This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

The Ferrari Fever: Why you should invest in Italian classics

Nikkan Navidi•2.4.2024

In the world of luxury and classic cars, the name Ferrari resonates like no other. It's not just a brand; it's an emblem of prestige, performance, and unparalleled investment potential. For many, the dream of owning a Ferrari is the ultimate symbol of success. But beyond the enticement of the prancing horse emblem, lies a compelling case for considering these Italian masterpieces as more than just cars—they can be lucrative investments if considering the right indicators. Let's shift gears and delve into why diving into Ferrari investment might just be the smart move you're looking for.

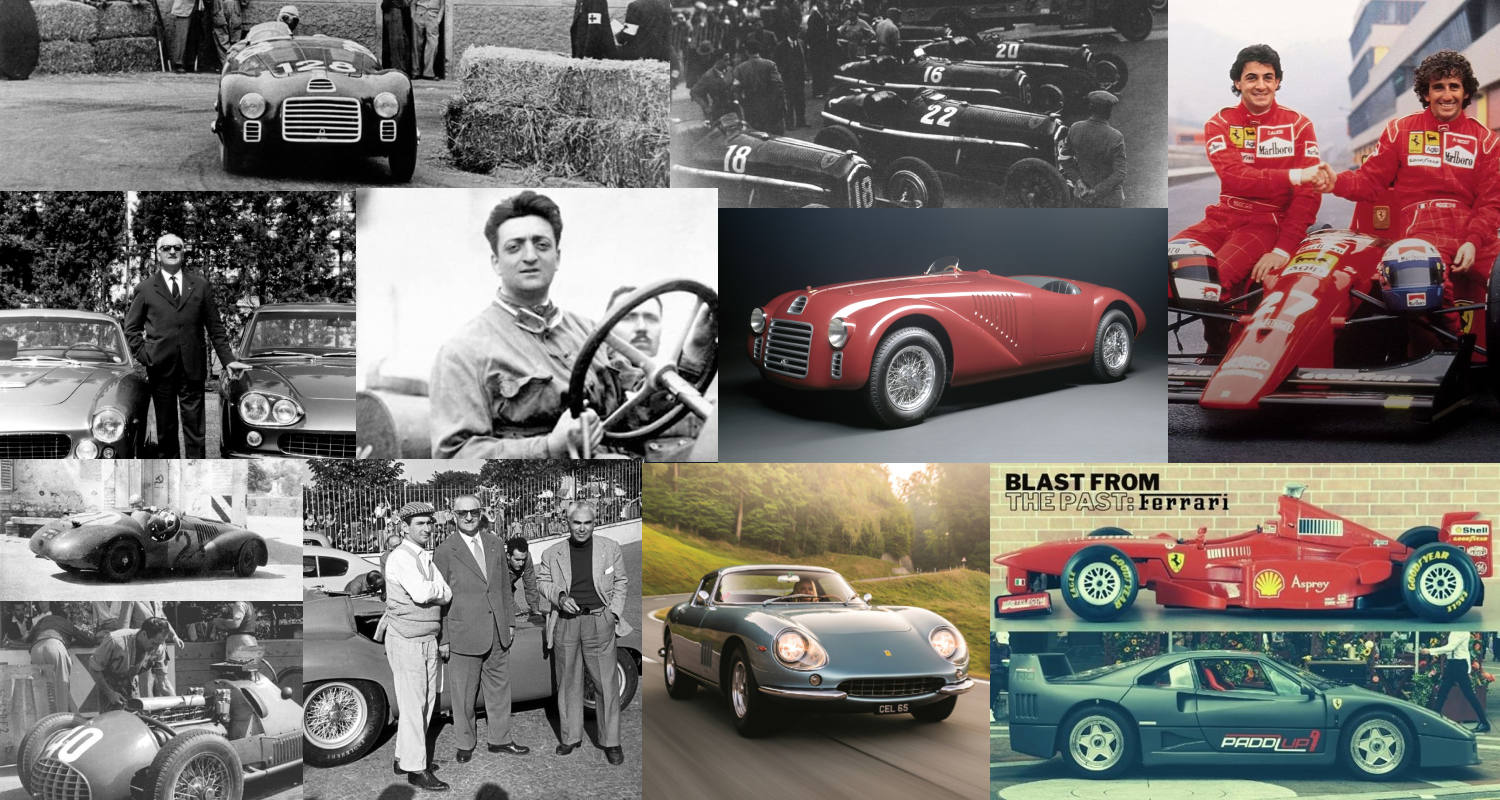

From Racer to Race-car maker

In 1908, the car racing scene captivated a young Enzo Ferrari, aged just ten, marking the start of a lifelong passion. Following his service in the Italian army during World War I, Enzo embarked on a career with several small car manufacturers.

