This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Market Correction: What Experts say about Diversification and Alternatives

Nikkan Navidi•11.4.2025

2025 has begun under a cloud of heightened market caution. After a resilient 2024, major indices such as the S&P 500 have shown signs of strain, driven by mixed earnings, geopolitical uncertainty, and a shift in monetary policy expectations. Recent market movements suggest that volatility is far from over—and fears of a market correction are quietly regaining traction.

One emerging pressure point is the renewed escalation of trade tensions, with new tariffs introduced between key economies including the U.S., China, and the EU. These measures have reignited concerns about global supply chains and import costs, contributing to what analysts now describe as stubborn sector-specific inflation, particularly in energy, transportation, and goods tied to international trade.

While overall inflation has moderated from post-pandemic peaks, its persistence in certain categories has complicated efforts by central banks to begin rate cuts. As a result, policymakers are treading cautiously—delaying monetary easing and signalling a longer runway for higher interest rates than previously expected.

Amid these macro headwinds, a growing number of institutional voices are warning that traditional portfolios—particularly those heavily weighted in equities—may no longer offer adequate downside protection. Strategy reports from leading banks increasingly reference the need for greater diversification in light of tightening financial conditions.

Investors are no longer asking if they should diversify beyond public equities—but how. And increasingly, the answer points to alternative assets: tangible, low-correlating, and historically resilient during times of economic uncertainty.

Why Traditional Portfolios Are Under Pressure

For decades, the 60/40 portfolio—60% equities, 40% bonds—served as the bedrock of balanced investing. But in recent inflationary cycles, that classic structure has come under scrutiny. Both asset classes suffered during 2022’s downturn, exposing the correlation risk inherent in today’s global markets.

Larry Fink, Chairman and CEO of BlackRock, addressed the same issue in his 2025 Annual Letter to Investors, writing:

“Generations of investors have done well following [the 60/40 portfolio] approach… But as the global financial system continues to evolve, the classic 60/40 portfolio may no longer fully represent true diversification.”

Government bonds, once viewed as a reliable hedge during equity slumps, have lost some of their defensive appeal in a climate of rising rates and persistent inflation. Meanwhile, growth stocks, which led the post-COVID rally, have shown signs of fatigue under the weight of tightening financial conditions and uneven earnings performance.

The result? Investors are seeking assets that sit outside the traditional market cycle—ones with low correlation, tangible utility, and historical durability. This has fuelled a surge in interest in alternative investments, from infrastructure and private equity to physical collectables such as art, rare watches, and graded comic books.

The Role of Alternative Investments in 2025

As traditional markets falter, the spotlight is turning to alternative investments—a broad category encompassing physical assets (like fine art, whisky, and rare comics), private equity, real estate, and infrastructure.

These assets are increasingly sought after for their:

- Low correlation with traditional stocks and bonds

- Potential to preserve capital during downturns

- Unique capacity to serve as an inflation hedge

- Access to uncommon alpha not tied to public markets

Even major institutions are adapting to the shifting macroeconomic landscape. As highlighted in Konvi’s analysis of the decline of the 60/40 portfolio, global private equity leader KKR has now allocated 30% of its wealth portfolio to alternative investments. This shift underscores a growing conviction that traditional portfolios alone are no longer sufficient in navigating structurally volatile conditions.

This reallocation is also being driven by recent global tariff escalations, which have added new uncertainty to supply chains and input costs. These trade frictions—most notably between the U.S., China, and the EU—are reshaping inflation expectations and creating ripple effects across both public and private markets. For institutional allocators, the result is a heightened focus on non-cyclical, uncorrelated asset classes that can hedge against external shocks and policy volatility.

In a recent Bloomberg UK interview (March 2025), Dan Skelly, Head of Market Research & Strategy at Morgan Stanley Wealth Management, noted:

“Uncertainty on the tariff front remains ridiculously high, leaving it incredibly tough for businesses or consumers to plan more than about a day into the future, and still making it nigh-on impossible for market participants to price risk”

Private markets and alternative investments are seen as part of that hedge. Tangible assets, particularly those with cultural significance and finite supply, are increasingly viewed not just as passion investments, but as strategic inflation shields in a fragmented global economy.

