This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Are Classic Video Games a Good Investment? The Rising Market for Gaming Collectibles

Nikkan Navidi•3.3.2025

Video games have evolved far beyond childhood nostalgia. What was once a niche hobby is now a multi-billion-dollar industry, influencing culture, technology, and investment markets. Today, classic video games and consoles are not just relics of the past; they are high-value collectibles sought after by investors and collectors alike.

As the demand for rare, graded, and sealed video games rises, so do their prices at auction. In recent years, record-breaking sales of first-edition games and limited-run consoles have highlighted the potential for gaming as an alternative investment asset. However, is this market driven by sustainable demand or short-term speculation?

This article explores the factors driving the rise in gaming collectibles, the correlation between esports and vintage gaming, the impact of nostalgia cycles, and the risks and rewards of investing in classic video games.

The Evolution of Video Games as Collectibles

The shift from playable entertainment to collectible asset did not happen overnight. Video games were initially mass-produced, intended to be played, exchanged, and eventually discarded as new titles emerged. However, as gaming culture matured, enthusiasts began to view early editions, limited releases, and unopened games as valuable artifacts rather than disposable entertainment.

One of the biggest catalysts for video game collectibility has been the rise of professional grading companies like Wata Games and VGA. These companies authenticate, grade, and seal games, providing investors with standardized value assessments—similar to grading systems for rare coins, comic books, or trading cards.

Scarcity also plays a key role. Many early gaming consoles and games were produced in limited quantities, with only a small percentage surviving in mint condition. Sealed copies of Super Mario Bros., The Legend of Zelda, and Pokémon Red & Blue now command hundreds of thousands, if not millions, of dollars at auction.

The Link Between Esports Growth and Gaming Collectibles

The rise of esports has had a profound impact on the gaming industry, creating a resurgence of interest in gaming history and its early pioneers.

- In 2012, the global esports market was valued at $130 million (Source: Newzoo, 2012).

- By 2025, it is projected to surpass $1.87 billion, fueled by sponsorships, media rights, and worldwide tournaments (Source: Statista, 2022).

- Games like Counter-Strike, League of Legends, and Super Smash Bros. have cultivated dedicated fan bases, reinforcing gaming’s place in mainstream culture.

As competitive gaming has grown, so has the appreciation for vintage gaming. Collectors, former players, and esports enthusiasts are increasingly seeking out early gaming memorabilia, from consoles to first-edition cartridges.

The correlation is clear: as gaming culture continues to expand, so too does the market for historical gaming artifacts. The global video game market was valued at approximately USD 55.08 billion in 2022 according to insights by Global Market Insights - gminsights.com.

The Role of Nostalgia in Video Game Prices

Nostalgia is one of the strongest drivers of the retro gaming market. Collectors from the 1980s, 1990s, and early 2000s now have the financial means to purchase the games they grew up playing. This leads to surges in demand as certain generations reach peak disposable income.

