This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Luxury investments 2024: Why fractional ownership is the future of the luxury industry

Nikkan Navidi•6.9.2023

In a rapidly evolving world of investment opportunities, fractional ownership has emerged as a game-changer in the luxury industry. This innovative approach to investing offers a myriad of advantages, from diversification to hedging, and it's poised to shape the industry's future. Here's why fractional ownership is gaining prominence as the go-to strategy for luxury investments and how market outlooks are predicting a bright future for the industry.

The Potential of fractional ownership:

The Power of Diversification

Diversification is the golden rule of smart investing, and fractional ownership makes it more accessible than ever in the luxury sector. By pooling resources with other investors, you can spread your risk across a range of opulent assets. This reduces the vulnerability of your investments to market fluctuations and economic downturns, ensuring a more stable and secure financial future. Another risk that is especially relevant for luxury assets is the hype factor and the pitfalls that come along with it.

Just like overvalued stocks, market hype, and speculations create a bubble that is just waiting to burst. Instead of putting your money into one luxury watch and risking that its price will only appreciate in the short term, you can obtain shares of various watch models, and brands, with different production origins.

For example: At the beginning of the year various models of hyped watch brands such as Rolex, Patek Philippe, and Audemars Piguet faced significant price drops after record-breaking highs right after the pandemic. On the other hand, low-production unit luxury watches were less affected as demand had stayed steady.

Uncertain Economic Developments

In uncertain times, hedging is a savvy strategy, and fractional ownership provides an elegant solution. Luxury assets show low correlations to conventional asset classes and the stock market, making them a valuable hedge against inflation. Additionally, they are less susceptible to market volatility, offering a safe haven for your wealth. As of June 2023, the inflation rate in the European Union was 6.4 percent, with prices rising fastest in Hungary, which had an inflation rate of 19.9 percent, which can indicate an impending recession, as businesses react to higher costs by reducing production and increasing prices.

While investing your cash is definitely a good starting point during times of high inflation, investing in assets that show a low correlation to the market on the other hand can offer protection against market downturns.

Access of ownership

Accessing luxury assets, such as rare watches, presents both consumers and investors with a unique set of challenges. For consumers, the foremost hurdle lies in the scarcity and exclusivity of these items. Rare watches, in particular, are often produced in limited quantities, making them elusive to acquire. The competition among collectors and enthusiasts drives up prices and can lead to frustration when attempting to secure a coveted timepiece.

Additionally, the authenticity of luxury assets can be a concern, with counterfeit products flooding the market. Investors, on the other hand, must navigate a complex landscape of market fluctuations and the risk of depreciation. The value of luxury assets can be subject to unpredictable shifts, influenced by factors such as brand reputation, historical significance, and trends in the luxury market.

For this reason, Konvi has dedicated its mission to safely enabling access to rare and exclusive investments for its user base by closely working with reputable partners with solid track records and in-depth industry knowledge.

Do you want to learn more about our partners? Check out this article with Dominic Khoo, the CEO of WatchFund.

Global developments in the luxury industry

The fastest market growth: Asia Pacific

In the Asia Pacific region, there exists a burgeoning community of affluent individuals, and their numbers are swiftly increasing. As one's wealth grows, so does the inclination toward acquiring elegant attire and exquisite accessories. In numerous Asian cultures, opulent items are not merely markers of affluence but also symbols of social distinction and accomplishment. This deep-seated cultural reverence for luxury items fuels a robust demand among those who aspire to display their elevated social positions. According to the Brainy insights report of 2023, the Asia Pacific region will face the highest surge in demand for luxury goods with its leading category being luxury cars followed by personal luxury such as jewelry and watches.

Furthermore, the younger demographic in the Asia Pacific is undergoing a significant shift in their perspective. They increasingly prioritize quality over quantity and are irresistibly drawn toward esteemed luxury brands renowned for their masterful craftsmanship, exclusivity, and enduring appeal. This shift will draw significant attention towards rare goods from reputationally well-established regions such as Switzerland for watchmaking, France for fine wine, and Ireland, Scotland, and Japan, as well as the US for whisk(e)y.

