This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Alternative Asset Liquidity: How Today’s Investors Are Rethinking Time Horizons

Nikkan Navidi•1.7.2025

Investors today are rethinking what it means to have access, control, and long-term strategy in their portfolios. While liquidity has traditionally been prized as the ultimate advantage, this mindset is beginning to shift. Easy access to trading can encourage short-term thinking, reactive decision-making, and an overemphasis on immediate results at the expense of sustainable growth.

At the same time, alternative assets are gaining ground as part of modern portfolio construction. These include fine wine, rare watches, vintage comics, luxury handbags, and other culturally significant collectables. Their appeal lies in scarcity, tangibility, and a slower but steadier appreciation curve that aligns with long-term wealth building.

For digital-native investors, this conversation is especially timely. Platforms now make it possible to invest fractionally in assets that once required large capital outlays. This change invites a re-examination of time horizons, risk tolerance, and the role of patience as a core investment strategy.

The question many investors face is how to determine the optimal holding duration and decide when it makes sense to maintain or sell an investment. Understanding liquidity, time horizons, and the trade-offs between immediate access and long-term value is becoming essential for building a resilient, well-balanced portfolio.

The Traditional Liquidity Mindset

Modern investing has been shaped by a strong preference for liquidity. Investors expect the freedom to trade assets such as equities, ETFs, or cryptocurrencies with ease, often in real time. This access is seen as empowering, offering flexibility to adjust portfolios in response to new opportunities or shifting economic conditions.

Advantages of High Liquidity

Liquidity does bring clear benefits. It enables tactical rebalancing, supports cash flow needs, and offers transparency in pricing. Investors can respond to news, hedge risks, or shift strategies quickly. Financial theory recognises liquidity as a source of utility, helping to manage uncertainty and maintain optionality.

Eugene Fama's Efficient Market Hypothesis relies in part on the idea that liquid markets incorporate information swiftly, ensuring fair pricing. Liquid assets often have lower transaction costs and tighter bid-ask spreads, making them attractive for many investors.

The Cost of Instant Access

Yet the convenience of liquidity can come at a price. Easy exits encourage reactive decision-making. Investors may respond impulsively to short-term price swings, news cycles, or market sentiment. Behavioural finance research, including the work of Daniel Kahneman and Richard Thaler, has shown how availability bias and loss aversion can drive investors to sell prematurely, crystallising losses instead of allowing for recovery.