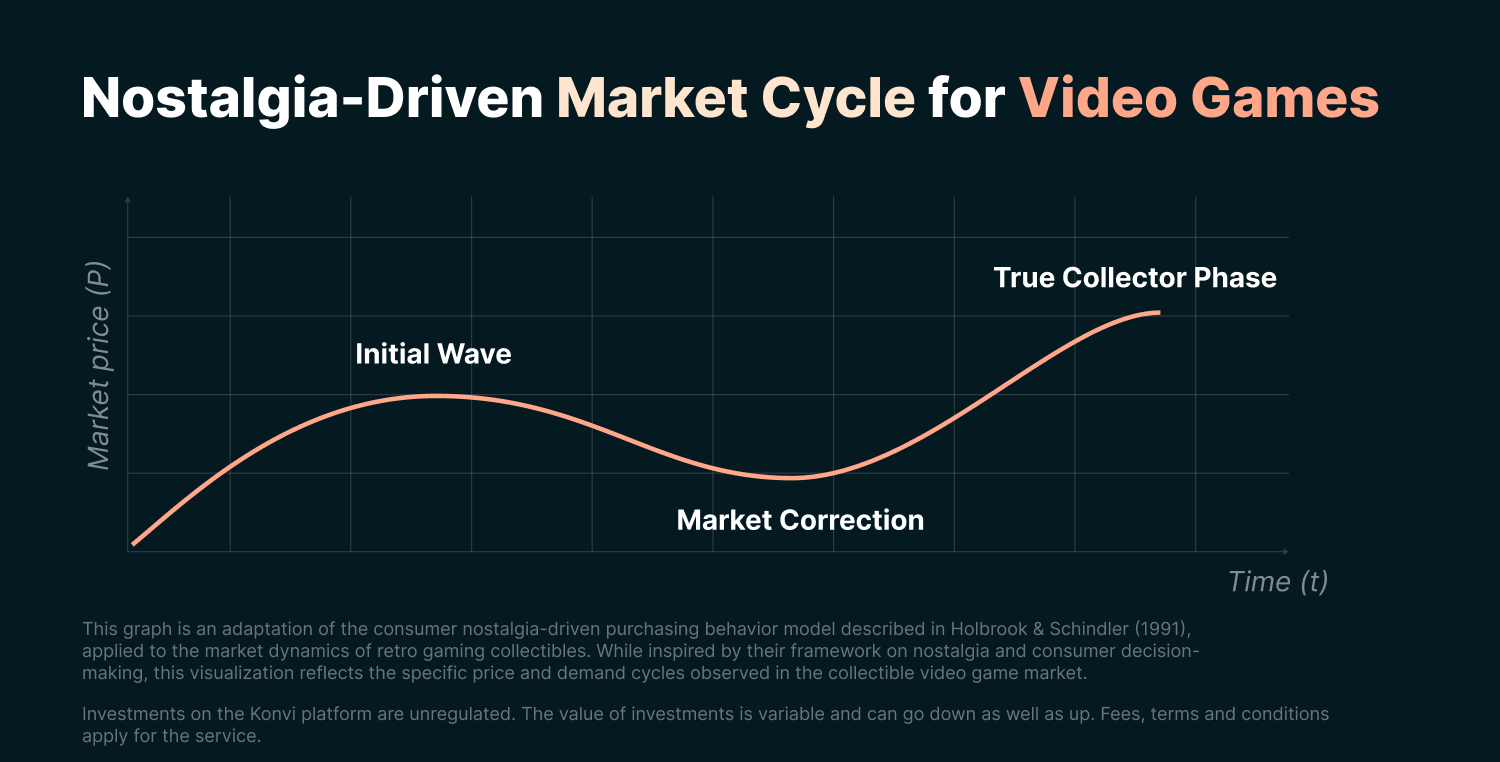

However, nostalgia-driven markets follow distinct cycles:

- Initial Wave – Buyers acquire games for sentimental reasons, driving prices up.

- Market Correction – Some collectors lose interest and resell, causing temporary price dips.

- True Collector Phase – As nostalgia-driven buyers exit the market, only serious collectors remain. With sealed copies being opened and used, supply diminishes, and prices rise again.

This transition from casual nostalgia buyers to serious collectors determines whether a game will hold its value in the long run. With diminishing supply and increasing prices, a more selected group of collectors will be interested in these collectibles, potentially leading to extreme value appreciation potentials also seen in other collectible areas such as game cards or sports memorabilia where e.g. Babe Ruth’s 1928-1930 jersey sold for $5.64 million.

What Makes a Classic Video Game Valuable?

Not all video games appreciate in value. Several factors influence the investment potential of a game:

First-Edition Status & Rarity

Games from early print runs, particularly launch editions, tend to be the most valuable. Titles like Super Mario Bros. (1985) and The Legend of Zelda (1987) fetch high prices due to their historical significance and limited availability.

Sealed & Graded Copies

Condition is everything. A sealed, high-grade copy can be worth 100x more than an unsealed one. For example, a 9.8-rated Super Mario 64 sold for $1.56 million, while an opened version sells for less than $100.

Limited Releases & Regional Exclusivity

Games with short print runs or exclusive regional releases often command higher prices. Titles like Stadium Events (NES) or Pokémon Snap Japan Edition are highly sought-after due to their scarcity.

Cultural & Historical Significance

Games that defined entire gaming generations, introduced new mechanics, or had global influence tend to hold their value better over time.

Record-Breaking Auction Sales: The Most Expensive Video Games

The past decade has seen multiple record-breaking sales, proving the strength of gaming as a high-value collectible:

- Super Mario Bros. (1985) – $2 million (Heritage Auctions).

- The Legend of Zelda (1987) – $870,000.

- Super Mario 64 (1996) – $1.56 million.

- Pokémon Red & Blue (1996) – Over $80,000 for sealed copies.

First-Edition Consoles: Collectible Gaming Hardware

Consoles can also be highly valuable investments, particularly first-generation models and prototypes:

- Nintendo PlayStation Prototype – Sold for $360,000.

- Limited-Edition Game Boys – Some Pokémon versions fetching $5,000+.

The Risks of Investing in Video Game Collectibles

While video games as collectibles have shown strong appreciation potential, investors need to be aware of the risks and market nuances that could impact value. Here’s a more in-depth look at the potential challenges:

1. Market Volatility: Price Fluctuations and Demand Shifts

Unlike stocks or real estate, which have more structured valuation models, the value of gaming collectibles is driven by market sentiment. Prices can spike due to media coverage, nostalgia cycles, or high-profile sales, only to correct sharply when interest cools.

