This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Investing in Luxury Watches: Konvi’s First Exit & the Next Big Opportunity

Nikkan Navidi•21.3.2025

Why Investing in Watches is Gaining Momentum

Luxury watches have long been associated with craftsmanship, heritage, and exclusivity. However, in recent years, they have evolved beyond being just status symbols to become a serious alternative investment class. Collectors and investors are increasingly recognising high-end timepieces as tangible, appreciating assets, with some rare models outperforming traditional investments such as stocks, gold, and real estate. According to a report conducted by Grand View Research (UK Luxury Watch Market Outlook, 2024) the UK luxury watch market appreciated by 25% in 2024.

The primary drivers of watch value appreciation include brand reputation, scarcity, innovation, and collector demand. Some pieces are released in minimal numbers, while others gain legendary status due to historical significance, design, or association with celebrities. These factors, combined with growing global demand for rare watches, have contributed to a thriving secondary market where prices can appreciate significantly over time.

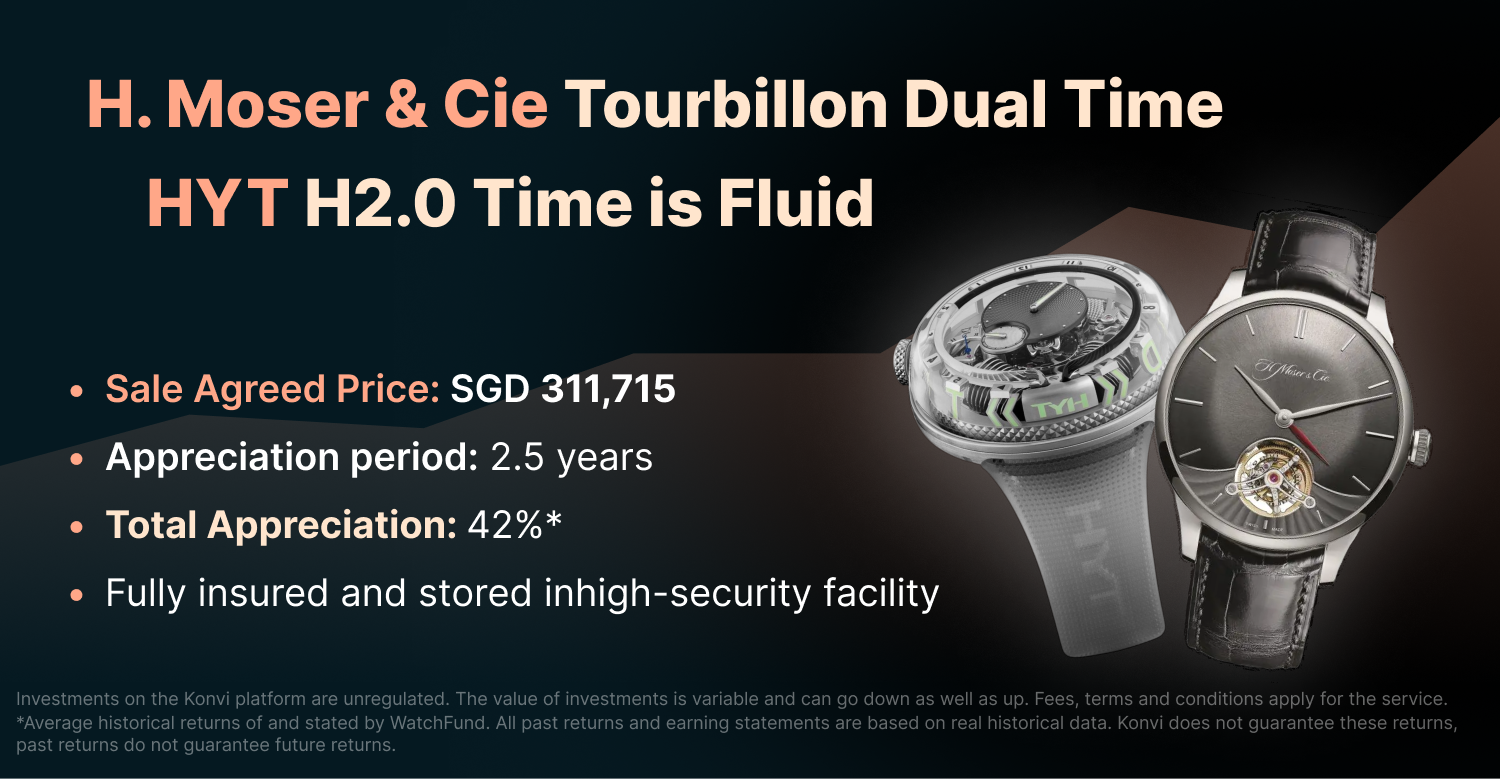

One of the most compelling success stories in watch investments comes from Konvi’s first successful fractional ownership exit, which saw investors achieve a 42% total return over 2.5 years—well ahead of the initial three-year investment timeline. The sale of a dual-watch portfolio featuring an H. Moser & Cie Tourbillon Dual Time and an HYT H2.0 Time is Fluid marks a key milestone for fractional luxury watch investments.