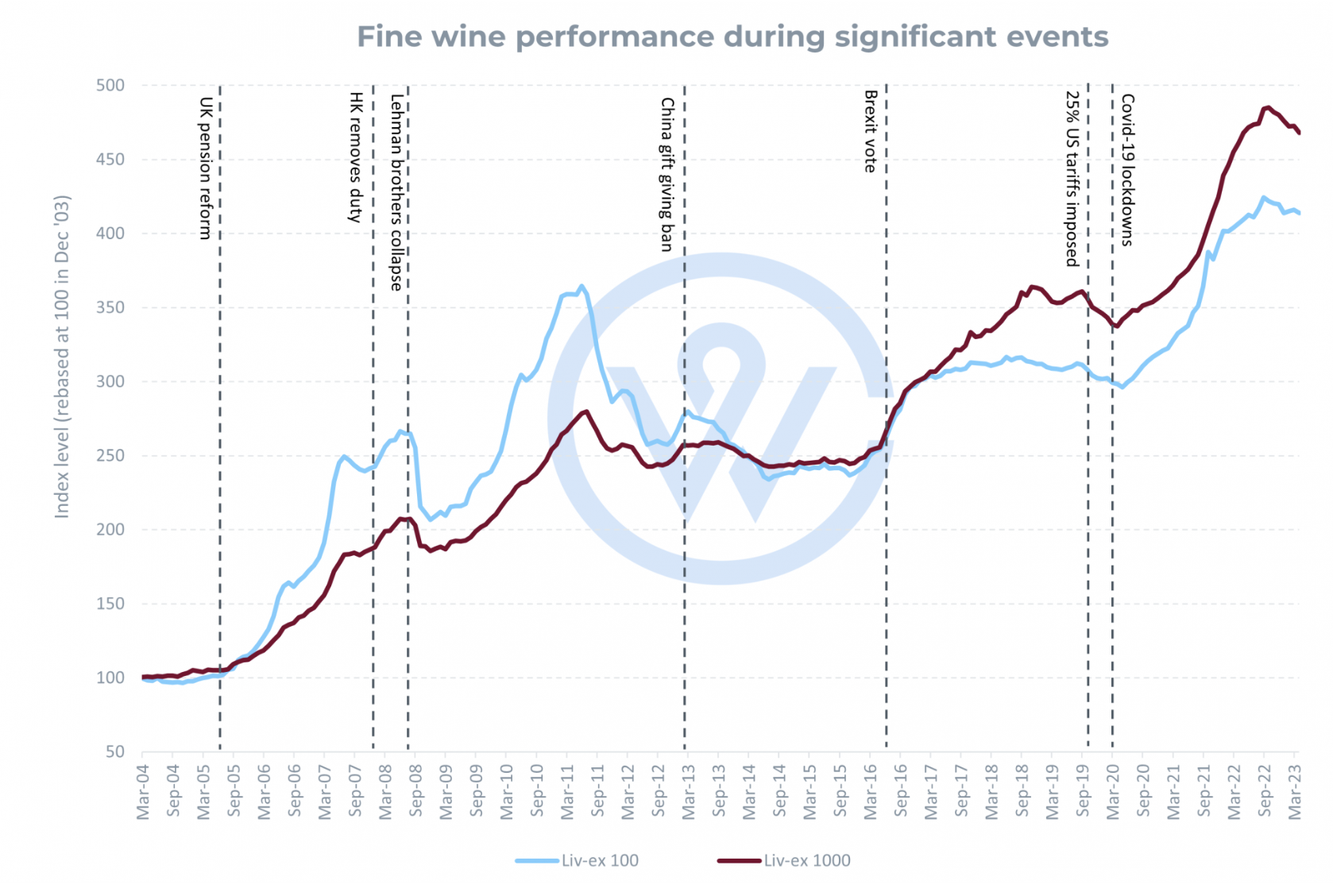

Market benchmarks and performance data reflect this trend. Leading alternative asset indices and reports, such as the Liv-ex Fine Wine 100, the Knight Frank Wealth Report, and the Artprice Global Art Market Index, continue to show that hard assets can outperform traditional markets over longer periods, particularly in inflationary or risk-off environments.

Historical Performance: How Alternatives Hold Up in Times of Stress

Throughout modern financial history, physical and alternative assets have shown notable resilience during economic downturns. In the 2008 financial crisis, while the S&P 500 plummeted nearly 40%, **asset classes like fine wine, rare coins**, and vintage art suffered far less volatility—and in some cases, appreciated in value.

Source: Liv-ex - The Fine Wine Market in 2023

Source: Liv-ex - The Fine Wine Market in 2023

The COVID-19 market shock in early 2020 highlighted the vulnerability of traditional portfolios, and the resilience of tangible, real-world assets. As equities plunged, demand surged for alternative investments like rare whisky, vintage timepieces, and even natural history artefacts. These assets, often seen as niche collectables, demonstrated their strength as stores of value in periods of financial stress.