Furthermore, the younger demographic in the Asia Pacific is undergoing a significant shift in their perspective. They increasingly prioritize quality over quantity and are irresistibly drawn toward esteemed luxury brands renowned for their masterful craftsmanship, exclusivity, and enduring appeal. This shift will draw significant attention towards rare goods from reputationally well-established regions such as Switzerland for watchmaking, France for fine wine, and Ireland, Scotland, and Japan, as well as the US for whisk(e)y.

A Closer Look: Chinese shoppers are back

China's recent reopening in March is poised to provide a significant boost to the luxury sector, especially given that Chinese consumers play a pivotal role in driving luxury spending worldwide. In the 2021 financial year, luxury goods companies derived approximately 30% of their total sales from Greater China. However, the COVID-19 pandemic did take its toll on business, with most brands experiencing a roughly 10% decline in sales for the 2022 financial year.

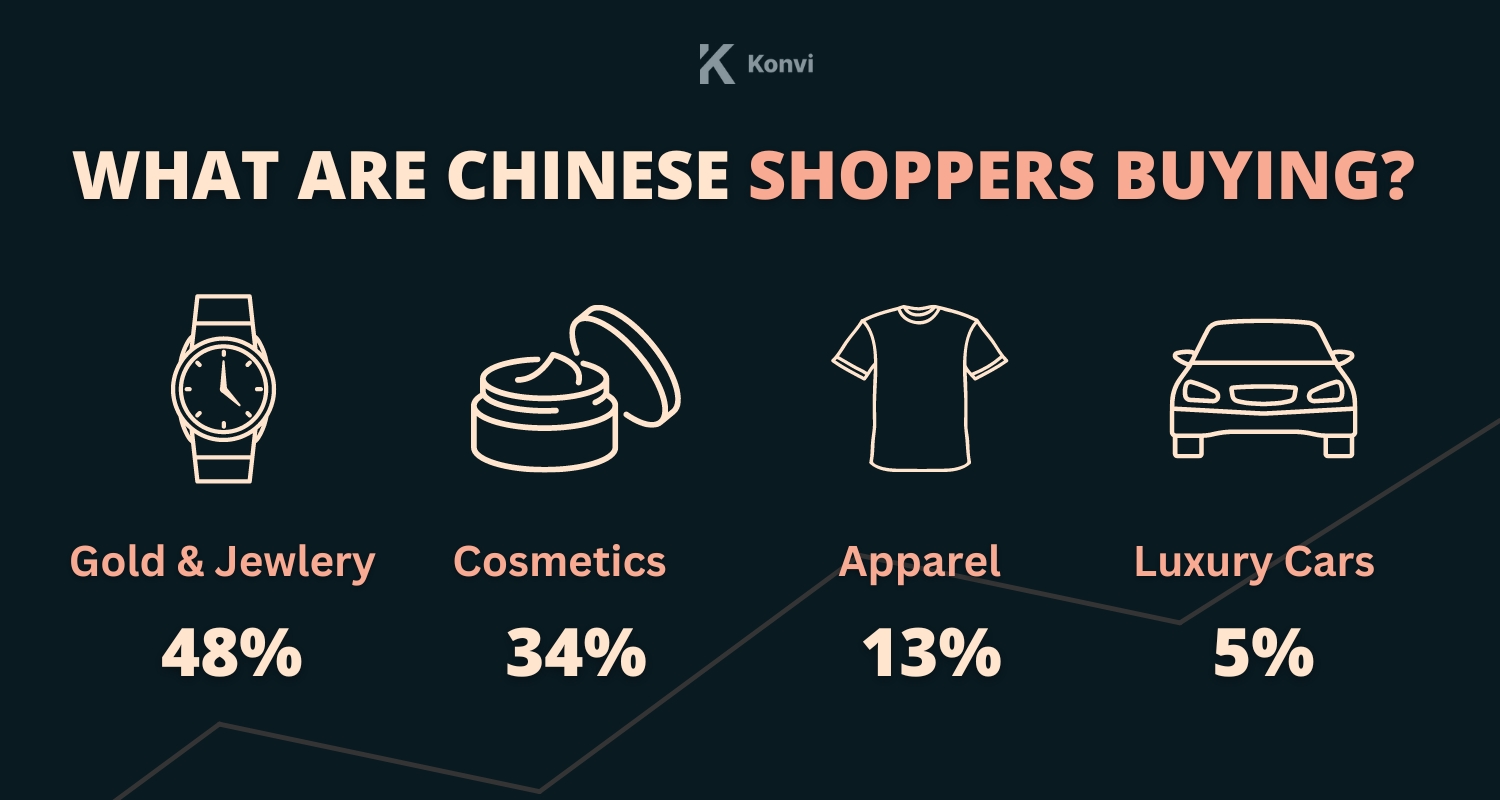

Similar to consumers in other parts of the world, Chinese shoppers have accumulated surplus savings over the past three years. According to J.P. Morgan Research, the average savings rate in China stood at 33.5% in 2022, up from 29.9% in 2019. This, coupled with pent-up demand, is driving a resurgence in spending post-pandemic. Notably, the domestic luxury sales market is flourishing. In the first two months of 2023, total retail sales in China witnessed a 17% increase compared to the previous four-year period. There was notable growth across all sectors tracked by J.P. Morgan Research, including gold and jewelry (+48%), cosmetics (+34%), and apparel (+13%). Demand for luxury timepieces is also on the rise, with Swiss watch exports to China registering a robust +68% increase over the same four-year period in February 2023.