This article will explore:

- Why luxury watches are a strong alternative investment

- How Konvi’s first successful exit validated fractional watch investing

- The significance of the latest investment opportunity: H. Moser & Cie Perpetual Yellow Dial

- Risks and considerations of watch investments

- How fractional ownership is making luxury watch investing more accessible

Konvi’s First Watch Investment Exit: A 42% Return in 2.5 Years

The Investment Opportunity

Konvi’s first successfully exited watch investment project included two highly sought-after timepieces:

- H. Moser & Cie Tourbillon Dual Time – Known for its precision engineering, limited production, and craftsmanship, this model is part of a prestigious Swiss independent brand.

- HYT H2.0 Time is Fluid – A futuristic, hydro-mechanical watch, renowned for its unique fluid-based time display and avant-garde aesthetics.

Originally structured as a three-year investment, the asset’s performance exceeded expectations when an early exit opportunity emerged.

Investor Decision: The Power to Vote

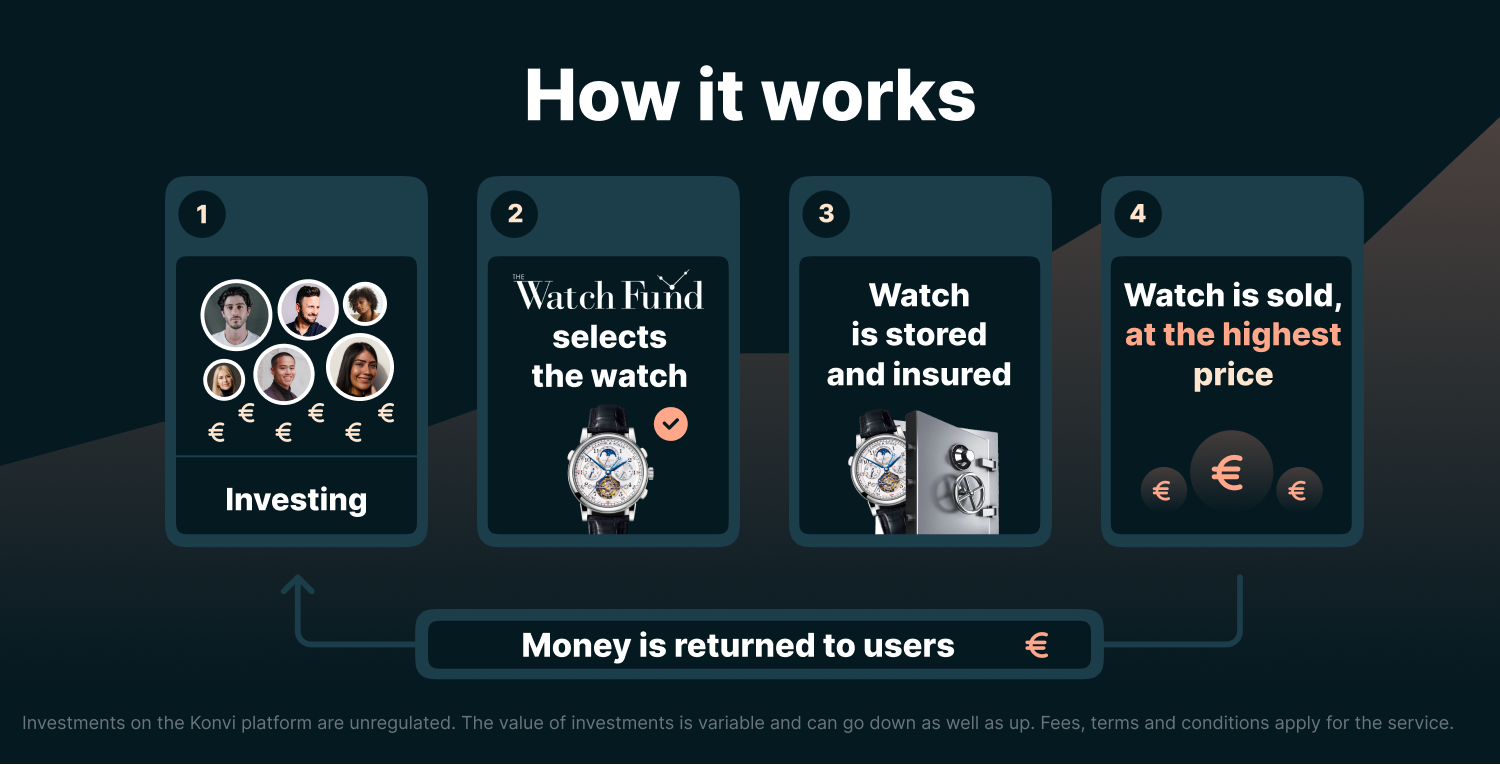

Unlike traditional watch investments, where an individual owner decides when to sell, Konvi investors were given the opportunity to vote on whether to accept an early buyout offer or hold for a potentially higher future return.

The final vote resulted in an early exit at 42% appreciation over just 2.5 years, allowing investors to capitalise on strong market demand while proving the viability of structured fractional ownership investments in luxury watches. Investors in our first sale-agreed watch have started receiving their cash back.

This milestone highlights Konvi’s strategic approach to watch investing, proving that carefully curated timepieces selected for their rarity, brand prestige, and collector demand can deliver strong returns in a shorter timeframe. Additionally, by allowing investors to vote on whether to sell or hold when buyout offers arise, Konvi democratises access to alternative investments and gives investors greater control over the holding period.

How Luxury Watches Appreciate in Value

1. Brand Reputation & Exclusivity

Prestige and exclusivity play a major role in watch valuation. Commercial luxury brands such as Rolex, Patek Philippe, and Audemars Piguet have built centuries-old reputations through marketing, iconic designs, and strong resale performance. Their desirability is maintained through controlled production numbers, continuous demand, and global brand recognition.

