This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Fine Wine Investing: Domaine de la Romanée-Conti as a High-Yield Wine Investment

Nikkan Navidi•17.6.2025

When wine collectors speak in hushed tones about a bottle that transcends taste and tradition, they are often referring to Domaine de la Romanée-Conti, better known as DRC. Nestled in the heart of Burgundy’s Côte de Nuits, this storied estate has become the gold standard for fine wine investing, with bottles regularly commanding five to six figures at global auctions.

Yet, DRC’s appeal is not just about rarity or record-breaking prices. It sits at the intersection of history, terroir, cultural prestige, and economic scarcity — elements that make it more than a drinkable delicacy. It’s a tangible store of value, increasingly viewed as a blue-chip asset class in diversified portfolios.

In 2025, with inflation risks persisting, traction in alternative assets continues to grow. Investors are not only asking which stocks to hold, but also what physical assets will retain their value, narrative, and scarcity over time. For a growing number of private collectors and fractional investors, the answer lies in the world of investment-grade wine, and few names carry more weight than DRC.

This article explores why Domaine de la Romanée-Conti is more than just a legendary wine, what drives its valuation, and how modern investors are gaining access to its enduring value proposition.

What is Domaine de la Romanée-Conti?

Domaine de la Romanée-Conti, often abbreviated as DRC, is widely regarded as the pinnacle of Burgundy winemaking. Located in the Côte de Nuits subregion of eastern France, the estate produces some of the world’s most coveted expressions of Pinot Noir and Chardonnay. Its name comes from its flagship vineyard, Romanée-Conti, which spans only 1.8 hectares and yields just a few thousand bottles per year — contributing significantly to its mystique and scarcity.

