This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Cookie Policy

What are cookies?

A cookie is a small text file that a website stores on your computer or mobile device when you visit the site.

- First party cookies are cookies set by the website you're visiting. Only that website can read them. In addition, a website might potentially use external services, which also set their own cookies, known as third-party cookies.

- Persistent cookies are cookies saved on your computer and that are not deleted automatically when you quit your browser, unlike a session cookie, which is deleted when you quit your browser.

Every time you visit our websites, you will be prompted to accept or refuse cookies. The purpose is to enable the site to remember your preferences (such as user name, language, etc.) for a certain period of time. That way, you don't have to re-enter them when browsing around the site during the same visit.

Cookies can also be used to establish anonymised statistics about the browsing experience on our sites.

How do we use cookies?

Currently, there are four types of cookies that may be generated as you browse our site: Strictly Necessary, Statistics, Preference and Marketing cookies.

1. Strictly Necessary Cookies

These cookies are essential for you to browse the website and use its features, such as accessing secure areas of the site. Cookies that allow web shops to hold your items in your cart while you are shopping online are an example of strictly necessary cookies. These cookies will generally be first-party session cookies. While it is not required to obtain consent for these cookies, what they do and why they are necessary are explained in the table below.

How do I control Strictly Necessary Cookies?

You can use your browser settings to control whether or not we set session cookies. More information on your browser settings is provided at the bottom of this page.

Please be aware that these cookies are critical to the efficient working of the site. If you choose to disable these cookies from this site, the functionality of the site may be greatly reduced.

2. Statistics Cookies

Also known as "performance cookies," these cookies collect information about how you use a website, like which pages you visited and which links you clicked on. None of this information can be used to identify you. It is all aggregated and, therefore, anonymized. Their sole purpose is to improve website functions. This includes cookies from third-party analytics services as long as the cookies are for the exclusive use of the owner of the website visited.

Statistical information is used in reports and to improve our site. For example, we have used analytics data to add, remove or change features of the site based on how popular they are with users.

We track, for example:

- the numbers of visitors to individual pages;

- when pages were visited;

- how long users stayed on the page;

- the IP address of the user of the website;

- the page they came from;

- technical data about the device being used to browse the site (such as browser and operating system version, and display size) — we use this data to ensure that the technology our site uses is appropriate for the majority of our users, and how best to display the site for users who have less capable browsers.

More information about Statistics cookies

We use cookies from different partners including Google to provide our analytics data. You can read more about how Google Analytics treats your data on their web site. You can also read Google's full privacy policy.

How do I control Statistics cookies?

Google provides a tool to opt-out of Google Analytics. This is available for all modern browsers in the form of a browser plugin. Additionally, you can control how cookies are set using your browser settings.

3. Preference cookies

Also known as "functionality cookies," these cookies allow a website to remember choices you have made in the past, like what language you prefer, whether you have accepted our cookie policy, what region you would like weather reports for, or what your user name and password are so you can automatically log in.

4. Marketing cookies

The advertisements you see displayed on this, and other, sites are generated by third parties. These services may use their own anonymous cookies to track how many times a particular ad has been displayed to you and may track your visits to other sites where their ads are displayed. Please note that advertisers can only track visits to sites which display their ads or other content. This tracking is anonymous, meaning that they do not identify who is viewing which ads.

Tracking in this manner allows advertisers to show you ads that are more likely to be interesting to you, and also limit the number of times you see the same ad across a wide number of sites. As an example of how advertisers operate, if you recently researched holidays, adverts for holiday operators may subsequently appear on our sites.

We do not have access to, or control over, these third party cookies; nor can we view the data held by these advertisers. Online advertisers provide ways for you to opt-out of your browsing being tracked. More information about the advertisers we use, and how to opt-out, is provided below.

Youtube

We display clips from Youtube related to our purchase opportunities. You can view Youtubes's privacy policy on their website. This page also allows you to control what cookies YouTube saves on your computer.

We work with Google to optimise how Google ads are displayed. You can discover how Google protects your privacy relating to ads at its privacy policy.

