This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

What Makes a Good Alternative Investment? A Due Diligence Checklist for New Investors

Nikkan Navidi•18.7.2025

Alternative assets give investors access to markets beyond traditional stocks and bonds. These include rare whisky, fine art, luxury watches, and other culturally significant collectibles. They can offer diversification, potential inflation protection, and the chance to participate in markets typically reserved for institutions or ultra-high-net-worth buyers.

However, success in these markets requires more than enthusiasm or taste. Unlike public equities or bonds, real-world assets (RWAs) are illiquid and highly individual in nature. They cannot be sold instantly at a transparent market price, and each asset must be researched on its own merits. Investors face the risk of overpaying, buying inauthentic items, or locking up capital for longer than planned.

This guide is designed to help Konvi investors perform effective due diligence. By following a structured process, you can better evaluate an asset’s risks, costs, and potential for appreciation. The goal is to support confident, informed decision-making that aligns with your personal investment objectives.

Understand the Asset Type

Selecting an alternative investment begins with understanding exactly what you are buying. Each asset class has its own market structure, typical buyers, holding periods, and appreciation potential. Careful research into the asset type lays the groundwork for all other due diligence steps.

Define the Alternative Investment Category

Alternative assets are diverse. Before anything else, identify what category you are evaluating. Examples include:

- Rare whisky and fine wine

- Investible art, both red- and blue-chip

- Luxury watches

- Collectible items such as historical documents or fossils

- Property or fractional real estate

Each category has distinct investment drivers, risk factors, and exit strategies.

Learn How the Market Works

Markets for alternative assets are specialized and often opaque. Investors should study:

- Buyer Profiles: Who typically buys these assets? Are they collectors, speculators, or institutions?

- Holding Periods: How long do investors usually hold them to realize value?

- Appreciation Trends: What has driven historical price growth? Is demand stable, cyclical, or speculative?

For example, fine wine has benefited from expanding global demand and constrained production, while contemporary art prices can fluctuate with cultural trends and critical reception.

Example Comparison: Rare Whisky vs. Contemporary Art

Rare Whisky

The rare whisky market is driven by global collectors, connoisseurs, and specialist investors. Buyers often come from the UK, Asia, and the US, with growing demand in emerging markets. Whisky casks are typically held for long periods (5 to 20 years) to allow further maturation or to target favorable market cycles.