On the other hand, independent artisan watchmakers like H. Moser & Cie focus on low production volumes, unique craftsmanship, and innovative designs. While they lack the mainstream awareness of commercial brands, their exclusivity often results in higher appreciation potential due to scarcity and collector demand. Interestingly, many of the world’s most prestigious watchmakers are headquartered in Geneva, Switzerland, due to the region’s historical agglomeration advantages. Over centuries, Geneva has cultivated a concentration of skilled artisans, technical expertise, and supply chain infrastructure, making it the global epicentre of haute horology.

2. Limited Production & Rarity

Luxury watches gain value partly due to artificial scarcity. Commercial brands limit production to maintain exclusivity, while independent watchmakers naturally produce in low quantities due to their craftsmanship-intensive process. For example, Rolex produces an estimated one million watches per year, while H. Moser & Cie manufactures only about 3,000 pieces annually. This differentiates true exclusivity from controlled scarcity, a key distinction for investors.

3. Craftsmanship, Complications & Collectability

A luxury watch is more than just a timekeeping device; it is a wearable piece of art that showcases technical mastery and innovative design. The inclusion of highly intricate complications—such as tourbillons, perpetual calendars, and minute repeaters—elevates a watch’s desirability, making it a sought-after collector’s piece.

Beyond functionality, the artistic expression in fine watchmaking contributes to its long-term value. Independent brands like H. Moser & Cie are known for their minimalist yet highly sophisticated aesthetic, blending mechanical ingenuity with timeless design. The Perpetual Calendar 1, for instance, is a masterclass in restrained complexity, distilling a traditionally cluttered complication into an intuitive and elegant dial layout.

The artistic integrity of such timepieces enhances their collectability, especially among connoisseurs who appreciate watches not just for their mechanics, but for their historical significance, design philosophy, and rarity. Winning the 2006 GPHG Complication Award, the H. Moser Perpetual Calendar is a testament to how horology meets high art, reinforcing its long-term value in the collector’s market.

4. Market Trends & Cultural Influence

A watch’s long-term value is influenced not only by historical significance and craftsmanship but also by market trends, celebrity endorsements, and cultural influence. Iconic timepieces with strong associations with public figures often see exponential appreciation. A prime example is the Rolex Daytona "Paul Newman", which fetched $17.8 million at auction, largely due to its connection to the legendary actor.