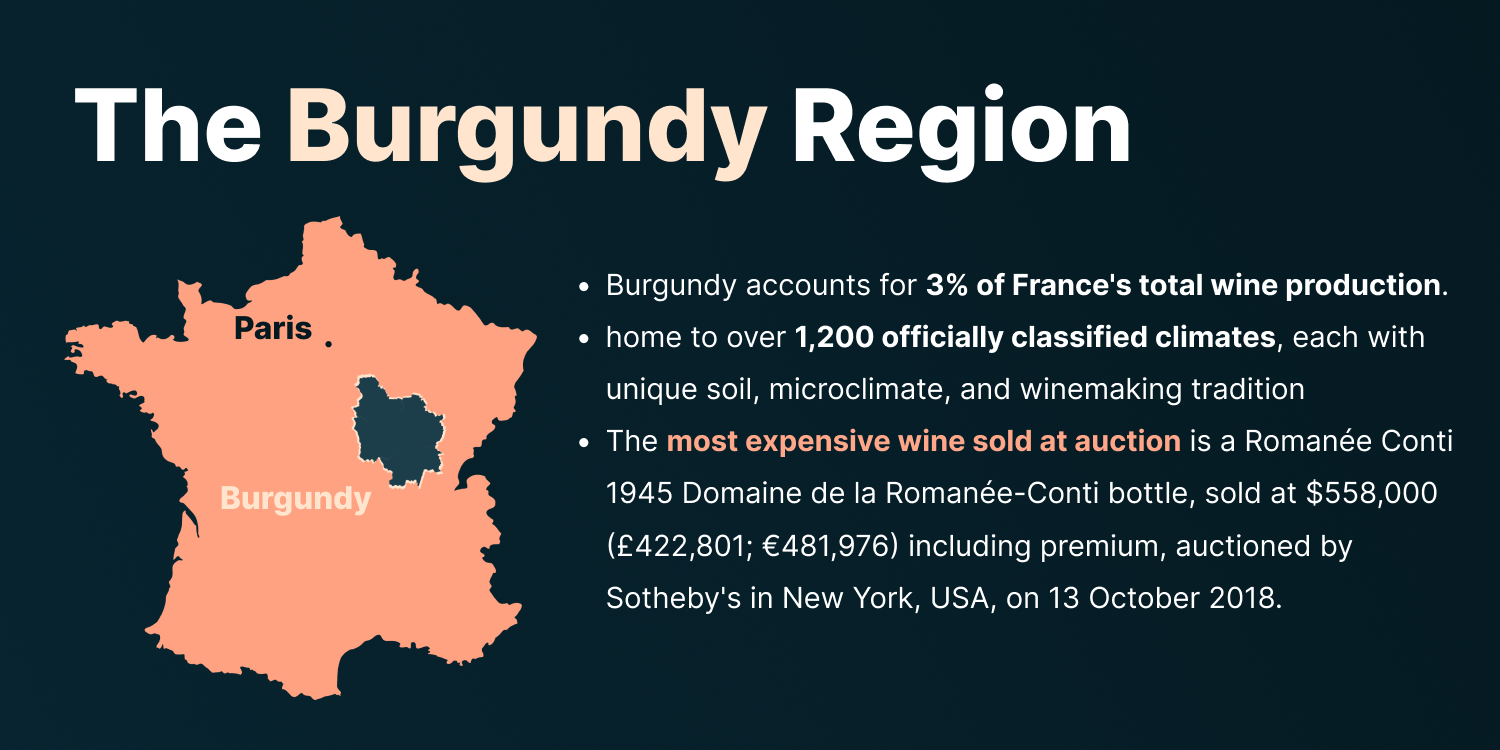

Why Burgundy Is Different

Burgundy’s distinction lies in its structure, philosophy, and geography. Unlike Bordeaux, where estates often own large vineyards and produce blended wines from several grape varieties, Burgundy is defined by small, meticulously classified plots known as climats, each with a unique soil composition, slope, and microclimate. The wines are usually single-varietal — Pinot Noir for reds, Chardonnay for whites — and the focus is on terroir expression over brand dominance.

This means that every vintage, vineyard, and producer in Burgundy tells a unique story. Domaine de la Romanée-Conti exemplifies this philosophy to an extreme degree, practising biodynamic viticulture, ultra-low yields, and hand-harvesting techniques designed to extract the purest expression of place.

This intense focus on craftsmanship, scarcity, and site-specific character makes Burgundy, and DRC in particular, stand out in the global wine market. The result is not just a remarkable wine, but a cultural artefact with enduring appeal among connoisseurs, collectors, and investors.

Why DRC Is an Investment-Grade Wine

Domaine de la Romanée-Conti has become a cornerstone in the portfolios of seasoned collectors and alternative asset investors. Its investment appeal lies in three key pillars: scarcity, prestige, and proven market performance.

Scarcity and exclusivity define the very DNA of DRC. With annual production across all its vineyards capped at around 6,000–8,000 cases, and only 450 cases of its flagship Romanée-Conti released per year, supply is perpetually limited. In a market where demand is global and growing, scarcity translates into enduring upward pressure on price.

DRC also enjoys an unparalleled level of brand prestige. Its wines are consistently rated among the best in the world, often receiving perfect or near-perfect scores from critics such as Robert Parker’s Wine Advocate and Wine Spectator. This recognition is compounded by its deep historical roots, the estate dates back to the 13th century and has remained a symbol of artisanal winemaking through revolutions, phylloxera outbreaks, and modern economic cycles.

Most compelling, however, is DRC’s historical price performance. According to Liv-ex, the global marketplace for fine wine, Romanée-Conti has shown consistent long-term appreciation. Bottles from acclaimed vintages such as 1990, 2005, or 2015 regularly fetch upwards of €15,000–€25,000 at auction. In 2018, a bottle of 1945 Romanée-Conti broke records at Sotheby’s, selling for $558,000, making it the most expensive bottle of wine ever sold at the time.

This combination of extreme scarcity, cultural prestige, and robust secondary market performance has made DRC a top-tier candidate for alternative investment.

Factors Influencing the Value of Domaine de la Romanée-Conti

The market performance of Domaine de la Romanée-Conti (DRC) is shaped by a series of interrelated factors, each contributing to its perception as a blue-chip wine asset. While DRC’s reputation may be legendary, its value is determined not by branding alone but through a combination of land, labour, climate, and meticulous curation. Understanding these drivers is essential for anyone considering DRC as part of a diversified portfolio.

Terroir and Geography

The Romanée-Conti vineyard is located in the heart of Burgundy’s Côte de Nuits, a region renowned for its complex limestone soils and microclimates. These geological conditions are critical to the wine’s layered expression and ageing potential. DRC’s plots are situated on a gentle slope with optimal drainage, minimal intervention, and a sun exposure that favours balance and structure in Pinot Noir. No other vineyard can replicate this exact terroir, which creates intrinsic scarcity at the origin.

Viticulture and Winemaking Approach

DRC’s vineyard management adheres to strict biodynamic principles, avoiding synthetic treatments in favour of natural processes that prioritise soil vitality and biodiversity. Manual harvesting, low yields, and indigenous yeast fermentations contribute to the purity of expression. Every detail, from canopy management to barrel ageing, is controlled with precision. This artisanal process does not allow for scaling, reinforcing the exclusivity of each vintage.

Vintage Quality and Aging Potential

Not all vintages perform equally in the market. Exceptional years, such as 1990, 1999, 2005, 2009, and 2015, often achieve record auction prices due to their balance, ageing potential, and critical acclaim. Wine critics and publications play a role in shaping perceptions of quality, but the actual demand is driven by collector sentiment, macroeconomic conditions, and release volume. A limited vintage with exceptional scores tends to see price appreciation over time, particularly if market timing aligns with broader interest in Burgundy.