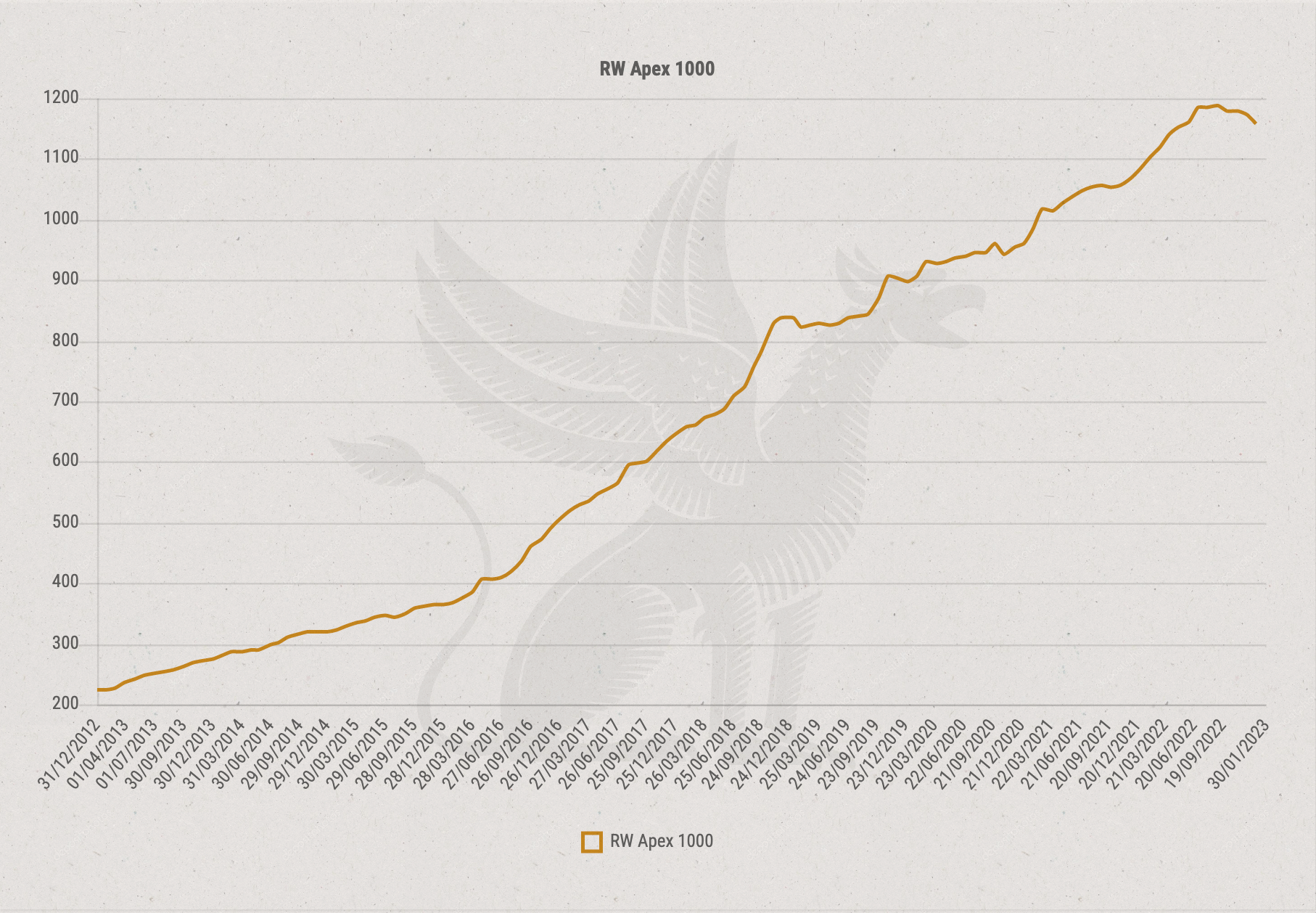

At the bottle level, official auction data shows strong appreciation trends. For example, the Rare Whisky 101 Apex Index, which tracks leading bottles, rose over 500% between 2010 and 2022 (source: Rare Whisky 101). Scarcity, brand prestige, and maturation potential all contribute to demand.

Source: Rare Whisky 101

Source: Rare Whisky 101

Contemporary Art

The contemporary art market attracts a mix of private collectors, museums, and investors. Buyers may be motivated by aesthetic value, cultural status, or investment potential. Holding times can vary widely. Some buyers seek quick flips, while others hold for decades.

Art auction results illustrate both the potential and the volatility of this market. According to Artprice, the Contemporary Art Market Report 2023 notes overall market growth of 2,200% between 2000 and 2022 but also points out sharp fluctuations depending on artist popularity and macroeconomic conditions. Resale values can soar for in-demand artists but drop if critical interest fades. Furthermore, if looking at prints with a limited production run, like most Banksy pieces, the production run and number of copies plays a crucial role in price development. A piece that might look identical to another might be from a different production run and fetch lower prices and vice versa.

This comparison underscores the need to study each market’s structure. While both categories can appreciate strongly, they demand different time horizons, research depth, and risk tolerance.

Verify Authenticity and Provenance

Authenticity and provenance are critical pillars of any alternative investment. Without them, even the most beautiful asset can be worthless on resale. Investors should prioritise rigorous verification to protect capital and maximise value.

Why Authentication Matters

High-value assets often attract forgeries or misrepresented items. Whether it is a luxury watch, a rare painting, or an ancient fossil, ensuring authenticity is essential for maintaining market confidence. An inauthentic asset is difficult or impossible to resell through reputable channels and can result in total loss of value.

For example, the global art market faces persistent issues with forgery. The Fine Art Expert Institute (FAEI) in Geneva has estimated that over 50% of artworks it reviews are either forged or misattributed (source: FAEI). Authentication processes, therefore, are not optional, they are fundamental.

Provenance Documentation

Provenance refers to the documented history of ownership, sale, or production. It serves as a chain of evidence supporting the asset’s legitimacy and value. Investors should seek:

- Certificates of authenticity from reputable authorities

- Historical ownership records

- Expert appraisals or condition reports

In luxury watches, provenance can mean factory papers, original receipts, or service histories from authorised dealers. In fine art, it may include auction house documentation, gallery records, or artist certificates.

Avoiding Fakes and Disputed Items

Avoiding counterfeit or disputed assets requires working with trusted sources. Investors should:

- Choose sellers and platforms with strong reputations for vetting and verifying assets

- Engage independent experts for high-value acquisitions

- Avoid deals lacking clear documentation

At Konvi, asset sourcing prioritises expert evaluation, ensuring only verified, investment-grade pieces enter opportunities offered to investors. By placing authentication and provenance at the heart of your due diligence process, you significantly reduce risk and support long-term value.

Assess Scarcity and Demand

Scarcity and demand are two of the most important drivers of value in alternative assets. Investors need to understand both dimensions to assess appreciation potential and market resilience.

Evaluating Scarcity

Scarcity can result from natural rarity, limited production, or historic significance. Assets with verifiable scarcity often command higher premiums and demonstrate more stable long-term demand.