By the 1920s, Enzo's career had shifted into high gear with a position at Alfa Romeo as a racing driver. This led to the founding of Scuderia Ferrari in 1929, which quickly evolved into Alfa Romeo's official racing team by 1933. However, by 1937, Enzo decided to close Scuderia Ferrari to lead Alfa Romeo's Alfa Corse racing department. In 1939, constrained by a non-compete clause, Enzo launched his own automotive company, debuting the first car bearing the Ferrari name in 1947.

The post-war period was pivotal for Ferrari, instigated by Luigi Chinetti, an accomplished Italian-American racer. Despite Ferrari's focus on competition, Chinetti convinced him to start manufacturing sports cars for the broader market. This led to the opening of the first Ferrari dealership in the U.S. in the early 1950s, significantly altering the company's trajectory. Iconic models like the California Spider, GTO, and Testarossa soon followed.

Facing the need for greater resources to ensure its competitiveness and survival, Enzo sold a 50% stake in Ferrari to FIAT in 1969.

Following Enzo's death, Luca Cordero di Montezemolo took the helm as President and then Chairman, steering Ferrari into the status of a global luxury marque.

Nowadays, Ferrari continues to dominate both the racetrack and the high-end car market, with its supercars and hypercars commanding prices in the hundreds of thousands to millions of dollars and continuously being at the forefront of innovation while maintaining their strong reputation.

What makes Ferraris valuable?

The concept of a car as an investment, particularly a luxury car like a Ferrari, might seem unconventional to some. Yet, the numbers speak volumes. The classic car market has witnessed remarkable resilience, with Ferrari leading as a beacon of investment potential. When considering a car as an investment, it's crucial to take into account factors such as the rarity of the model, its condition, maintenance history, and market demand when evaluating the appreciation potential. Additionally, cost factors such as storage, maintenance costs, and insurance should be taken into consideration when evaluating whether they outweigh the appreciation potential or not.

Other factors you should consider are:

- Historical significance

- The production volume

- Celebrity ownership

- Unique features, technology or design

- Racing pedigree from winning races or that are influenced by an era of Ferrari dominance in Formula 1.

Over the previous decade, classic cars have witnessed a remarkable increase in valuation, surpassing the growth observed in other high-end assets. In a survey conducted for the 2024 Knight Frank Wealth Report, over 600 private bankers, wealth advisors, intermediaries and family offices were asked which passion investments are becoming more popular among their clients. On average 38% of the respondents selected classic cars, highlighting the globally increasing demand (Knight Frank, 2024). Ferraris, in particular, have been at the forefront of this surge, with some models appreciating in value by over 300% in the past decade such as the infamous F40 or F50. While these examples have scored exceptional returns on investment they offer a small hint towards the tangible financial rewards of investing in a Ferrari.

The Cult Factor

The shift towards electric vehicles is expected to increase the value and appeal of classic cars, with Ferraris leading the way. According to industry experts, this move to electrification will make classic cars more sought-after, making them cult objects and turning them into treasured collectables. In the auction world, Ferraris have shown their worth, with an average auction price of $589,000 in the 2021-22 period, outpacing other prestigious brands like Mercedes-Benz and Porsche. The community of classic car enthusiasts has grown and diversified over the years. Initially dominated by experts with extensive knowledge of these vehicles, it now includes a wider range of people who appreciate the beauty and value of owning a classic car and can afford to purchase an asset that also retains its value.

Ferrari stock vs. car investment

Some alternative investments such as classic cars offer individuals the option to invest in the brand instead of a specific asset the carmaker created. Both options carry distinct advantages and potential risks. Investing in Ferrari's stock offers liquidity and ease of entry, allowing investors to benefit from the brand's overall financial health and growth in the luxury automotive sector without the substantial upfront costs associated with purchasing a classic model. However, stock investments are subject to market volatility and can be influenced by factors beyond the company's control, such as economic downturns.

On the other hand, investing in a physical Ferrari, particularly vintage or limited-edition models, can yield significant appreciation over time, driven by rarity and desirability among collectors. Yet, this form of investment requires substantial initial capital, along with ongoing maintenance costs and insurance, not to mention the illiquidity of selling such specialized assets.

