This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

The Ideal Time to Invest in Classic Cars! Recognizing Green Flags

Nikkan Navidi•21.2.2024

Fluctuations in the Classic Car Market

The classic car market is a fascinating world where passion meets investment. It's where history's most iconic cars find their value not just in their beauty or engineering excellence, but in their scarcity and the stories they tell. But like any market, it has its ups and downs. Recently, the Monterey auctions, a key barometer for this niche, showed a decline. But is this a red flag or a green light for potential investors?

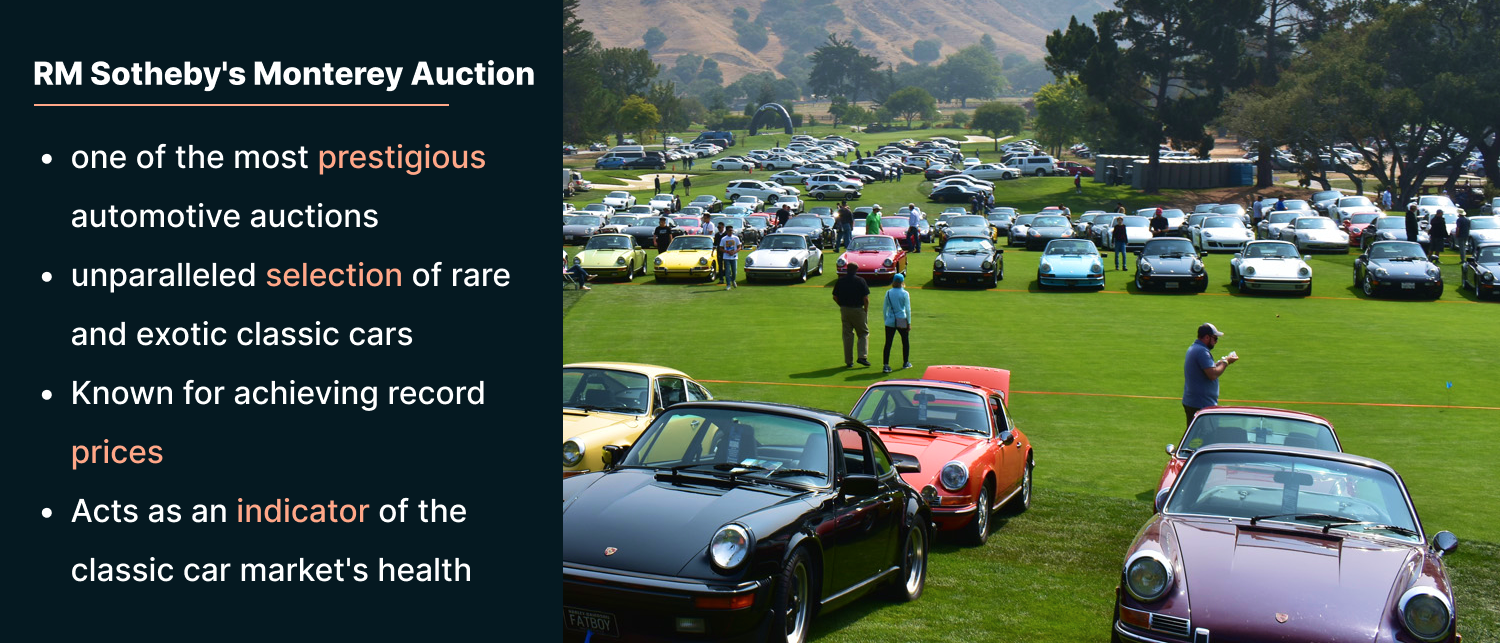

The Monterey Auctions: A Market Indicator

The Monterey auctions have long been a litmus test for the health of the classic car market. Observers noted a downturn, sparking debates about the market's future. Following the event, data revealed a shifting marketplace. Revenue from the top five auction companies slightly exceeded $400 million, marking a decrease compared to last year's $473 million. The proportion of cars sold, out of 1,225 offered, was 68 %, dropping from previous years rate of 78 %. A healthy market typically exhibits a sell-through rate above 80 percent. Not even leading brands such as Ferrari were immune to this trend. For instance, a 1967 Ferrari 412 P, with a pre-auction estimate of $40 million at Bonhams, only achieved a sale price of $30.2 million. This significant change prompts an intriguing question about the timeliness of investing in classic cars. Let's delve into this further.

However, savvy investors know that such fluctuations can create opportunities. Lower prices now could mean higher returns later as the market rebounds. But what factors could indicate a potential market rebound? Let’s delve deeper into this topic.