Cookie Table of our cookies

Cookies you may see used on konvi.app

| Cookie name | Default expiration time | Purpose | Description |

|---|---|---|---|

| _fbp | 3 months | Marketing cookies | Facebook: to store and track visits across websites. |

| _ga | 2 years | Statistics cookies | Google Analytics: to store and count pageviews. |

| _gat_UA-* | 1 minute | Statistics cookies | Google Analytics: functional |

| _gid | 1 day | Statistics cookies | Google Analytics: to store and count pageviews. |

| _iub_cs-* | 1 year | Preferences cookies | iubenda: to store cookie consent preferences. |

| euconsent-v2 | 1 year | Preferences cookies | To store cookie consent preferences. |

| referrerReferralId | 1 browser session | Strictly necessary cookies | Track user referrals |

| t_gid | 1 year | Marketing cookies | Taboola: assigns a unique User ID that allows Taboola to recommend specific advertisements and content to this user |

| APISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| HSID | 2 years | Marketing cookies | Youtube: to provide fraud prevention |

| LOGIN_INFO | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| PREF | 2 years | Marketing cookies | Youtube: to store and track visits across websites. |

| SAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| SID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| SSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| VISITOR_INFO1_LIVE | 1 year | Strictly necessary cookies | Youtube: to provide bandwidth estimations. |

| YSC | 1 browser session | Marketing cookies | Youtube: to store a unique user ID. |

| __Secure-1PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-1PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PAPISID | 2 years | Marketing cookies | Youtube: Google Ads Optimization |

| __Secure-3PSID | 2 years | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| __Secure-3PSIDCC | 1 year | Marketing cookies | Youtube: to provide ad delivery or retargeting, provide fraud prevention. |

| IDE | 1.5 years | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| RUL | 1 year | Marketing cookies | doubleclick: serving targeted advertisements that are relevant to the user across the web. |

| variant | 1 browser session | Strictly necessary cookies | For providing targeted content to users |

| cookie_consent | 1 year | Strictly necessary cookies | For persisting cookie consent |

| 1P_JAR | 1 month | Marketing cookies | Google: optimize advertising, to provide ads relevant to users |

| NID | 1 month | Marketing cookies | Google: to provide ad delivery or retargeting, store user preferences |

Removing cookies from your device

You can delete all cookies that are already on your device by clearing the browsing history of your browser. This will remove all cookies from all websites you have visited.

Be aware though that you may also lose some saved information (e.g. saved login details, site preferences).

Managing site-specific cookies

For more detailed control over site-specific cookies, check the privacy and cookie settings in your preferred browser

Blocking cookies

You can set most modern browsers to prevent any cookies being placed on your device, but you may then have to manually adjust some preferences every time you visit a site/page. And some services and functionalities may not work properly at all (e.g. profile logging-in).

Further help

If you still have any concerns relating to our use of cookies, please contact us at support@konvi.app

Beat inflation - Why it’s vital to invest your savings

Ioana Surdu-Bob•9.4.2021

Keeping your hard earned cash "safely" on your bank account is a no brainer for many people. But it's an illusion to think one's money is safe just laying in a bank account. Reality is unfortunately, that especially in today's time with negative interest rates, keeping all your wealth in your bank account will eventually cost you money. But, before locking in hard earned money, one must first understand why they are doing it.

What are the benefits of investing?