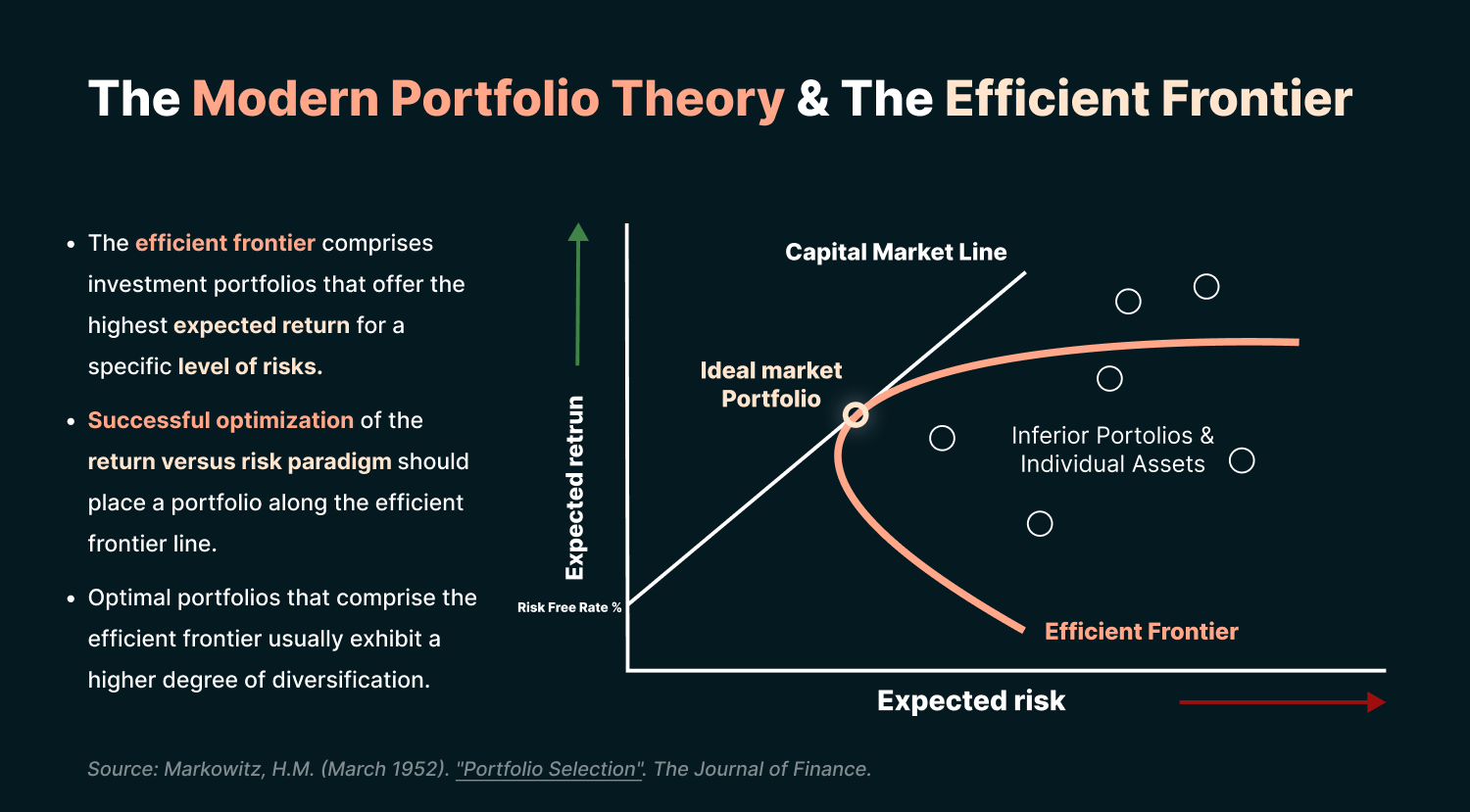

This tendency towards short-termism undermines the compounding benefits of patient investing. A portfolio designed for long-term growth can suffer if investors continually react to volatility, missing the opportunity to capture the full return profile of their chosen assets. This tendency towards short-termism undermines the compounding benefits of patient investing. A portfolio designed for long-term growth can suffer if investors continually react to volatility, missing the opportunity to capture the full return profile of their chosen assets. According to Modern Portfolio Theory (MPT), a well-diversified portfolio aims to maximise expected return for a given level of risk. This approach requires assessing both the risk profile of individual assets and their correlation with other holdings in order to balance overall portfolio volatility.

Immediacy vs. Strategic Patience

The culture of immediacy in investing promotes an illusion of control that does not always lead to better outcomes. Constant access to trading tools can shift focus from strategic allocation to tactical speculation. Instead of selecting assets with enduring value and holding them through market cycles, investors may chase short-term trends, eroding potential gains with frequent trading costs and poorly timed exits.

Time diversification theory suggests that risk reduces over longer horizons. By holding investments through cycles, volatility tends to average out, allowing intrinsic value to emerge. Instant liquidity can disrupt this principle, making it harder for investors to stay committed to their strategies.

Recognising the Limitations

Understanding the drawbacks of constant liquidity is vital for those considering alternative assets. Unlike stocks or bonds, many alternative investments are illiquid by nature, with limited markets and specialised buyer bases. While this illiquidity might appear restrictive, it also removes the temptation for reactive selling, aligning investor behaviour with the longer timelines over which these assets appreciate.

Recognising that not every asset benefits from instant tradability can help investors design more resilient portfolios. Balancing liquid and illiquid holdings requires accepting that true value often takes time to materialise, and that patience can be as important a strategy as timing.

How Liquidity Works in Alternative Markets

Liquidity in alternative assets does not operate in the same way as traditional markets. Unlike equities or bonds, which can be traded instantly on public exchanges, alternative assets often require specialised channels to facilitate sales.

Auctions remain a key exit route for many collectible and luxury assets. Renowned auction houses provide credibility, authentication, and access to serious buyers willing to pay premiums for provenance and rarity. This model supports strong pricing but also requires timing and patience, as sales may be seasonal or event-driven.

Private sales and secondary markets offer additional pathways. These channels can provide flexibility, although transactions often depend on finding the right buyer who recognises the asset’s value. Increasingly, digital platforms are emerging that connect collectors and investors, helping to streamline these processes with verified listings and transparent pricing.

