of high inflation.

However, it has to be noted that large upfront capital is usually required to build a portfolio that allocates this much into alternative assets. As alternative assets are all non-traditional investments, many asset classes fit in the alternative bucket, such as startup investments, private equity, private debt, real estate, or exotic assets/collectables - which is the main focus of Konvi.

For example, let's say you want to allocate 30% of your portfolio worth €100,000 into alternative assets. This means that you would be able to allocate €30,000 into alternative investments such as purchasing equity in a start-up or maybe buying a luxury watch. While this amount would have allowed you to spread the capital into different ETFs, with alternative assets it has not been as easy in the past as it requires a lot of upfront capital.

Through Konvi however, investors can acquire a share in luxury watches, rare whisky casks, blue-chip art or even pre-historic fossils starting from only €250.

What’s the model Konvi proposes in this context? What are the benefits compared to the direct purchases of alternative assets?

Access to investment-grade assets requires well-established industry connections, not only to acquire them in the first place but also to purchase something that bears low risk. If you do not have deep knowledge about the asset class you are investing in, there is a high risk of choosing the wrong asset (or, even worse, fake). Investing in Konvi has three benefits: diversification, increased safety, and access.

The low entry barrier helps customers spread their investments across multiple projects, allowing them to reduce downside risk and also help participate in investment opportunities that they find personally appealing or have a connection to.

Also, many alternative assets come with struggles such as storage, maintenance, and finding a suitable buyer when it's time to sell the asset. Konvi lifts these headaches by connecting retail investors with world-leading suppliers and asset managers.