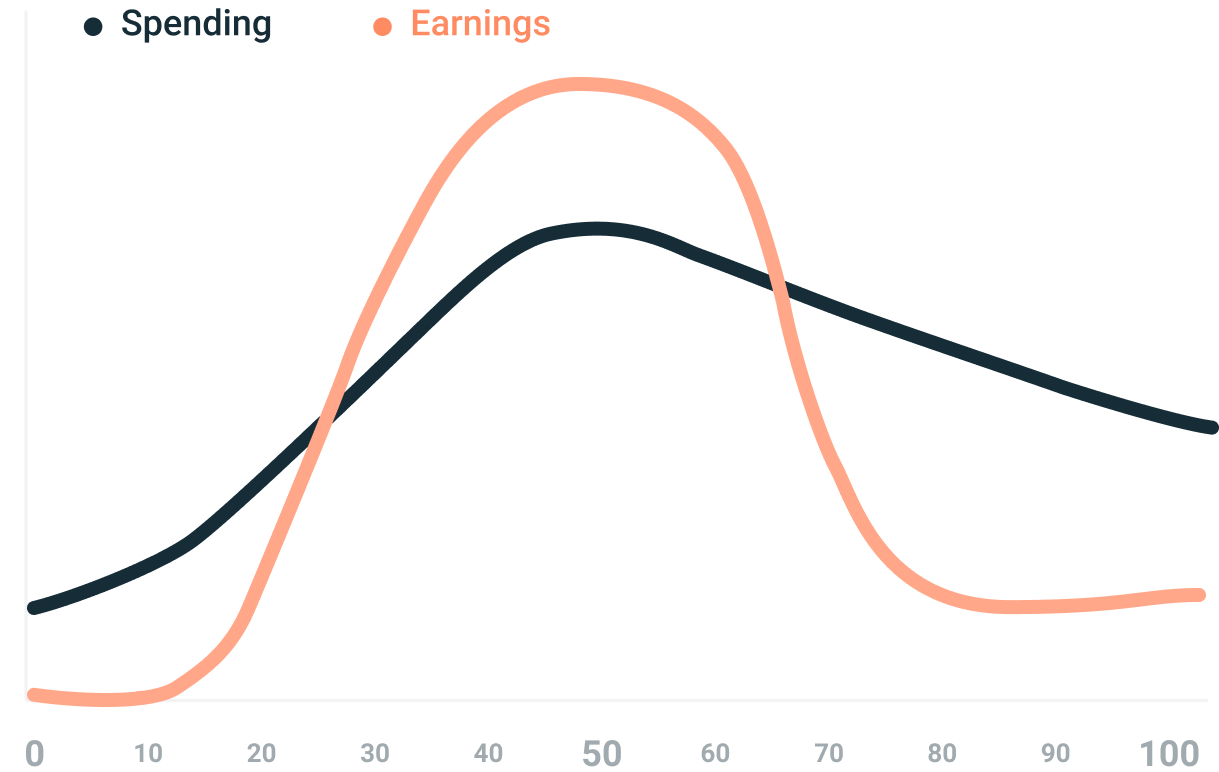

Let’s look at a very general situation. Let’s imagine our spending as humans in relation to our age: our lifespan from 0 to 100 years old. Of course, everyone’s spending pattern is different, but there are general trends.

When we are kids, we don’t have hobbies, but we have basic needs. As infants and young children, our costs of living are very low. But with time, we start going to school and requiring more items to supply our learning. We also start having more and more social activities, and some of those cost money. Then, we go to college, and maybe start paying our own rent. Our costs go up again.

After college, we have to pay our tuition, get married, have kids… all at a cost. We invest, get a bigger apartment, go on vacation, start eating out at restaurants more often. Our spending continuously goes up throughout our lifetime, but only up to a certain point. When we don’t have kids to care for anymore, our spending starts going down again.

That’s our spending curve. But how do we afford all of these things? We earn income to counteract our spending. And the earnings curve looks different. To sustain our lifestyle, we need to find a way to balance our earning and our spending. When we spend more than we earn, we need to have enough income to sustain our spending habits.

Many people don’t plan ahead, that they'll produce less income in the later stage of their lives. In this case, they either have to reduce their spending habits or, if they are lucky, get support from their children. But if we are seeking complete financial independence, they need to hold enough savings to make up for the earning deficit towards the end of our lives. With the life expectancy rate going up every year, this amount of time gets longer and longer. And we have to account for it.

There’s another big player in this scene: inflation. If you keep your money under the couch, the amount you have today will be valued less next year. This is where investments come into place. For the value to go up, the money needs to circulate into the economy. There are many investment instruments out there, some safer than others. When looking at higher yearly returns, one must be comfortable with the risk associated with it.

Before investing, one must ask themselves the following two questions:

- How does their cash flow look like?

- What are their goals?

When building a solid investment portfolio, risk must be taken into account. How fast do we need a return, and how much are we willing to lose in case some investments don’t do well short term, without hurting cash flow?

For example, when retiring at 60 and expecting a certain pension, how much money would you need in addition, to maintain a comfortable lifestyle for the rest of your life? That would be a long term strategy. You might as well have short term strategies at the same time. Let’s imagine the goal is buying a car in a couple of years. Then, are you flexible with the time of purchase, in case some of your more volatile investments go up in value? And how does this large spending affect your savings?

At the end of the day, everyone’s goals are different, which implies different risk levels. But we know for sure that, by smartly investing our money with a sound strategy, our money can work for us and generate passive income. And if we are not investing our money back into the economy, they will lose some of its value. Therefore, not investing has a bigger associated risk than investing with safe methods (eg. bonds).

And if you have considered diversifying your financial portfolio with alternative methods, Konvi is one of the options out there. Our rare, timeless luxury watches sourced through The WatchFund have had an average historical appreciation of 20% per annum.

We believe everyone should have the access to financial diversification, and education in this area is vital throughout the path to financial freedom. If you enjoyed this article, share it with a friend that would enjoy learning more about financial strategies!