An Opportunity: The Growing Power of the Middle East

The Middle East is becoming a focal point in the evolving luxury market. This region is increasingly drawing in high-end brands, and currently, the luxury sector here is valued at 15 billion euros. Projections in the "Altagamma Consumer and Retail Insight" edition, prepared by the Boston Consulting Group in collaboration with Altagamma indicate that this figure is set to double to 30 billion euros by 2030, primarily due to the growing prominence of Saudi Arabia. According to Filippo Bianchi from the Boston Consulting Group:

"The Middle East, especially Saudi Arabia, is emerging as a new frontier for luxury"

Until recently, Saudi Arabia had relatively few dedicated luxury retail spaces, but the landscape is changing rapidly. The current value of luxury sales in the country is around 3 billion euros, and it's expected to reach 6 billion euros by 2030, with an annual growth rate of 10% to 12%. Tourism plays a significant role in this transformation, aligning with the government's "Vision 2030" initiative, which involves investments exceeding 1 trillion euros. In Riyadh alone, plans include dedicating 500,000 square meters to luxury retail and establishing three large shopping centers.

Surge in demand and its effect on Fractional Investing

The surging demand for luxury items in emerging/emerged markets around the globe is poised to have a substantial impact on the price escalation of rare assets. As more affluent consumers seek out exclusive and high-end products, the scarcity of such assets, like rare items such as luxury watches or exclusive spirits, is likely to intensify. This heightened demand, in conjunction with limited supply, is expected to drive up the prices of these coveted items. For investors who choose to invest in fractions of these assets, the outlook appears promising as they benefit from the potential price appreciations while decreasing item-specific risks.