Critical Scores and Reviews

As mentioned before, ratings from influential wine critics such as Robert Parker, Wine Advocate, and Wine Spectator have a measurable impact on pricing. Wines receiving scores above 95 often experience substantial demand spikes. For example, Bordeaux wines with 98+ scores from Parker have fetched price premiums of 20–30%. DRC consistently ranks at the top, cementing its reputation among collectors.

Global Demand

The fine wine market has become increasingly international. Burgundy, and DRC in particular, have benefited from rising demand in regions like China, Hong Kong, and the U.S. These markets value both the rarity and prestige of French wine. Asian buyers, in particular, often prioritise Burgundy and Bordeaux labels that signal status, exclusivity, and long-term appreciation.

Economic and Political Stability

Wine functions as a hedge during periods of economic uncertainty. As a tangible, historically appreciating asset, it tends to hold value better than many equities in volatile markets. However, trade dynamics, such as tariffs, Brexit disruptions, or export regulations, can temporarily suppress global demand or create pricing asymmetries across markets.

Provenance and Storage Conditions

Fine wine as an asset class is sensitive to handling history. Bottles stored under ideal temperature and humidity conditions, and with clear provenance documentation, consistently outperform in resale value. DRC collectors pay close attention to proof of purchase, original wooden cases (OWCs), and professional storage records. Gaps in documentation or improper cellaring can result in diminished returns or difficulty selling at top-tier pricing.

Trends in Fine Wine Investment

As the global investment landscape broadens beyond traditional stocks and bonds, fine wine is earning increasing attention from institutional and retail investors alike. Once the domain of connoisseurs and private cellars, the fine wine market has evolved into a recognised asset class, supported by robust infrastructure, data-driven platforms, and global demand.

Growth of Wine Funds and Digital Wine Exchanges

In the last decade, wine funds have emerged as a preferred vehicle for diversifying high-net-worth portfolios. These funds, managed by industry experts, acquire investment-grade bottles and collections with the intent to hold, appreciate, and eventually sell at a premium. Investors benefit from professional storage, market expertise, and reduced entry barriers.

Simultaneously, the rise of digital wine exchanges like Liv-ex has brought much-needed transparency to the market. These platforms offer real-time pricing data, market indices, and a secondary marketplace where fine wines can be bought and sold like financial instruments. As a result, the wine trade is becoming more liquid and accessible, opening the door to fractional ownership, algorithmic tracking, and cross-border investing.

From Collecting to Strategic Diversification

The motivations behind fine wine acquisition are changing. While traditional collectors often purchased bottles for personal enjoyment or cellar prestige, today's investors are increasingly focused on diversification, inflation hedging, and non-correlated performance.

Fine wine, particularly from estates like Domaine de la Romanée-Conti, has shown resilience across market cycles. Its supply is finite, its cultural value is strong, and its price trajectory often mirrors demand from emerging global markets. This makes it an attractive holding during periods of equity volatility or economic uncertainty.

In parallel, generational shifts are influencing behaviour. Younger investors, especially Millennials and Gen Z, are approaching wine not only through personal taste but through thematic alignment. Sustainability, provenance, and storytelling now play a growing role in purchasing decisions, with asset-backed wine platforms adapting their offering to cater to this mindset.

Risks and Considerations When Investing in DRC

While Domaine de la Romanée-Conti holds an elite status in the world of fine wine, investing in these bottles requires an understanding of key risks. From fraud prevention to storage logistics, the stakes are high when dealing with such exclusive and expensive assets. Being aware of these considerations helps protect capital and ensures informed decision-making.

Provenance and Counterfeiting

Given DRC’s prestige and high secondary market prices, it has become a prime target for counterfeiting. Forged labels, tampered corks, and fraudulent ownership claims are not uncommon in the unregulated corners of the wine market. While it may be possible for experts to tell the difference between an altered or even completely forged bottle, it is important to note that every brand and every bottle has its own intricacies, making thorough industry experience even more relevant. Authenticity directly influences resale value, making provenance verification critical. Serious investors rely on platforms or brokers that provide full documentation of the wine’s history, including storage conditions, auction records, and original purchase certificates.

Storage and Condition Sensitivity

Fine wine is a living asset. Even a perfectly legitimate bottle can lose its value if improperly stored. Factors such as temperature fluctuation, humidity, and light exposure can deteriorate the wine’s quality and packaging. For DRC in particular, which often appreciates over decades, long-term professional storage in bonded warehouses is essential. These facilities maintain optimal conditions and retain the wine’s eligibility for tax-efficient trading.