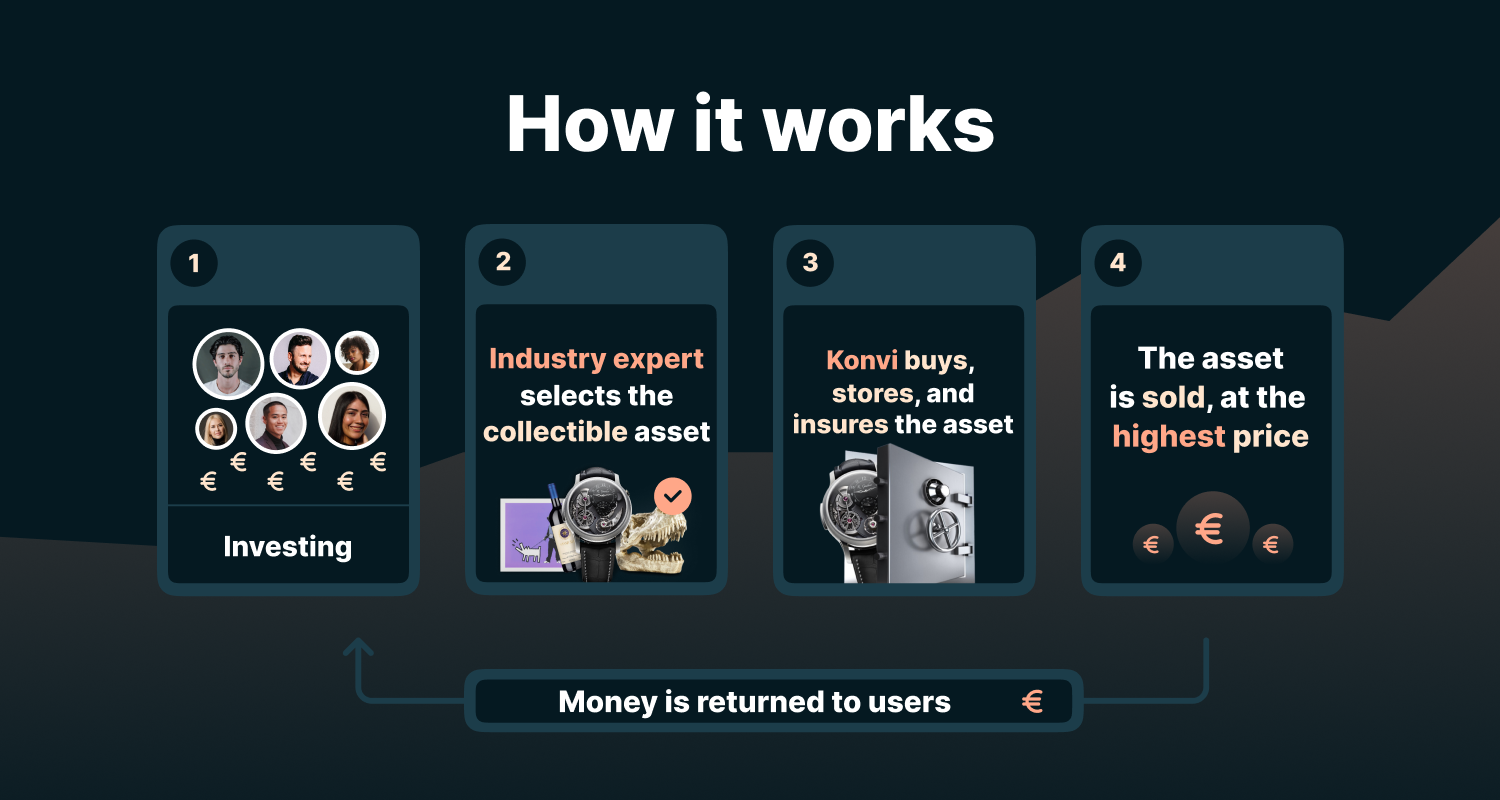

Here is a quick explanation of how it works:

A great example of a watch purchased by the Konvi community is the RRP $500,000 Cartier Extra Large Tortue High Complication Platinum, of which only 15 exist in the world, or a Banksy art piece curated by our partner TGB Contemporary

What are the recommended holding periods for assets listed on Konvi?

The assets funded on Konvi typically have a predetermined holding period of between 3 to 5 years. Of course, as a customer, you may choose the length based on your personal financial goals. However, it is guaranteed that the holding period for each project is ideal, as the supplier always chooses the assets that best fits the predetermined holding period of the investment project. Remember, some asset classes that are inherently more liquid, like gemstones, may be held for shorter periods, while assets like art or whisky may require 5-10-year holding periods.

Art and other collectables are usually known to be illiquid investments; hence, they are not considered to be easily converted into cash at the current fair market price. However, with respect to “traditional” investing, much of the attention is given to long-term opportunities that recommend a holding period of 5-10 years (e.g. sustainability). How does the market respond to alternative assets in this context?

It is recommended that exotic assets be held for more extended periods spanning multiple years as the rarity and exclusivity of tangible assets will increase over time. Think about wine vintages for example. While a certain vintage might already show high investment potential in the early years after being bottled as demand is high, the longer you hold it the fewer bottles will be in the open market, which drives the increase in price. Therefore, most investors who are serious about exotic investments prefer long-term investing to maximising their returns. While the reasons may differ, many investors invest for the long term for retirement or kids' education. Such investors build a diversified portfolio, including stocks, bonds, and alternative investments (including exotic assets). While it is possible to invest in alternative assets for the short term, exiting through secondary markets may be risky as such investments are not widely traded. Therefore, it is generally preferred to consider the asset locked for a set period, and of course, if an early exit opportunity arises, take advantage of it.

You come from a background of traditional investing. Why do you personally go into alternative ones besides passion?

I've always invested in alternative investments from an analytical rather than a passion perspective. Besides traditional investments such as ETFs, I added various alternative investments to my portfolio. I invested in real estate due to the appreciation potential and low interest rates at the time. I invested in peer-to-peer loans to yield profits regularly. At the same time, I dollar-cost-average a tiny amount with Ethereum to avoid losing the potential opportunity within the crypto space. I sought exotic assets such as watches and handbags but did not have access to them due to the high cost of these items.

In this context, my co-founder and I saw the vast opportunity to make fractional investments possible within the exotic assets space and set ourselves to build a European-wide solution. The benefits were apparent to us: tangible assets are an inflation hedge because their prices go up with inflation; secondly, they present a low correlation to traditional investments offering a great diversification tool; and lastly, they offer higher average historical returns than traditional investments.

This has led us to work hard to bring awareness and educate individuals about portfolio allocation and wealth building. An important step here was the launch of Discover, our in-app community where our 50,000+ users can discuss investment strategies and news in the world of alternative assets, and reach out to others for questions - Join us for free!

Note: this article only engages the opinion of its author and does not constitute financial advice.

About the original author

Giulia Bacelle is a Branded content editor & Project manager at WeWealth, the most important Fintech in the wealth management field in Italy. It’s a fast-growing business based in Milan, created by asset managers and digital experts in financial markets. The original article is available at the following link.