Konvi and fractional investing

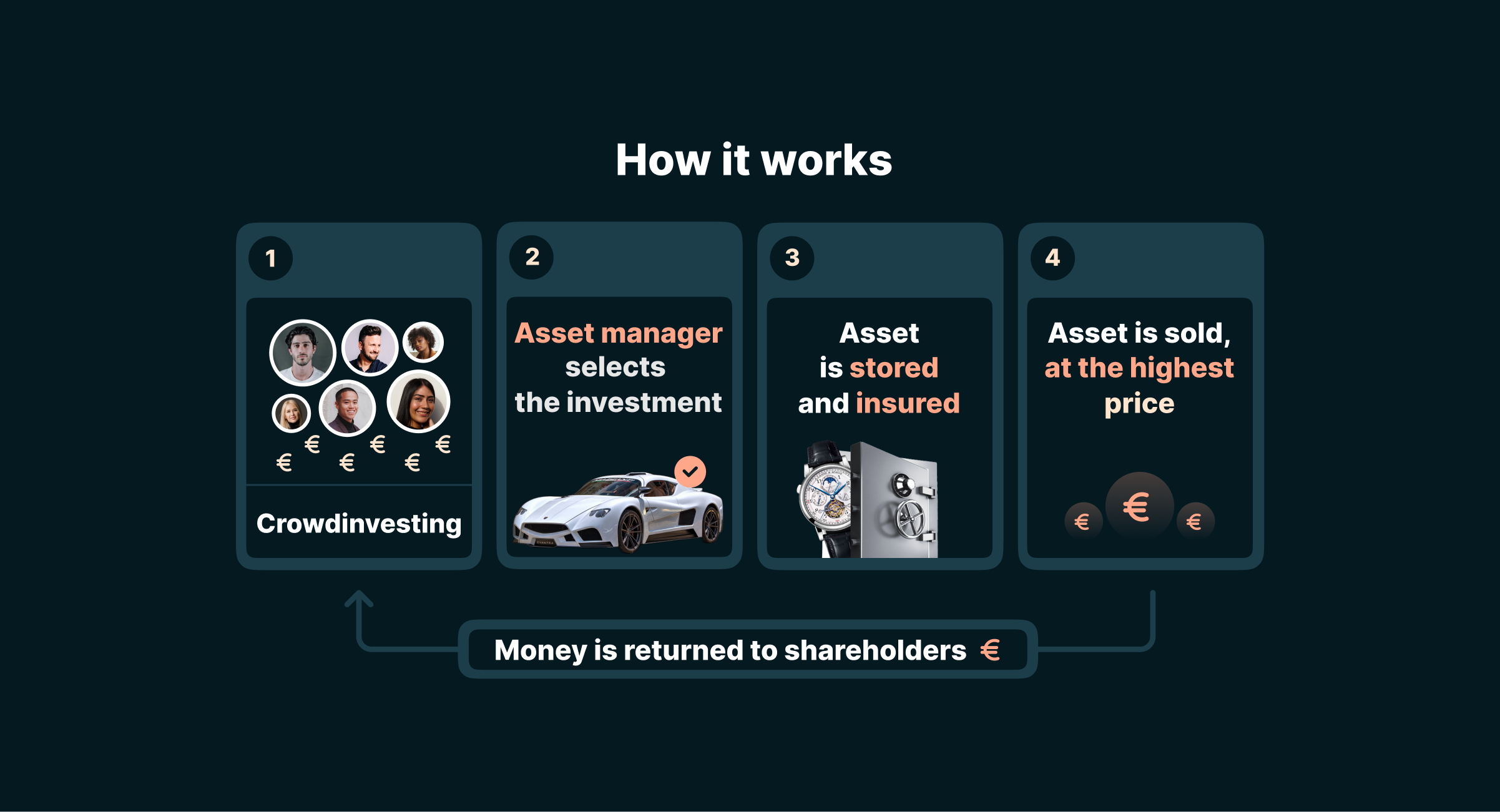

Konvi is the first Pan-European crowd-investing platform enabling retail investors to diversify their portfolios by fractionally investing in alternative asset classes. By collaborating with industry experts with relevant track records we ensure that investments are carefully curated. Here is a short breakdown of how Konvi works:

1. Crowdfunding

Konvi lists the best investment opportunities by collaborating with world-leading experts. You, alongside other verified investors, fund an investment-grade asset.

2. Acquisition

Our industry experts will utilize data-based analytics and established networks to source the most suitable investment opportunity. A company is created to hold the funded asset.

3. Appreciation

After the purchase, the asset will be safely stored and insured at a high-security facility. The asset will appreciate for 3 to 5 years, until ready to be sold.

4. Sale

Within 6 months after the appreciation period, Konvi's partners will sell the asset. The most attractive buyer will be identified ensuring the highest possible returns to our community.

Conclusion

In a rapidly changing investment landscape, fractional ownership has emerged as a game-changer in the luxury industry, offering diversification and hedging advantages. It's poised to shape the industry's future. Fractional ownership facilitates diversification, reducing investment vulnerability to market fluctuations and hype-driven risks. It's a prudent hedge against uncertain economic times, offering a safe haven. Access to luxury assets, like rare watches, is challenging but vital. Global luxury markets, particularly Asia Pacific and the Middle East, are booming. Chinese consumers are driving luxury spending, and the Middle East, notably Saudi Arabia, is emerging as a luxury frontier. The surge in demand for luxury items is set to increase rare asset prices, benefiting fractional investors who can enjoy price appreciation while mitigating risks.

Note: this article only engages the opinion of its author and does not constitute financial advice.