The rise of independent brands has also been fueled by celebrity endorsements from serious collectors, rather than just fashion-driven hype. A-list figures such as Ed Sheeran (Richard Mille & F.P. Journe), Drake (Patek Philippe & Jacob & Co.), and Kevin O’Leary, the Canadian businessman, who is best known as a ‘shark’ investor on the reality series ”Sharktank” (H. Moser & Cie, F.P Journe) have helped elevate the prestige of these independent maisons. Unlike trend-driven commercial brands, artisan timepieces are viewed as wearable art, appealing to investors who seek unique, handcrafted pieces with intrinsic value and limited availability.

The Latest Addition: H. Moser & Cie Perpetual Yellow Dial

Curated by WatchFund for the Konvi Community

After the successful early exit of its first watch investment, Konvi added a new timepiece to its portfolio: the H. Moser & Cie Perpetual Yellow Dial (Piece Unique). This investment project was successfully funded on the platform and is now in its appreciation phase.

The selection was curated by WatchFund, Konvi’s trusted curation partner in the world of horology. With years of experience in sourcing high-potential watches, WatchFund focuses exclusively on artisan, independent brands known for their craftsmanship, innovation, and long-term collector appeal. Their approach avoids mass-market volatility, instead prioritising low-production, high-desirability pieces—making them ideal assets for long-term investment.

H. Moser & Cie fits perfectly within this framework. Revered for its bold innovation and understated elegance, the brand has earned a strong reputation among high-end collectors. The Perpetual Yellow Dial, being a unique piece, exemplifies WatchFund’s strategy: backing exclusive, technically sophisticated watches with enduring market appeal.

What Makes This Watch a Strong Investment?

The H. Moser & Cie Perpetual Yellow Dial showcases the brand’s mastery of minimalist design paired with award-winning mechanics. It offers investors exposure to a watch that’s as rare as it is technically advanced—one that embodies the best of modern independent watchmaking. Similar to other swiss.

Key Features & Investment Appeal:

- Curated by WatchFund: Selected for its rarity, collector demand, and brand prestige, ensuring strong resale and appreciation potential.

- One-of-a-kind creation: As a unique piece, this watch ensures exclusivity, a crucial factor in appreciation potential.

- Award-winning complication: Features Moser’s renowned Perpetual Calendar 1, which won the 2006 GPHG complication award—one of the most prestigious recognitions in watchmaking.

- DLC-coated titanium case: A fusion of modern materials and traditional craftsmanship, enhancing durability and desirability.

- Striking yellow dial: One of Moser’s signature design elements, highly coveted among collectors.

- Extremely limited production: H. Moser & Cie produces only around 3,000 watches per year, making their timepieces highly collectable.

With a recommended retail price of 70,200 CHF and a 3-year projected appreciation period, this investment offers exposure to one of the most exciting independent brands in Swiss watchmaking. Backed by WatchFund’s curation expertise, this opportunity allows investors to participate in a tangible, historically resilient asset class, with a structured path toward appreciation and liquidity. Future watch offerings will continue to follow the same high standard and pair aesthetic brilliance with tangible investment potential for the Konvi community.

What are the Risks and Challenges of Watch Investing

While investing in luxury timepieces can be highly rewarding, it comes with unique risks that every investor should carefully evaluate. Understanding these risks can help you make informed decisions and differentiate between speculation and long-term value appreciation.

1. Market Volatility & Speculative Pricing

The luxury watch market is influenced by trends, economic conditions, and collector demand. While certain timepieces experience consistent appreciation, others are subject to hype cycles and unpredictable price swings.

- Commercial brands like Rolex and Audemars Piguet have historically been prone to speculative surges, often fueled by social media hype and short-term investor interest. As seen in recent years, prices for Rolex Daytona and AP Royal Oak models spiked significantly before undergoing a correction.

- Independent, artisan brands like H. Moser & Cie and HYT, on the other hand, tend to offer more stable long-term appreciation due to their limited production, craftsmanship, and dedicated collector base.

Key Takeaway: Watch investing requires patience. Avoid short-term speculation and focus on brands with strong fundamentals and intrinsic collector demand.

2. Authentication & Counterfeit Risks

Luxury watches are prime targets for counterfeiters and fraudulent sellers, with some high-value models being replicated with alarming precision. Without expert verification, investors risk:

- Buying counterfeits or modified pieces, significantly impacting resale value.

- Overpaying for watches with undisclosed replacements or refinished parts.

- Acquiring timepieces with questionable provenance, which could make resale difficult.

3. Liquidity & Resale Challenges

Unlike stocks or bonds, luxury watches do not have instant liquidity. Finding a buyer willing to pay the expected premium can take time, as resale depends on:

- Market demand at the time of sale.