Liquidity and Exit Timing

Unlike public stocks or ETFs, DRC wines are not traded in open markets with daily liquidity. Finding a buyer at the desired price point can take time, particularly for ultra-rare vintages or large collections. Market cycles, global economic sentiment, and fine wine trends can influence exit timing. Investors must be prepared to hold their position longer than with traditional financial products.

Market Volatility and Macroeconomic Factors

While fine wine is historically more stable than equities, it is not immune to external pressures. Shifting demand from key markets, changes in import/export regulations, or downturns in global luxury spending can affect valuations. Price volatility tends to be less frequent but can be significant when it occurs, particularly if triggered by broader macroeconomic events.

Access and Information Gaps

Access to top-tier investment-grade wine markets is still relatively opaque. Many high-value transactions happen through closed networks, private auctions, or long-standing merchant relationships. For new investors, this can create barriers to entry and make price discovery more difficult. Transparency and expert sourcing are essential for navigating this landscape effectively.

As Domaine de la Romanée-Conti wines continue to captivate collectors and investors globally, the ways in which people access these bottles have evolved significantly. While auctions and private sales still play a role, new platforms and partnerships are making this once-exclusive asset class more accessible, transparent, and structured.

How Investors Access DRC Today

As the fine wine market matures and digitises, Domaine de la Romanée-Conti has become more accessible to investors through a range of modern channels. Whether through private brokers, specialist platforms, or fractional investment opportunities, access to this exclusive label is broader than it once was, though still limited by supply and high entry prices. Here's how investors participate in the DRC market today.

Auction Houses and Private Brokers

Traditional entry into the DRC market still happens through global auction houses like Sotheby’s, Christie’s, and Acker. These auctions often include pristine vintages with well-documented provenance and command strong attention from collectors and institutions. Private brokers and merchants, especially those with long-standing relationships with Burgundy producers, also facilitate direct sales or allocations. However, this route usually requires a significant capital outlay and deep expertise in vintage valuation and authentication.

Fine Wine Investment Platforms

Over the last decade, digital marketplaces and wine exchanges have helped create transparency in pricing and improve liquidity. Platforms such as Liv-ex offer data-driven analysis and access to trade opportunities for high-end wines. They provide market insights, trend tracking, and trading tools, which can be valuable for investors who wish to manage wine holdings like a portfolio.

Wine Investment Funds

Some investors prefer the pooled model of wine funds, which are managed by professional teams with access to elite suppliers and deep market experience. These funds acquire and hold a diversified portfolio of investment-grade wines, including DRC, and aim to deliver capital appreciation over time. This model removes the burden of sourcing, storing, and reselling individual bottles but typically requires higher minimum investments and longer lock-in periods.

Investing in DRC with Konvi

For investors looking for curated access without the barriers of full ownership, Konvi offers an innovative entry point. Konvi sources, verifies, and manages rare and investment-grade wines — including from the DRC estate.

Each wine asset listed on the platform is professionally vetted, securely stored, and held with investment-grade standards. Investors can buy shares starting from as little as €250, gaining exposure to bottles that would otherwise be out of reach. Konvi's approach ensures that collectors and investors benefit from expert oversight, storage, and resale timing, without needing to manage the physical asset directly.

This structure allows investors to:

- Gain exposure to DRC and other high-tier wines through a regulated and transparent platform

- Diversify portfolios with tangible assets historically known for low volatility

- Join a community of like-minded cultural investors

By collaborating with industry experts, Konvi brings deep market knowledge, trusted sourcing, and real-time valuation methodologies into its offering. This model not only protects investor interests but also reflects the broader shift toward democratising access to passion-led alternative investments.

Conclusion: Why DRC Deserves a Place in the Modern Investment Portfolio

Domaine de la Romanée-Conti represents a rare convergence of history, craftsmanship, scarcity, and cultural significance. Its position at the pinnacle of the fine wine world is not incidental but the result of centuries of meticulous vineyard management, generational stewardship, and unwavering commitment to quality. For collectors, connoisseurs, and investors alike, DRC offers more than exceptional wine — it offers an asset that embodies timeless value.

In a world of increasing market volatility and shifting investor behaviour, DRC stands out as a tangible, alternative asset with a proven track record of resilience. Its strong historical performance, low correlation to traditional markets, and enduring global demand make it a compelling addition to any diversified portfolio.

Platforms like Konvi are unlocking this opportunity for a new generation of investors, enabling co-ownership of assets that were once the exclusive domain of ultra-high-net-worth individuals. By collaborating with industry leaders, Konvi ensures that access to DRC is not only more democratic but also backed by expertise, transparency, and robust asset management.

For those seeking to combine cultural capital with financial discipline, DRC offers an unmatched proposition: a wine that tells a story, holds its value, and belongs in the modern investment conversation.