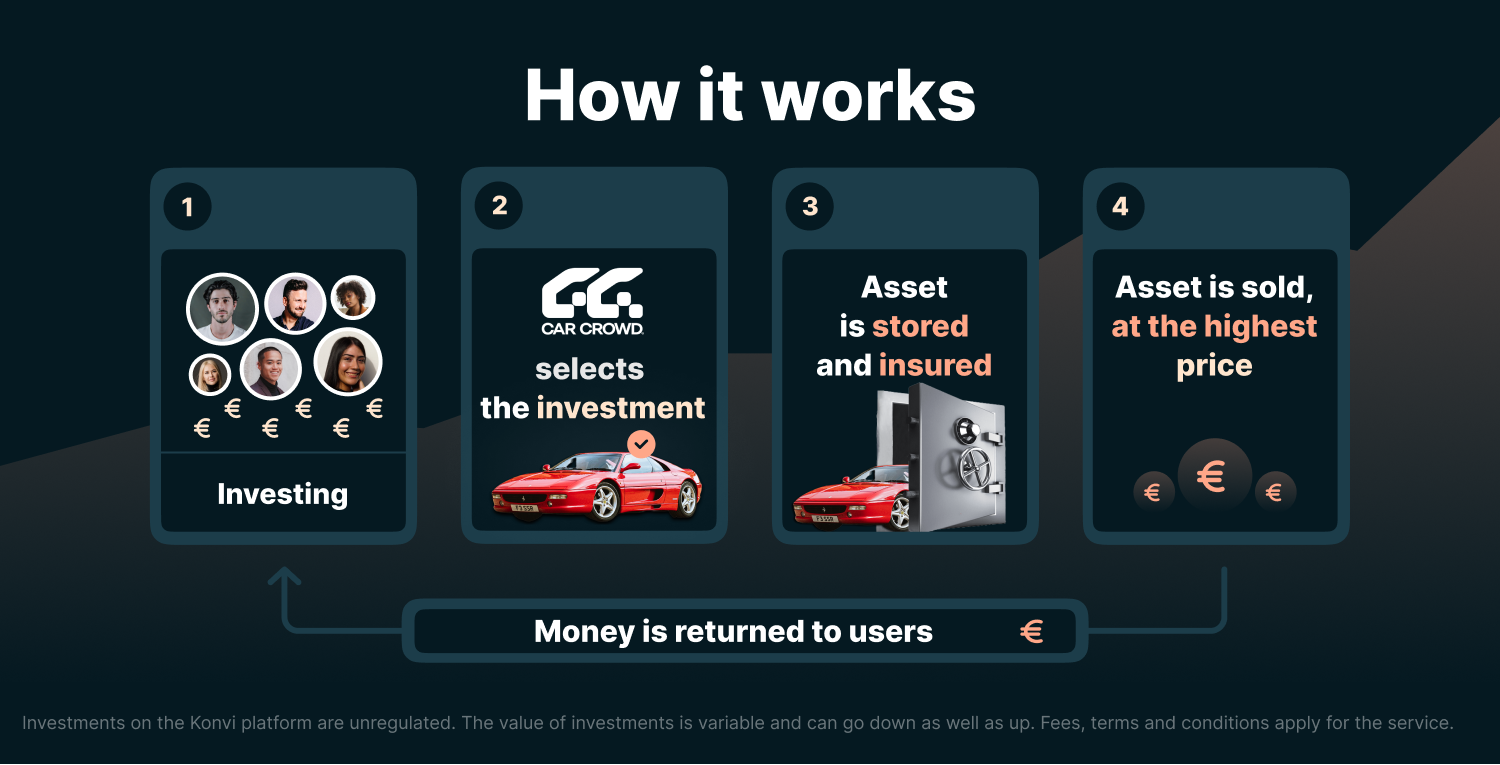

As a resolution to these challenges, fractional investing emerges as a compelling solution. This innovative approach allows investors to own a share of a classic Ferrari, combining the tangible appeal and potential for appreciation of a physical car with the accessibility and flexibility of stock investment. Through fractional ownership, investors can mitigate some of the financial barriers and risks associated with classic car investment, making it an attractive option for enthusiasts and investors alike. With Konvi you can invest in classic cars supported by industry experts starting from €250 with maintenance and storage being taken care of.

What you should consider before investing

Do Your Homework: If you're thinking about buying a Ferrari as an investment, start with some serious homework. Get to know the different Ferrari models, how many were made, how much they've been worth in the past, and what they're selling for now. This info will help you make smart choices.

Talk to the Pros: It's also a good idea to chat with people who know a lot about investing in classic cars. They've got the experience and know-how to guide you through the process and can help you avoid mistakes and find the best deals.

Remember the Extra Costs: Buying a Ferrari isn't just about paying the sale price. You've got to think about the money it'll cost to keep it running smoothly, pay for insurance, and store it properly. Keeping your Ferrari in top shape is important if you want it to keep or increase its value.

Think Long-Term: Investing in a Ferrari isn't a quick way to make money. It's more about playing the long game. While their prices can go up and down in the short term, Ferraris tend to become more valuable over time. Being patient can really pay off.

Investing in a Ferrari can be really exciting and rewarding, both for your heart and your wallet. By doing your research, staying up to date on market trends, and listening to advice from experts, you can make wise investment choices. So, if you're ready to invest in a Ferrari, get ready to do some learning, talk to knowledgeable people, and enjoy the journey of owning a piece of car history. However, as with all investments timing plays a pivotal role. Check out this article if you wanna find out how you can recognize green flags before you start off your classic car investment journey

In our most recent project in collaboration with our industry expert, CarCrowd, we are enabling the Konvi community access to invest in a Classic 80s Icon with a capital goal of €105,000.

Note: this article only engages the opinion of its author and does not constitute financial advice.