- The condition and provenance of the watch.

- Availability of similar models on the market.

High-end, artisan watches with limited production runs often retain their value better than mass-produced commercial models, as scarcity drives demand. However, resale is still a process that requires strategic timing and a well-established network of collectors and auction houses.

4. Storage, Maintenance & Depreciation Risks

Luxury timepieces require proper care and maintenance to preserve their value. Investors must consider:

- Storage conditions: High humidity, temperature fluctuations, and improper handling can damage delicate movements and degrade dials.

- Servicing costs: Regular servicing from brand-certified professionals is essential, but can be costly, particularly for complex timepieces like tourbillons and perpetual calendars.

- Potential depreciation: Certain watches depreciate over time if demand shifts or newer models overshadow older references.

How to Avoid This Risk:

Proper storage in temperature-controlled environments, regular servicing, and investing in rare, historically significant models can help mitigate depreciation risks.

5. The Importance of Market Expertise

Not every luxury watch is a good investment. The market is filled with models that may seem appealing but lack long-term collector interest or historical significance.

- Limited editions do not always guarantee appreciation unless they are linked to a brand’s heritage and collector demand.

- Trendy or hyped-up releases may see a quick surge in price but can crash when interest fades.

- Understanding brand reputation and production numbers is critical to selecting timepieces with proven value retention.

How Konvi Lowers Risk when Investing in Watches

1. Expert Curation & Risk Mitigation with WatchFund

Konvi works with WatchFund, a renowned specialist in high-value watch investments, to handle both the curation and resale process of luxury timepieces. Every watch is authenticated by WatchFund, led by one of the leading certified horology experts Dominic Khoo, ensuring high standards of quality and provenance. WatchFund’s approach ensures that every selected watch meets the highest standards of authenticity, scarcity, and investment-grade quality. Their expertise includes:

- Identifying high-potential artisan and independent watch brands with strong appreciation potential.

- Managing market volatility by selecting models with historical price stability and growing collector demand.

- Executing optimal exit strategies by leveraging their extensive collector network to secure premium resale offers.

By relying on WatchFund’s deep industry knowledge, Konvi investors gain access to strategically curated watches, reducing exposure to market speculation and short-term hype cycles.

2. Fractional Ownership Lowers Capital Exposure

Traditional watch investing requires significant upfront capital, often in the six-figure range, limiting access to only the wealthiest collectors. Through Konvi’s fractional ownership model, investors can:

- Gain exposure to luxury watches for as little as €250.

- Diversify their portfolio across multiple high-value assets.

- Reduce individual risk by spreading capital over several curated investments.

This model democratizes access to the exclusive world of luxury watch investing, making it more accessible to a wider range of investors.

3. Strategic Exit Planning for Liquidity & Returns

One of the biggest challenges in watch investing is liquidity—finding the right buyer at the right time to maximize returns. Unlike traditional ownership, where selling a watch can take months or even years, Konvi investors benefit from structured exit strategies facilitated by WatchFund.

- Resale Optimization: WatchFund leverages its private collector and investor network to secure optimal resale opportunities.

- Investor Decision-Making: Konvi investors vote on early exit offers, ensuring they have a say in when and how they realize returns.

- Proven Track Record: The recent early exit of the H. Moser & Cie & HYT investment delivered 42% appreciation in just 2.5 years, showcasing the effectiveness of this approach.

By combining expert curation, fractional ownership, and structured exit strategies, Konvi’s model provides a safer and more accessible pathway to investing in luxury timepieces.

Conclusion: Why Watches Deserve a Place in Your Portfolio

Luxury watches are more than just timepieces; they are a unique asset class that blends craftsmanship, heritage, and financial appreciation potential. The successful early exit of Konvi’s first watch investment, delivering a 42% return in just 2.5 years, highlights the potential of well-curated watches as alternative investments.

For investors looking to diversify their portfolios, watches offer a tangible, historically resilient asset that benefits from brand prestige, scarcity, and collector demand. Konvi’s fractional ownership model removes the traditional barriers to entry, allowing investors to participate in high-end watch investments without requiring significant capital. By working with WatchFund’s expertise in curation and resale, Konvi provides access to structured, risk-mitigated investment opportunities in a market traditionally reserved for industry insiders.

Join the future of luxury watch investing! co-own rare timepieces with Konvi today.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Investing in collectibles, including retro video games, involves risks, including market volatility and liquidity challenges. Investors should conduct their own research and consult with financial professionals before making any investment decisions. Past performance is not indicative of future results.