The Millennial Demand

Interestingly, the demand for classic cars is from more than just seasoned collectors. Millennials are increasingly drawn to automotive classics and brands such as Porsche, Ferrari, and rare BMWs or Mercedes emerging as favorites. Perhaps it's the allure of analog in a digital world or the sustainability of investing in something built to last. These brands’ blend of timeless luxury and icon status makes them stand out among current-generation cars.

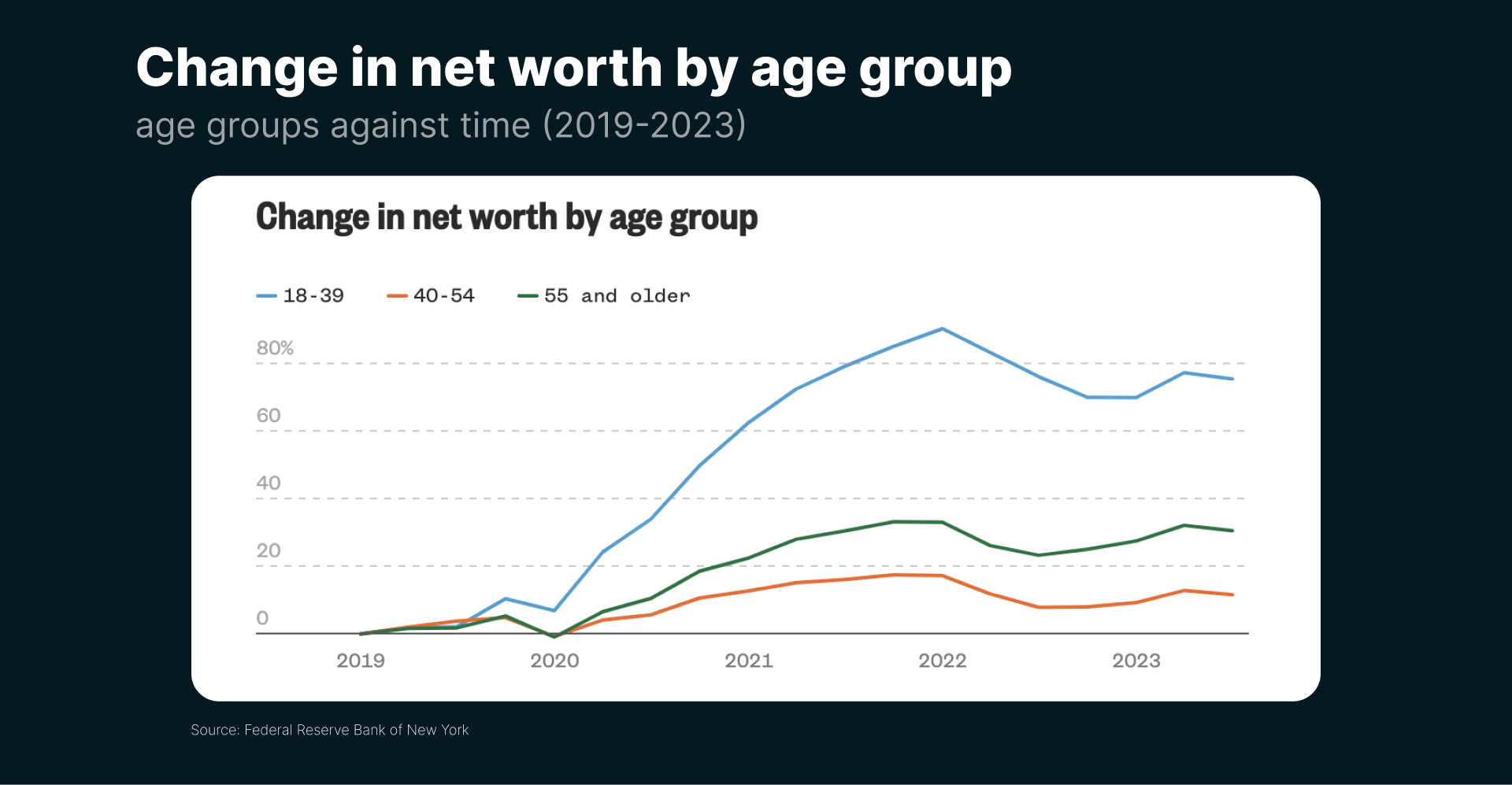

According to a 2024 NY Fed report millennial and Gen Z wealth has grown by 80% in recent years. This demographic is poised to inherit an estimated $68 trillion from previous generations. Additionally, according to Craig Jackson, the chairman, and CEO of the infamous Barrett-Jackson auction, specializing in classic and antique cars, the number of Millennial buyers has increased by an average of 48 percent every year since 2009, leading many to believe that they could become the collector-car hobby's biggest group in the near future.