Examples include:

- Limited-edition luxury watches produced in small, documented runs

- Vintage wine vintages with a finite supply of remaining bottles

- Unique or single-edition artworks with clear provenance

When assessing an asset, investors should ask:

- Is the production genuinely limited, or is the scarcity a result of brand marketing?

- Is there verifiable evidence of rarity and restricted supply?

Artificial Scarcity and Brand Strategies

Some brands manage perceived scarcity through allocation strategies rather than truly limited production. Rolex, for instance, carefully controls distribution to create long waiting lists for popular models like the Submariner or Daytona. While production numbers are substantial, brand-controlled supply at retail maintains high demand and strong resale values on the secondary market.

Investors must understand these dynamics:

- Brand-managed scarcity can be effective at supporting resale value but depends on continued brand discipline and consumer interest.

- True limited editions with documented production numbers are often less reliant on brand marketing and can be easier to verify in terms of rarity.

Auction house data can help confirm genuine scarcity by tracking long-term pricing and sell-through rates for well-documented limited editions versus mass-market models.

Analysing Collector and Investor Demand

Demand comes from collectors, investors, and cultural institutions. It can be steady and predictable or highly cyclical.

Key considerations include:

- Historical and recent auction results showing sell-through rates and price trends

- Demographics of buyers, including growth in emerging markets

- Cultural shifts that influence taste and collecting trends

For example, Christie’s and Sotheby’s have documented rising demand for certain categories, such as vintage Rolex and Patek Philippe watches, driven by global collector competition. Similarly, the fine wine market has seen expanding demand from Asia, with Liv-ex data showing growth in the share of Asian buyers in 2025 (Liv-ex June Market Report 2025). Generally, a trend can be observed that **Gen Z, Gen X, and Millennials, are reconsidering their investment strategies** and re-allocating new capital into alternative investments, thereby creating a more robust investment environment.

Evaluate Market Liquidity

Liquidity is one of the defining characteristics of alternative assets. Unlike stocks or bonds, these investments are not designed for immediate sale at a transparent, market-wide price. Instead, investors should think in terms of planned, strategic exits that balance time horizon with expected returns. Furthermore, it is important to understand that illiquidity isn’t necessarily disadvantageous but potentially a determining factor in alternative asset appreciation. If you want to learn more about how illiquidity affects your investment decisions, read this article.

Rethinking Liquidity in Alternative Assets

Liquidity in this context does not mean instant cash-out. It means the ability to exit at a fair, market-supported price given the right strategy and timeframe. Alternative investors should expect to plan their exits carefully, recognizing that the best opportunities often reward patience.

This is why understanding market structures is essential:

- Auction houses provide scheduled, reputable sales channels.

- Private dealers and specialist brokers help match serious buyers and sellers.

- Online platforms offer broader reach but require careful due diligence.

Platforms like Sotheby’s, Christie’s, Bonhams, and Liv-ex (for wine) publish detailed sales data that help investors evaluate realistic resale options.

Setting Holding Period Expectations

Successful alternative investing means setting appropriate time horizons. Even assets with strong demand benefit from strategic timing.

Key considerations:

- Market cycles: Demand can fluctuate with macroeconomic trends and collector interest.

- Transaction processes: Auctions and private sales involve preparation, marketing, and fees.

- Expected appreciation: Many assets are best held long enough to capitalize on supply-demand imbalances or scarcity recognition.

For example, fine wine futures may offer resale within a few years once bottled, while property investments often require five years or more to capture meaningful value shifts.

Aligning with Your Strategy

At Konvi, we emphasise helping investors understand these dynamics from the beginning. Liquidity in alternative assets doesn't mean immediate access to capital. It means having a clear, informed plan for when and how you might exit a position based on market mechanisms, asset type, and your personal goals.

Investors should consider:

- How long capital may be committed before resale becomes viable

- Which channels exist for exit such as scheduled auctions, secondary marketplaces, or private sales

- What conditions affect timing including market cycles, demand fluctuations, and asset readiness (e.g., wine bottling or art authentication)

By setting expectations early, investors can make choices aligned with their cash flow needs, risk appetite, and time horizon. Strategic liquidity planning avoids disappointment and supports more disciplined, confident investing in real-world assets.

Examine Historical Price Performance

Studying historical price performance is an essential part of due diligence in alternative assets. While past results never guarantee future returns, they provide critical insight into market maturity, volatility, and demand drivers.

Review Auction Records and Price Trends

One of the most reliable ways to assess an asset’s investment potential is to analyze documented auction sales. Reputable auction houses maintain detailed records of past sales, often searchable online.