- Example: The record-breaking $2 million sale of Super Mario Bros. (1985) in 2021 sparked massive interest in graded video games, but soon after, the market saw price drops in similar collectibles as demand normalized.

- Why It Matters: Investors need to evaluate whether the demand for a particular game is sustainable or part of a short-lived speculative bubble.

2. Speculative Bubbles & Hype-Driven Markets

The video game collectibles market has, at times, shown signs of speculative behavior. Hype can create unsustainable price spikes, only for values to drop when the excitement fades.

- Case Study: The comic book and trading card markets have experienced similar booms and busts. During the Pokémon card frenzy in 2020-2021, certain cards saw 1000%+ appreciation, only for values to crash within two years. The video game market could face similar risks.

- Mitigating the Risk: Investors should avoid making purchases based purely on hype and instead focus on long-term historical value and demand stability.

3. Condition and Grading Issues: The Danger of Overpaying

Grading is a crucial component of gaming collectibles, as even minor flaws can significantly impact value. However, grading standards can vary between Wata Games, VGA, and CGC, creating inconsistencies in valuation.

- Example: A 9.4 Wata-graded Super Mario Bros. might sell for $300,000, while an identical-looking ungraded copy could be worth just a few thousand dollars. Buyers without grading knowledge risk overpaying for items that do not justify their price.

- Key Risk: The subjectivity of grading means investors should thoroughly understand the criteria and pricing trends before making a purchase.

4. Authentication and Fraud: Counterfeit and Tampered Games

The counterfeiting of retro games and consoles has become more sophisticated. Some sellers reseal games to mimic factory-sealed copies, making it difficult for untrained collectors to identify fakes.

- Common Scams Include:

- Resealing opened games with fake shrink-wrap.

- Reproducing rare labels to pass off common versions as valuable editions.

- Selling unauthorized reprints that appear identical to original cartridges.

- How to Avoid This: Stick to reputable auction houses, graded listings, and verified dealers. If a deal seems too good to be true, it probably is.

5. Liquidity Challenges: Finding the Right Buyer

Unlike stocks, gold, or cryptocurrencies, video game collectibles are not highly liquid assets. Selling a rare game can take months or even years, depending on demand.

- Example: Even highly valuable items like the Nintendo PlayStation Prototype, which sold for $360,000, took years of negotiations before a buyer committed.

- What This Means for Investors:

- Investors should be prepared for long holding periods before realizing returns.

- Auction fees and dealer commissions can eat into profits, so selling requires strategic timing.

6. Nostalgia-Driven Demand: Temporary or Sustainable?

A major factor in gaming collectible values is nostalgia-driven buying. Many high-priced sales come from millennials and Gen X buyers who grew up with these games and now have the disposable income to purchase them.

- The Risk: As this generation ages and loses interest, will demand still exist, or will it fade as newer generations shift focus to digital gaming?

- Case Study: The decline of the vinyl record boom in the late 2010s showed how nostalgia trends can peak and then decline. If gaming follows this pattern, prices could soften in 10-20 years.

How You Can Invest in Rare Video Games

Investing in vintage video games and first-edition consoles can be highly lucrative, but as outlined in the previous section, it comes with significant risks, including market volatility, speculative bubbles, grading inconsistencies, counterfeiting, liquidity challenges, and nostalgia-driven demand cycles. For individual investors, navigating these risks alone can be daunting. However, Konvi’s partial ownership model, combined with expert partnerships, provides a structured approach to mitigating these risks and unlocking investment potential in the gaming collectibles market.

1. Expert Evaluation Reduces Market Volatility & Speculative Risk

Konvi works with Ewbank’s, a leading auction house with over 30 years of expertise in fine art, collectibles, and gaming assets. Their role is crucial in evaluating, authenticating, and valuing retro video games, ensuring that investments are based on tangible historical significance rather than market hype.

Unlike the unpredictable swings seen in high-profile auctions—such as the $2 million sale of Super Mario Bros., which raised concerns over market bubbles—Ewbank’s applies rigorous authentication and valuation methodologies to identify investment-worthy gaming assets.

Example:

- Instead of chasing short-lived trends, Ewbank’s focuses on sealed and graded titles from iconic consoles, such as:

- Nintendo World Championships cartridges, which have a documented history of sustained demand and scarcity.

- Prototypes or development editions, such as the Nintendo PlayStation console, which sold for $360,000 due to its unique role in gaming history.

By working with trusted experts in collectibles, Konvi provides investors with access to secure, high-value gaming assets that have been professionally appraised and authenticated—reducing risks related to speculation, overvaluation, and counterfeit collectibles.

2. Professional Authentication Eliminates Counterfeit & Grading Risks

One of the biggest risks in video game collecting is the proliferation of counterfeits, resealed games, and grading discrepancies. Konvi eliminates this concern by ensuring all assets are professionally authenticated, graded, and verified through industry-leading institutions before acquisition.