Understanding Classic Car Investment Indices

To navigate the classic car market, investors turn to various indices. These tools, like the Knight Frank Luxury Investment Index and Hagerty's data, track the market's performance, offering insights into trends and volatility. They're the compass guiding investors through the complex terrain of classic car investment.

The Knight Frank Luxury Investment Index

The Knight Frank Luxury Investment Index provides a broader view of luxury assets, with classic cars being a significant component. It's shown that, over the long term, classic cars have outperformed many other investment categories, demonstrating resilience and the potential for substantial returns. The 2023 report showcases a notable statistic: a 25 percent increase in the value of vintage cars over the last year, making them the luxury asset with the second-highest performance, just after fine art. Yet, similar to other investments yielding high returns, classic cars come with their share of volatility. Their stability is comparable to that of startups, suggesting they carry both significant risks and the possibility of substantial rewards.

The HAGI Index

The Historic Automobile Group International (HAGI), a pioneer in creating indices for classic cars, operates as an independent research organization and think-tank with a focus on the niche market of rare classic automobiles. Since its inception in 2009, HAGI has applied stringent financial analysis methods, commonly used in traditional investment tracking, to monitor the performance of classic cars as an unconventional investment class. HAGI publishes six distinct indices, each dedicated to a different segment of the classic car market.

- “Top Index” is a general index for rare automobiles that incorporates the top 50 most valuable car models on the market.

- “Top ex. P&F” excludes all Porsche and Ferrari from its figures. This can give owners (or prospective buyers) of less popular brands a more accurate picture of the section of the market that pertains to them.

- “MBC Index” tracks only the market for classic Mercedes-Benz cars from between 1920 and 1980.

- “P Index” tracks only the Porsche Market.

- LPS Index” tracks only the Lamborghini market.

- “F Index” tracks only the Ferrari market.