Exit planning is an essential part of investing in alternatives. Understanding when and how to sell is as important as knowing what to buy. By considering market demand, valuation trends, and the authentication process, investors can approach liquidity not as an obstacle but as a strategic element in building long-term value.

Why Alternative Assets Are Less Liquid, and Why That Matters

Alternative assets come with inherent limitations on how quickly they can be sold. Unlike public equities or cryptocurrencies that trade on open markets with continuous pricing and liquidity, these assets often rely on more specialised, less frequent channels. While this can seem like a disadvantage at first, understanding why these limitations exist reveals how they actually support long-term value creation.

1. Scarcity as a Core Value Driver

One of the defining features of alternative assets is their scarcity. Items such as fine wine, luxury watches, rare books, or designer handbags are produced in limited quantities, often with specific provenance or historical significance that cannot be replicated.

This limited supply underpins price stability and appreciation over time. As demand grows, especially among collectors or culturally motivated buyers, the restricted availability ensures that prices do not simply follow short-term market noise but instead reflect enduring desirability. Quick exits can undermine this value by flooding the market or breaking the narrative of rarity that supports premium pricing.

2. The Role of Provenance and Authentication

Unlike financial securities that are standardised, alternative assets depend heavily on provenance and authentication to maintain value. Ownership history, condition, and verified authenticity all play crucial roles in determining an asset's worth.

Transferring such items requires careful documentation, expert appraisal, and sometimes legal oversight to ensure their market integrity. These processes introduce natural friction that slows down sales but also protects buyers and sellers. This deliberate pace helps maintain confidence in pricing and supports the long-term health of the market.

3. Built-In Discipline Through Delayed Liquidity

Delayed liquidity acts as a discipline mechanism for investors. Without the ability to sell instantly, holders are encouraged to adopt a patient, strategic approach that aligns with the timeframes over which these assets tend to appreciate.

This enforced patience reduces the risk of reactive decision-making often seen in highly liquid markets, where investors may respond to short-term volatility or sentiment shifts at the expense of long-term returns. By removing the temptation to exit hastily, alternative assets help investors stay committed to their original strategy.

4. Matching Value Creation with Real-World Cycles

Alternative assets often appreciate in cycles that mirror broader cultural or economic trends. For example, the value of fine wine may grow as vintages mature and global demand expands. Luxury items can see renewed interest with shifts in consumer taste or increased recognition of their cultural significance.

These cycles do not operate on the rapid timelines of equity markets. Holding periods must reflect the natural appreciation curve of the asset class. Recognising and aligning with these cycles is essential for investors seeking to unlock the full value of their positions.

The Time-Value of Risk and Reward

One of the key considerations for any investor is how risk and reward change over time. In traditional finance, the concept of the illiquidity premium describes the additional return investors expect when they commit capital for longer periods. This premium compensates for reduced flexibility and the inability to react quickly to market changes.

Alternative assets often embody this principle. Their scarcity, cultural value, and slower appreciation cycles mean that holding for longer durations can unlock greater rewards. Unlike equities or bonds, which offer daily pricing and frequent trading opportunities, collectibles and tangible assets typically see value build over years as their rarity and provenance strengthen.

Financial theories such as time diversification also support this approach. The idea is that risk can decrease over longer horizons because short-term volatility tends to smooth out, allowing the underlying value drivers to assert themselves. By committing to a long-term perspective, investors can benefit from compounding, scarcity-driven appreciation, and the cultural narratives that enhance an asset’s desirability.