Key benefits of auction data:

- Transparent pricing with verified buyers and sellers

- Trends over time for specific artists, brands, vintages, or editions

- Clues about liquidity and demand depth in a given category

- Recent auction results are especially valuable, as they reflect current buyer sentiment and market conditions more accurately than older records, which may no longer represent the prevailing price environment

Understand Volatility in Niche Markets

Alternative asset markets are heterogeneous. Some segments demonstrate blue-chip stability, while others are highly speculative. Investors must evaluate:

- How frequently prices have changed at auction

- Differences between top-tier and lesser-known items

- Market cycles that influence investor sentiment

For example, blue-chip art by established names (like Gerhard Richter or Yayoi Kusama) tends to show more consistent auction demand than emerging artists with limited sales history. In watches, classic models from Rolex or Patek Philippe consistently sell well, while niche microbrands may struggle on resale.

Blue-Chip Art vs. Red-Chip Art (Emerging Artists)

An investor evaluating art might compare:

- Blue-Chip Art: Backed by consistent auction records, global collector demand, and institutional interest. Prices tend to rise steadily but may require significant upfront capital.

- Red-Chip Art (Emerging Artists): Lower initial prices and potential for higher percentage gains, but with higher risk of price volatility and demand shifts. Auction data may be sparse or inconsistent.

This type of analysis helps investors balance their risk appetite with expected returns, shaping a more resilient, informed investment strategy.

Understand Costs and Manage Risks

Alternative investments carry unique risks and ownership costs that directly impact net returns. Proper due diligence means identifying these factors in advance and planning for them strategically.

Factor in All Costs of Ownership

Beyond the purchase price, investors must account for ongoing costs that affect profitability. These include:

- Storage: Specialised facilities for wine, whisky casks, or art require climate control and security.

- Insurance: High-value assets must be insured against theft, damage, or loss.

- Authentication and Appraisal Fees: Ensuring authenticity and market valuation may require expert services, particularly at resale.

- Transaction Costs: Auction fees, dealer commissions, and taxes can reduce net proceeds.

For example, whisky casks typically incur annual storage and insurance fees with specialist warehouses, while fine art requires professional handling and valuation for resale.

Recognise Illiquidity and Time Horizon Risk

Alternative assets are illiquid by nature. Selling often involves finding the right buyer at the right time, which can take months or years. This illiquidity demands patience and careful alignment with your financial goals. Liquidity planning is not about expecting instant sales, but about structuring an exit strategy to achieve fair value over a suitable time horizon.

Understand Market Cycles and Volatility

Like any market, alternative assets experience cycles of demand and pricing. Economic downturns, shifting tastes, or oversupply in certain categories can suppress prices.

For instance, auction data shows contemporary art can experience sharp corrections during global recessions. Wine and whisky prices may also fluctuate based on changing consumer demand and regulatory changes in key markets.

Address Fraud Risk and Provenance Issues

High-value collectibles attract counterfeiters and unscrupulous sellers. Risks include:

- Fake or misattributed art

- Counterfeit watches with cloned serial numbers

- Questionable provenance or undocumented ownership histories

Investors should insist on robust documentation, expert authentication, and sourcing from reputable dealers or platforms that prioritize verification.

The Importance of Diversification and Patience

A well-structured portfolio diversifies across asset types, reducing reliance on any single market cycle or price trend. Patience is equally essential, as quick flips are often unrealistic in these markets. A well-known figure within this space, Warren Buffett, who’s investment strategies have cemented his status as one of the world's most astute investors, focuses on long-term value, diversification, and a deeply philosophical approach to capital growth.

At Konvi, we emphasize education and transparency to help investors understand these realities. Informed investors can plan for costs, mitigate risks, and approach alternative assets as long-term, strategic components of their overall portfolio.

Conclusion

Alternative investments offer unique opportunities to diversify a portfolio with tangible, culturally significant assets. They can deliver meaningful long-term value, hedge against inflation, and connect investors to markets traditionally reserved for institutions or ultra-wealthy buyers.

Yet success in these asset classes requires careful, informed decision-making. Illiquidity, authentication challenges, market cycles, and ownership costs all demand thorough due diligence. Investors who take the time to understand the asset type, verify authenticity, assess demand, evaluate liquidity, study price history, and plan for costs and risks are better positioned to make confident, strategic choices.

At Konvi, our mission is to make these exclusive markets accessible to retail investors through expert curation, transparent sourcing, and education. By lowering the minimum investment threshold to €250 and working with industry-leading partners, we help investors participate in opportunities once out of reach.

With research, patience, and the right approach, alternative assets can become a rewarding, resilient component of a well-diversified portfolio.

Disclaimer

This article is provided for informational purposes only and does not constitute investment advice, financial advice, or a recommendation to buy or sell any financial instruments or assets. Past performance is not indicative of future results. Investing in alternative assets carries risks, including potential illiquidity, market fluctuations, and loss of capital. Readers should conduct their own due diligence or consult with a qualified financial advisor before making investment decisions.