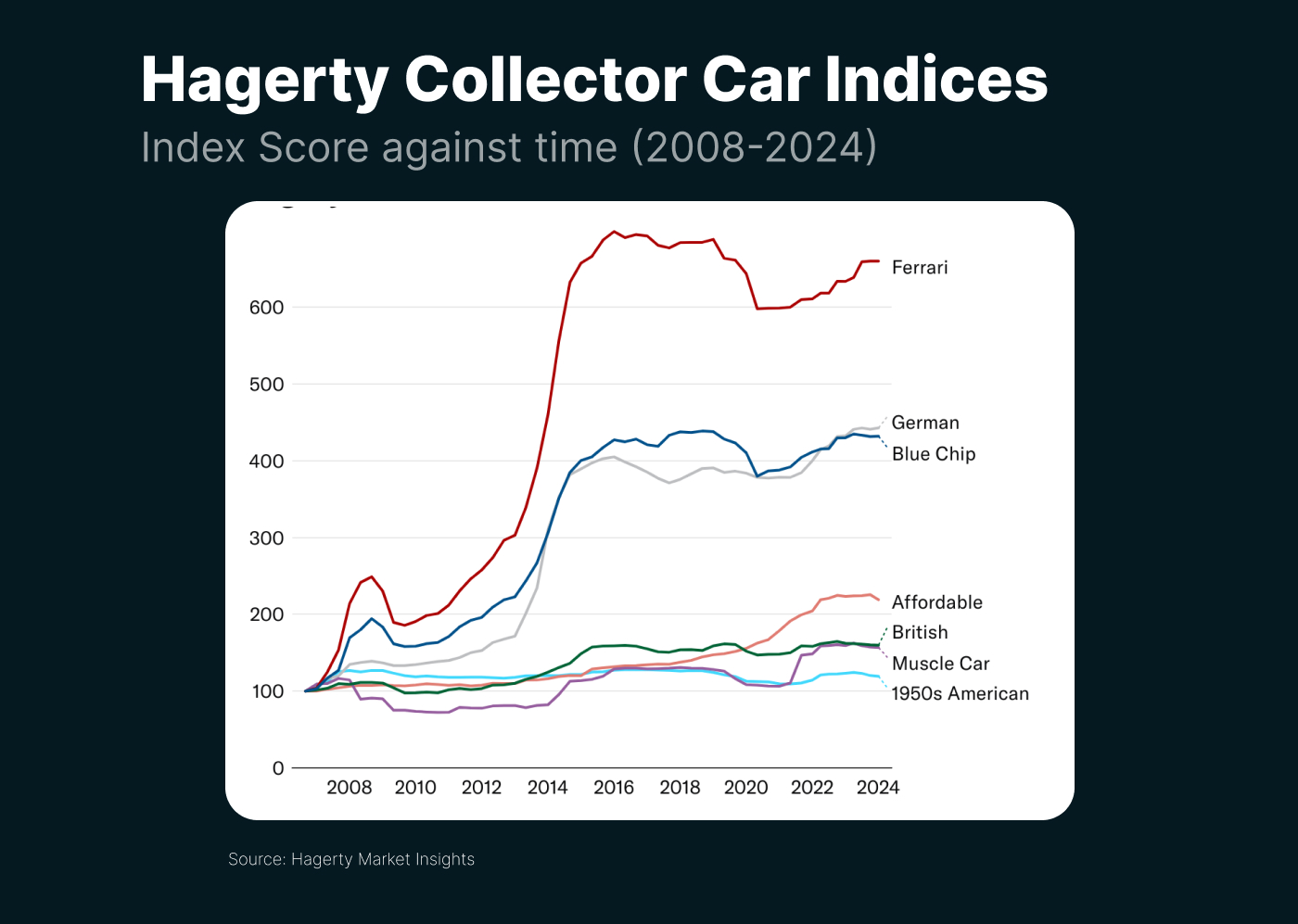

The Hagerty Market Insights

Hagerty, based in the United States, provides specialized insurance coverage for classic and luxury vehicles. This niche focus endows Hagerty with a deep understanding of the classic car market, which it leverages to compile and publish a series of well-regarded classic car indices. These indices, adjusted for inflation, offer a comprehensive overview of the international market. The indices produced by Hagerty include:

- Ferrari: Specifically tracks classic models from Ferrari.

- German Collectibles: Covers classic cars from Porsche, Mercedes-Benz, and BMW.

- Muscle Cars: Focuses on American muscle cars.

- 1950s American: This index covers classic American cars from the 1950s.

- Affordable Classics: This tracks the value of classic cars priced below $30,000.

- Blue Chips: Focuses on the highest-valued cars in the market.

- British Cars: Dedicated to classic cars from British manufacturers.

Overall, all indices published by Hagerty signify an upward trend starting from the post-pandemic era, where the indices dip was highly correlated to the more significant equities market downturn.

Why Invest in Classic Cars Now?

With current market conditions, the timing might just be right. The recent dip in auction prices could be a temporary blip in an otherwise upward trajectory that the variety of indices reflect. Investing now, especially in iconic models known for their stability or growth, could be a smart move for those looking to diversify their portfolios with tangible assets.

Risks and Considerations

Investing in classic cars is not without its risks. Market trends can be unpredictable, and the costs of maintenance and restoration can add up. However, for car enthusiasts and automotive passionates who want to reap the potential benefits, industry experts can help navigate through the maze of collectible classic cars and find investment-worthy classic cars using their wide network and industry insights.

In one of our most recent collaborations with one of the leading car investment experts, the CarCrowd, the Konvi community purchased a 1994 Ferrari 348 Spider worth €95,100

How to invest in classic cars?

Before investing in classic cars a variety of factors and risks have to be considered in order to evaluate whether you have the required resources. While the most obvious factor is the needed capital to fund and maintain your personal car investment, without sufficient information and the necessary automotive expertise, you run the risk of purchasing a car that will depreciate in value, despite being rare. Especially, for older cars that have gained the “Icon” status, finding OEM replacement parts and a suitable mechanic that will handle maintenance and repairs to keep the car running can cost a fortune. Additionally, storing the car in a place that is safe and protects it from the environment, is also a cost factor one has to consider. However, if you have the needed resources storing a car can still yield significant returns, making it a worthwhile investment.