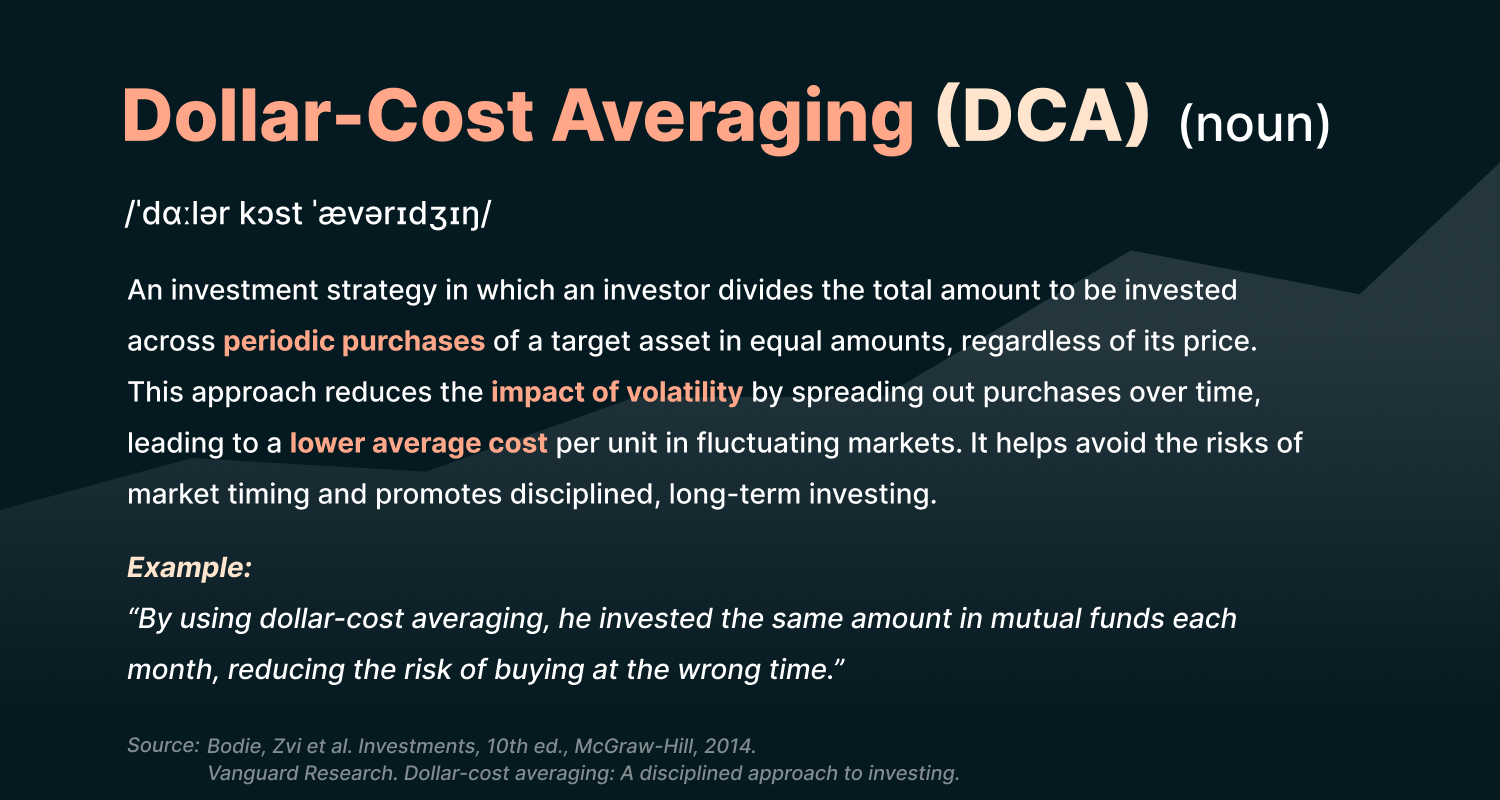

Dollar-Cost Averaging: Smoothing Entry Timing

Another important strategy for managing risk over time is Dollar-Cost Averaging (DCA). This approach involves investing a fixed amount at regular intervals, regardless of market conditions. By spreading purchases over time, investors reduce the impact of short-term volatility and avoid the risks of poor market timing.

For alternative assets, DCA can be applied by gradually building exposure across different categories, vintages, or artists. This approach supports diversification and helps investors align their entry points with varying market cycles. It also fosters a disciplined mindset that resists the temptation to concentrate capital too quickly or react to temporary price movements.

This perspective reframes illiquidity not as a barrier but as a strategic choice. It becomes a way to align investment behaviour with the realities of how these assets generate value, encouraging discipline and patience in pursuit of sustainable returns.

Changing Investor Behaviour

Investor preferences are evolving in response to new asset classes, technological access, and cultural shifts. Many Millennials and Gen Z investors are demonstrating a willingness to allocate capital to assets that demand longer holding periods and offer more than just financial returns.

This generation is redefining what it means to invest, placing value on items that carry personal meaning, cultural significance, and storytelling potential. From rare handbags and limited-edition sneakers to artist collaborations and fine wine, these investments are as much about identity as they are about wealth creation.

Digital platforms and fractional ownership models have lowered barriers to entry, making these alternative assets accessible to a broader audience. Investors are no longer restricted to institutional channels or high net worth circles. This democratisation has encouraged a shift from trading speed to intentionality, where ownership aligns with personal values, aesthetic appreciation, and long-term goals.