How This Works:

- Only acquiring WATA- or VGA-graded games with proven provenance and third-party verification.

- Sourcing from reputable sources who have a strong track record in handling high-value gaming collectibles.

- Avoiding private market sales and uncertified listings, which carry a higher risk of forgery or misrepresented grading.

Example:

- The 1990 Nintendo World Championships Gold Cartridge, one of the rarest NES cartridges, was sold for $100,088 at auction but only after it was graded and verified by WATA Games to ensure authenticity. Without this verification, the risk of a fraudulent listing or an overgraded version could have significantly reduced its true value.

By leveraging expert authentication processes, Konvi ensures that investors only gain access to fully verified, high-grade collectibles, eliminating the risk of unknowingly purchasing counterfeits or misrepresented assets.

3. Fractional Ownership Solves Liquidity Issues & High Entry Costs

One of the biggest barriers to investing in high-value video game collectibles is liquidity—the ease of buying and selling assets. Unlike stocks, gold, or cryptocurrencies, a rare graded video game is an illiquid asset. Finding the right buyer at the right price can take months, even years.

Konvi solves this challenge through fractional ownership, allowing investors to:

- Enter the market with as little as €250, rather than needing six or seven figures to acquire an entire asset.

- Diversify across multiple collectibles, reducing exposure to the value fluctuations of a single item.

- Exit investments strategically, as Konvi’s structured holding periods ensure assets are sold at optimal market conditions to maximize investor returns.

Example:

- Instead of an individual investor needing significant upfront capital to buy a sealed Super Mario Bros. game, Konvi enables a pool of investors to co-own it, allowing for broader participation in this high-value asset class and less risk exposure in their investment portfolio.

This approach increases liquidity for investors, as they do not need to worry about finding individual buyers or auctioning items themselves. Instead, Konvi handles the sale process at the right market conditions, ensuring optimized returns.

4. Timing Investments to Avoid Nostalgia-Driven Price Cycles

The video game market is heavily influenced by generational nostalgia cycles, meaning that values can fluctuate as collectors move in and out of the market. Many games see price surges when millennials and Gen X collectors reach peak purchasing power, but some may decline once this generation loses interest or shifts toward other assets.

Konvi’s expert-led approach helps navigate these trends by:

- Identifying which assets have enduring collector appeal beyond nostalgia, such as those with historical significance or limited availability.

- Timing sales based on market cycles, ensuring optimal exit points before a price decline.

Example:

- While some games appreciate due to nostalgia, others become true historical artifacts, such as:

- The Nintendo PlayStation Prototype, which was never commercially released, ensuring permanent scarcity and demand.

- The sealed first edition of The Legend of Zelda (1986), a franchise that has remained consistently popular across generations, making it a long-term collector’s item rather than just a nostalgia-driven investment.

Konvi’s strategy ensures investors are not left holding assets whose value diminishes as generational interest fades, making the investment process more stable.

Conclusion: Should You Invest in Classic Video Games?

Gaming collectibles have evolved from entertainment into a viable investment asset class. While rare and graded retro games can appreciate significantly, the market is subject to volatility, liquidity challenges, and speculative trends. Investors should carefully assess market cycles, authentication processes, and resale potential before entering this space.

For those looking to diversify their portfolio, sealed first editions, limited-run consoles, and highly graded classics present unique opportunities. Through Konvi, investors gain access to professionally curated gaming assets without requiring significant upfront capital, making this niche market more accessible than ever.

Questions to Ask Before Investing in Retro Games

To determine if investing in gaming collectibles aligns with your strategy, consider these key questions:

What drives value in the retro gaming market?

Rarity, historical significance, and cultural impact determine long-term appreciation. Are you investing in genuinely scarce games, or chasing short-term trends?

How does nostalgia influence prices?

Prices often surge when a generation reaches peak earning years and seeks to reclaim childhood memories. Will the asset retain value once nostalgia-driven buyers exit the market?

What are the risks of market volatility?

The gaming collectibles market has seen record-breaking sales and sudden corrections. Have you researched past trends and potential price fluctuations?

Is the asset properly graded and authenticated?

Condition and authenticity are critical to value. Has the game been professionally graded by WATA or VGA, ensuring its legitimacy and investment-grade status?

How liquid is the market for resale?

Selling rare video games isn’t as straightforward as stocks or real estate. Are you prepared for a longer holding period, or would fractional ownership through Konvi offer better flexibility?

What role do industry trends, such as esports and digital gaming, play?

As digital downloads dominate modern gaming, could this drive demand for physical games as collectible artifacts, or will it reduce market interest over time?

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Investing in collectibles, including retro video games, involves risks, including market volatility and liquidity challenges. Investors should conduct their own research and consult with financial professionals before making any investment decisions. Past performance is not indicative of future results.