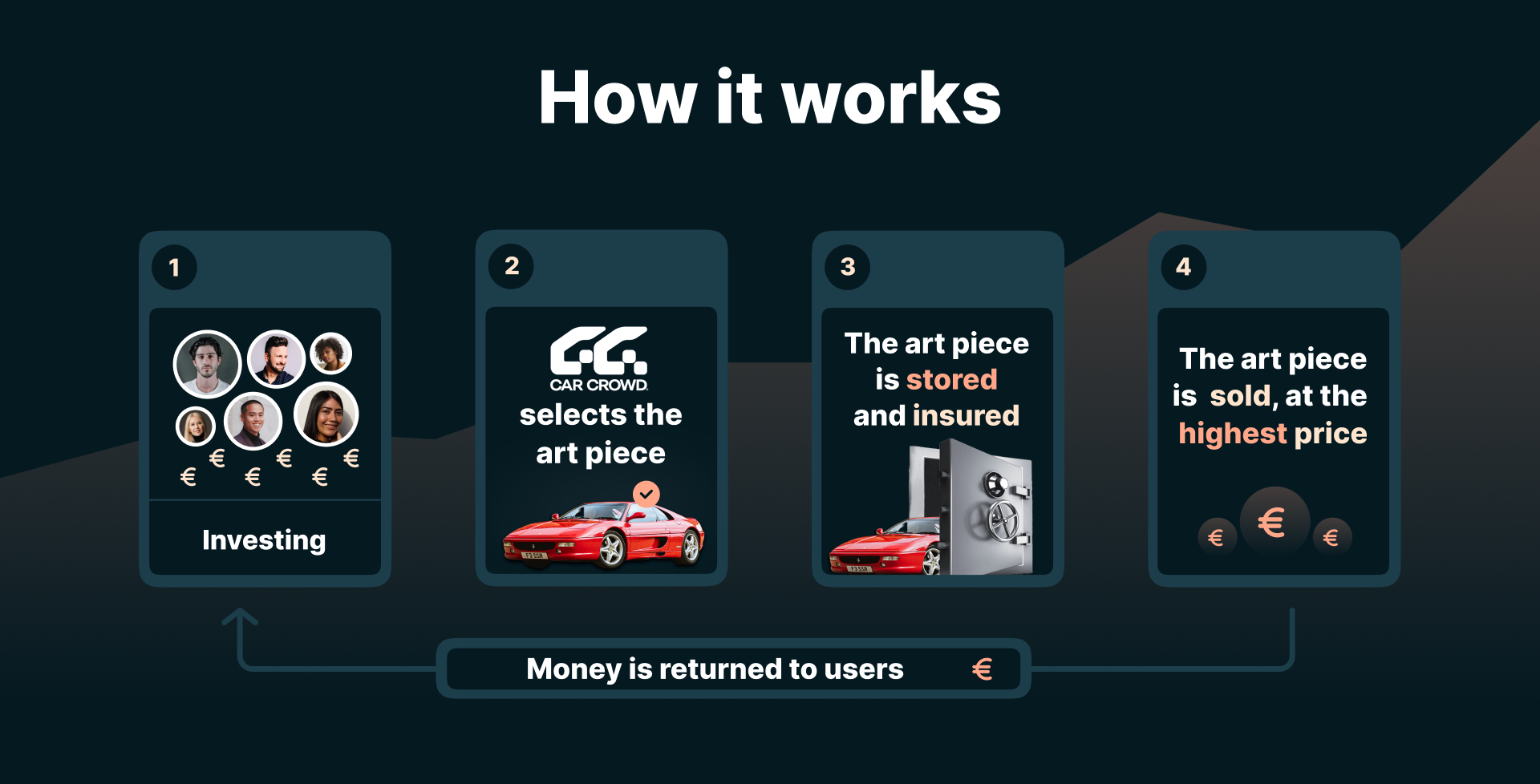

Participating in the investment opportunity a classic car offers does not necessarily mean that you have to fully own it though. Through Konvi, you can start investing in collectible cars starting from as little as €250 and reap the benefits without having to take care of all the responsibilities that would usually follow.

How does it work?

Konvi collaborates with world-leading specialists to ensure you can secure the best investment opportunities considering the most current market trends. After you select the investment opportunity you want to participate in, our experts select the classic car that offers the most investment potential and deals with storage, maintenance, and insurance. After the pre-determined investment period has ended the car is sold to our expert network of collectors, auction houses, or enthusiasts at the highest price to maximize your return. After the sale is completed all the proceeds are distributed to the individual owners of the classic car.

Conclusion

The classic car market is currently experiencing a transformative phase, marked by a slight downturn in sales and noticeable market shifts. This scenario might initially prompt caution among potential investors. However, history has shown that such periods of change often create lucrative opportunities for those with an eye for value. Recent auction results highlight the market's resilience, supported by both high-end classics and more accessible models.

This environment, coupled with growing demand and wealth in regions like East and Southeast Asia and the Middle East, suggests a bright future for classic car investments. The decreasing availability of these vehicles over time only adds to their exclusivity and potential for appreciation. Beyond the financial aspects, the unique appeal of classic cars—encompassing their rich history, exceptional craftsmanship, and aesthetic beauty—presents an attractive proposition for investment. For individuals balancing a passion for automotive excellence with a strategic investment mindset, the present moment offers a prime opportunity to engage with the classic car market.

Note: this article only engages the opinion of its author and does not constitute financial advice.