As a result, cultural capital is becoming a recognised component of modern wealth planning. Investors are not simply seeking financial gain but looking to build portfolios that reflect their tastes, convictions, and patience for value to mature over time.

Case Study: Fractional Ownership and Defined Holding Periods

Fractional ownership has introduced a new way to engage with alternative assets. Instead of requiring large capital commitments to acquire a single item, investors can now co-own assets with others, spreading both risk and opportunity across a broader base.

Konvi’s model is built around this principle. Each asset on the platform is offered with a clear holding period, typically ranging from 24 to 60 months. This timeframe is not a limitation but a deliberate strategy designed to match how value appreciation occurs in rare and culturally significant markets.

For example, high-demand items like fine wine, limited-edition timepieces, or investment-grade art pieces do not tend to deliver meaningful returns over short intervals. Their value increases as they become rarer, as provenance strengthens, and as market awareness grows. By committing to a structured holding period, investors align their expectations with the asset’s natural cycle of appreciation.

This approach also helps reduce the likelihood of impulsive sales, which can undermine potential gains. Knowing that liquidity events are planned and professionally managed offers clarity and confidence, turning what might appear to be a constraint into a disciplined wealth-building mechanism.

Risks and Considerations

Investing in alternative assets requires careful planning and awareness of the unique challenges involved. Illiquidity, while beneficial for promoting discipline, can also limit flexibility. Investors may face difficulties accessing capital quickly if personal circumstances change or if markets experience a downturn.

Exit timing is another important consideration. Markets for rare and collectible items can be influenced by broader economic conditions, shifts in cultural trends, or changes in buyer appetite. A well-timed sale can maximise returns, but poor timing can reduce realised gains or extend holding periods unexpectedly.

Authentication and provenance remain critical. High-value alternative assets often attract forgery attempts, making expert verification essential. Working with trusted platforms, recognised appraisers, and industry specialists helps to mitigate these risks and ensures that assets retain their market credibility.

Diversification is equally important. Allocating too much capital to illiquid or niche assets can expose a portfolio to unnecessary concentration risk. By balancing alternative holdings with more liquid and traditional investments, investors can create a well-rounded strategy that offers both security and potential for meaningful growth.

What the Future Looks Like

The market for alternative assets is evolving rapidly. Investors are showing growing interest in models that balance the benefits of long-term holding with more predictable, planned liquidity events. Scheduled exits, for example, help align investor expectations with the natural appreciation cycle of rare and collectible items while still offering clarity about when returns may be realised.

Tokenisation and digital platforms are also reshaping the landscape. By enabling fractional ownership and secure, transparent tracking of provenance, these technologies expand access to markets that were once the preserve of high-net-worth collectors. They also offer potential for new forms of liquidity, such as peer-to-peer sales or community-governed exit votes.

Investors are increasingly valuing authenticity and cultural significance as part of their portfolio construction. This shift moves investing beyond purely financial calculations, incorporating passion, storytelling, and identity into wealth-building strategies. As this trend grows, platforms that can combine expert curation, clear exit planning, and education around realistic time horizons will continue to stand out.

In this new era, successful investing will reward those who can balance conviction with flexibility and who appreciate that real value often takes time to mature.

Conclusion

Rethinking liquidity is becoming an essential part of modern investing. While traditional markets have conditioned investors to prioritise speed and flexibility, the rise of alternative assets invites a different approach. These assets demand patience, careful planning, and an understanding of how time itself contributes to value creation.

Holding periods for rare wine, luxury fashion, fine art, and other cultural assets are not barriers but opportunities to align investment strategy with the natural pace of appreciation. By committing to longer horizons, investors can benefit from scarcity, provenance, and the deep narratives that drive demand over time.

Platforms like Konvi are helping investors adopt this mindset by offering structured, transparent access to high-quality alternative assets. With clear holding periods and expert curation, investors can confidently balance liquidity needs with the rewards of long-term commitment.

Embracing this approach is not just about maximising returns. It is about building portfolios that reflect personal values, cultural engagement, and a willingness to invest with intention and patience.

Disclaimer

This article is provided for informational purposes only and does not constitute investment advice, financial advice, or a recommendation to buy or sell any financial instruments or assets. Past performance is not indicative of future results. Investing in alternative assets carries risks, including potential illiquidity, market fluctuations, and loss of capital. Readers should conduct their own due diligence or consult with a qualified financial advisor before making investment decisions.