In October 2019, just months before the COVID crisis, a bottle of The Macallan Fine & Rare 1926 sold for £1.5 million, a record that sent ripples through the whisky investment world. Despite the pandemic’s global disruption, interest in rare spirits remained strong, with top bottles continuing to break records at Sotheby’s and Bonhams. In November of 2023 a bottle of Macallan Valerio Adami 60 Year Old 42.8 ABV 1926 - 75cl sold for £ 1.75 million

Even more unconventional assets captured investor attention. In 2020, a Tyrannosaurus rex skeleton nicknamed “Stan” fetched $31.8 million at Christie’s, while in 2024, a Stegosaurus fossil became the most expensive of its kind ever sold. These record-breaking sales demonstrate a growing appetite for scarce, culturally significant physical assets that operate independently of financial market cycles.

From aged whisky to prehistoric fossils, today’s alternative investments are broadening in scope and they are gaining legitimacy as long-term, non-correlated components of a diversified portfolio. This makes them especially attractive as a hedge against market crashes, inflation, or currency devaluation.

What Investors Are Doing Now

Retail and institutional investors are rethinking how to build portfolios that withstand turbulence—and participate in growth. The result is a noticeable shift towards diversification, not just across sectors, but across asset classes.

As covered in Konvi’s portfolio diversification guide, diversification is most effective when assets are non-correlated—not simply spread across industries. Owning stocks in multiple sectors doesn’t insulate you from a macro correction. But diversifying into uncorrelated physical assets can. This sentiment is echoed by other institutional players as well. According to Goldman Sachs' recent Market Strategy Note, the bank sees rising risks of a drawdown in the S&P 500, citing elevated valuations, earnings pressure, and the lack of a clear monetary policy path:

“The main message we're giving is twofold. First of all, you want to think about more diversification across assets... The other thing that will be important for this year is more diversification within assets. Don't just rely on a few stocks.”

Even long-term investors like Warren Buffett have emphasised holding concentrated positions in well-understood assets while recognising the importance of strategic diversification. As explored in Konvi’s profile on Buffett’s strategy, he champions deep knowledge over sheer variety—but also advocates for resilient portfolio design, especially when navigating volatile cycles.

Investors today are taking those principles to heart—allocating part of their capital to alternative markets that offer tangible exposure, historical relevance, and asymmetric upside.

How Konvi Enables Access to Alternative Investments

While institutional investors have long had access to exclusive markets—like private equity, art funds, or rare asset portfolios—retail investors have traditionally been left on the sidelines. Konvi is changing that by opening the door to fractional ownership in high-value physical assets—including rare comic books, vintage watches, fine whisky, and more—starting from just €250.

What sets Konvi apart is its commitment to accessibility, transparency, and curation:

Expert Selection & Authentication

Assets are carefully sourced and authenticated in partnership with trusted valuation experts like Ewbank, a leading UK auction house. Every item is professionally graded, stored, and insured.

Fractional Co-Ownership

Investors can buy shares in premium assets without needing six-figure capital. This model allows for strategic portfolio diversification across multiple asset classes and themes—an approach traditionally reserved for family offices or UHNW investors.

Transparent Oversight & Community Engagement

When a potential sale arises, the investor community is invited to vote, ensuring democratic decision-making and visibility throughout the investment lifecycle.

By lowering the barrier to entry and maintaining institutional-grade standards, Konvi empowers a new generation of investors to gain exposure to cultural assets that have historically proven resilient during market downturns—and increasingly relevant as long-term stores of value.

Conclusion: Diversifying Beyond the Index

In a year defined by volatility, geopolitical uncertainty, and fears of a stock market correction, investors are rethinking the foundations of modern portfolio strategy. The once-reliable 60/40 model is under pressure, and experts across the industry—from Morgan Stanley to BlackRock, and beyond—are calling for greater allocation to alternative assets.

Whether it's for inflation protection, market hedging, or long-term capital preservation, alternative investments are no longer a niche—they're becoming a cornerstone of smart diversification.

Through its fractional model, Konvi enables everyday investors to access the kind of alternative assets that wealth managers and institutions are increasingly prioritising. These are assets with low market correlation, rich cultural significance, and a proven history of resilience.

As the world navigates its next financial cycle, the portfolios that will endure are those built with growth in mind as well as stability, scarcity, and story-driven value at their core.